Atal Pension Yojana

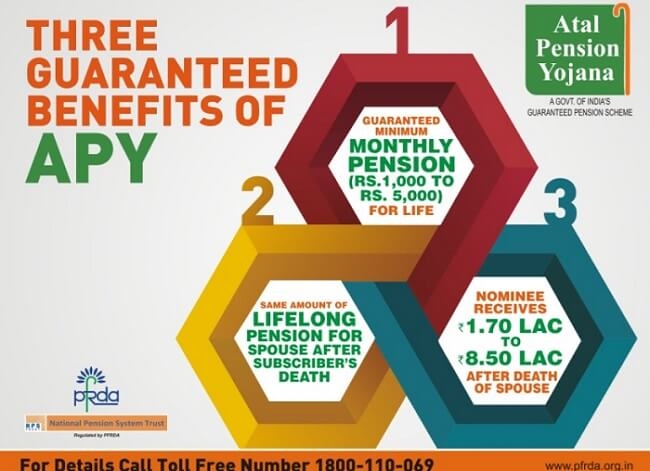

Under the Atal Pension Yojana, there is guaranteed minimum monthly pension of Rs 1000 per month to Rs. 5000 per month, for the subscribers.

Atal Pension Yojana will be focussed on all citizens in the unorganised sector, who join the National Pension System (NPS) administered by the Pension Fund Regulatory and Development Authority (PFRDA).

Benefits

Fixed pension for the subscribers ranging between Rs. 1000 to Rs. 5000, if he joins and contributes between the age of 18 years and 40 years. The contribution levels would vary and would be low if subscriber joins early and increase if he joins late.

Eligibility

The minimum age of joining Atal Pension Yojana (APY) is 18 years and maximum age is 40 years. The age of exit and start of pension would be 60 years. Therefore, minimum period of contribution by the subscriber under APY would be 20 years or more.

Documents Required

Aadhaar will be the primary KYC. Aadhar and mobile number are recommended to be obtained from subscribers for the ease of operation of the scheme. If not available at the time of registration, Aadhar details may also be submitted later stage.

Exit from scheme

Exit from Atal Pension Yojana happens in 3 cases.

-

On attaining the age of 60 years: The exit from APY is permitted at the age with 100% annuitisation of pension wealth. On exit, pension would be available to the subscriber.

-

In case of death of the Subscriber due to any cause:In case of death of subscriber pension would be available to the spouse and on the death of both of them (subscriber and spouse), the pension corpus would be returned to his nominee.

-

Exit Before the age of 60 Years: Exit before 60 years of age is not permitted however it is permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease.

Apply for Atal Pension Yojana

All Points of Presence (Service Providers) and Aggregators under Swavalamban Scheme would enrol subscribers through architecture of National Pension System. The banks, as POP or aggregators, may employ BCs/Existing non - banking aggregators, micro insurance agents, and mutual fund agents as enablers for operational activities. The banks may share the incentives received by them from PFRDA/Government, as deemed appropriate.

Contribution

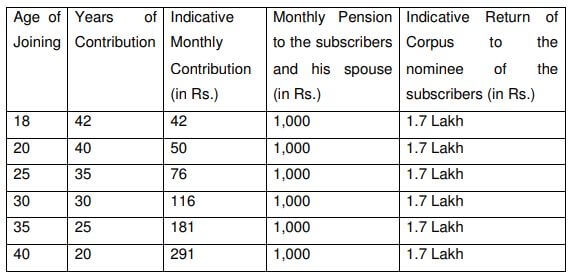

Table of contribution levels, fixed monthly pension of Rs. 1,000 per month to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period under Atal Pension Yojana

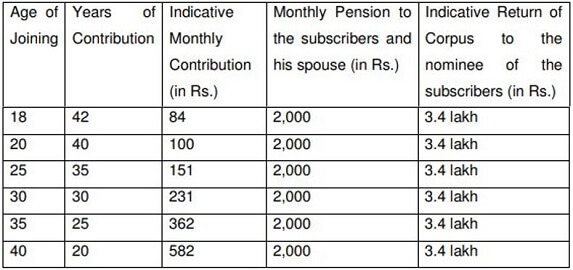

Table of contribution levels, fixed monthly pension of Rs. 2,000 per month to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period under Atal Pension Yojana

