Sukanya Samriddhi Yojana Scheme

- Sections

- Features of Sukanya Samriddi Yojana

- Benefits of Sukanya Samriddhi Yojana Scheme

- Eligibility Criteria of Sukanya Samriddhi Yojana Scheme

- Documents Required for Sukanya Samriddhi Yojana Scheme

- How to Apply for Sukanya Samriddhi Yojana Scheme?

- Opening Account

- Interest Rate Calculation

- Withdrawal Criteria

- Interest on Deposit

- Closing of Sukanya Samriddhi Yojana Account

- References

- FAQs

Quick Links

| Name of the Service | Sukanya Samriddhi Yojana Scheme |

| Beneficiaries | Citizens of India |

| Application Type | Offline |

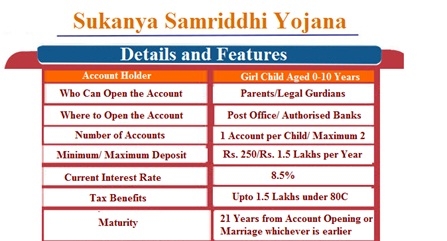

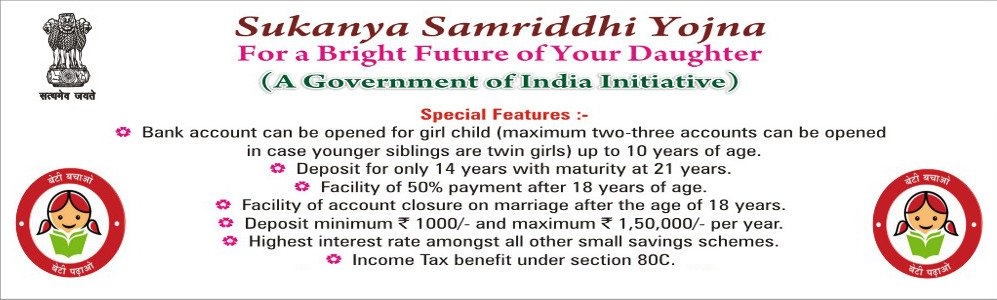

Sukanya Samriddhi Yojana is a saving scheme by the Government of India targeted at the parents of girl children.

Sukanya Samriddhi Yojana scheme helps parents to save money for the future education and marriage expenses of their female child. Sukanya Samriddhi Yojana scheme offers a very high-interest rate (8.5%) and the account can be opened for a girl child up to 10 years of age.

A minimum of Rs 250 must be deposited in the account initially. Thereafter, any amount in multiples of Rs 100 can be deposited. The maximum deposit limit is Rs 150,000.

The scheme provides a premature withdrawal facility. ie; when the girl attains 18 years of age one can withdraw 50% of the deposited amount for her higher education purpose.

The salient features of the scheme are provided below.

Features of Sukanya Samriddi Yojana

Following are the features of Sukanya Samriddi Yojana.

-

Account can be opened in the name of a girl child till she attains the age of 10 years.

-

Only one account can be opened in the name of a girl child.

-

Accounts can be opened in Post Offices and notified branches of Commercial Banks.

-

Birth certificate of a girl child in whose name the account is opened shall be submitted.

-

The account may be opened with a minimum initial deposit of two hundred and fifty rupees and in multiples of fifty rupees thereafter and subsequent deposits shall be in multiples of fifty rupees subject to the condition that a minimum of two hundred and fifty rupees shall be made as deposit in a financial year in one account.

-

The total amount deposited in an account shall not exceed Rs 1,50,000 in a financial year: (Provided that the deposit in excess of one lakh fifty thousand rupees in any financial year, if accepted due to any accounting error, shall not be eligible for any interest and be returned immediately to the depositor)

-

Interest on balance [at rate notified by the government from time to time] will be calculated on a yearly compounded basis and credited to the account.

-

On an application in Form-3, withdrawal of up to a maximum of fifty per cent. of the amount in the account at the end of the financial year preceding the year of application for withdrawal, shall be allowed for the purpose of education of the account holder (Provided that such withdrawal shall be allowed after the account holder attains the age of eighteen years or has passed tenth standard, whichever is earlier).

-

The account can be transferred anywhere in India from one post office/Bank to another.

- The account shall mature after 21 years from the date of opening or on marriage of the girl child under whose name the account is opened, whichever is earlier.