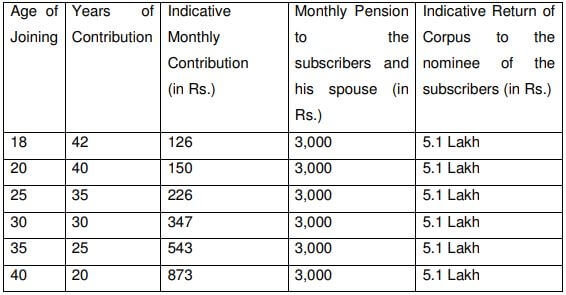

Table of contribution levels, fixed monthly pension of Rs. 3,000 per month to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period under Atal Pension Yojana.

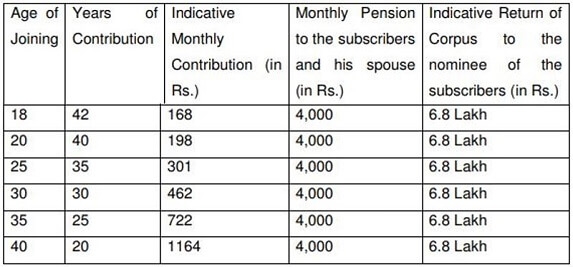

Table of contribution levels, fixed monthly pension of Rs. 4,000 per month to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period under Atal Pension Yojana.

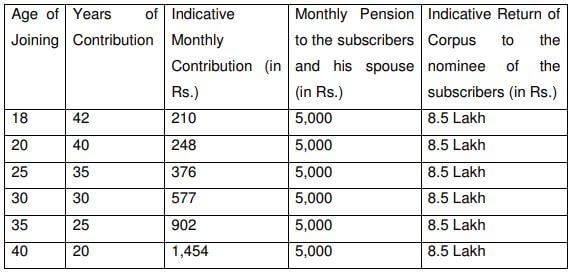

Table of contribution levels, fixed monthly pension of Rs. 5,000 per month to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period under Atal Pension Yojana.

Penalty for Default

Under APY, the individual subscribers shall have an option to make the contribution on a monthly basis. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Rs. 1 per month to Rs 10/- per month as shown below:

-

Rs. 1 per month for contribution upto Rs. 100 per month.

-

Rs. 2 per month for contribution upto Rs. 101 to 500/- per month.

-

Rs. 5 per month for contribution between Rs 501/- to 1000/- per month.

-

Rs. 10 per month for contribution beyond Rs 1001/- per month.

The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Discontinuation of payments of contribution amount shall lead to following:

-

After 6 months account will be frozen.

-

After 12 months account will be deactivated.

-

After 24 months account will be closed.

Pension Payment

Upon completion of 60 years, the subscribers will submit the request to the associated bank for drawing the guaranteed monthly pension.

Exit before 60 years of age is not permitted, however, it is permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease.

Swavalamban Scheme to APY

The existing Swavalamban subscribers between 18-40 years will be automatically migrated to APY. For seamless migration to the new scheme, the associated aggregator will facilitate those subscribers for completing the process of migration. Those subscribers may also approach the nearest authorised bank branch for shifting their Swavalamban account into APY with PRAN details.

The existing Swavalamban subscriber, if eligible, may be automatically migrated to APY with an option to opt out. However, the benefit of five years of government Co-contribution under APY would not exceed 5 years for all subscribers. This would imply that if, as a Swavalamban beneficiary, he has received the benefit of government Co-Contribution of 1 year, then the Government co-contribution under APY would be available only 4 years and so on. Existing Swavalamban beneficiaries opting out from the proposed APY will be given Government co-contribution till 2016- 17, if eligible, and the NPS Swavalamban continued till such people attained the age of exit under that scheme.

The Swavalamban subscribers who are beyond the age of 40 and do not wish to continue may opt out the Swavalamban scheme by complete withdrawal of entire amount in lump sum, or may prefer to continue till 60 years to be eligible for annuities there under.

Related Links

FAQs

You can find a list of common Government Schemes queries and their answer in the link below.

Government Schemes queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share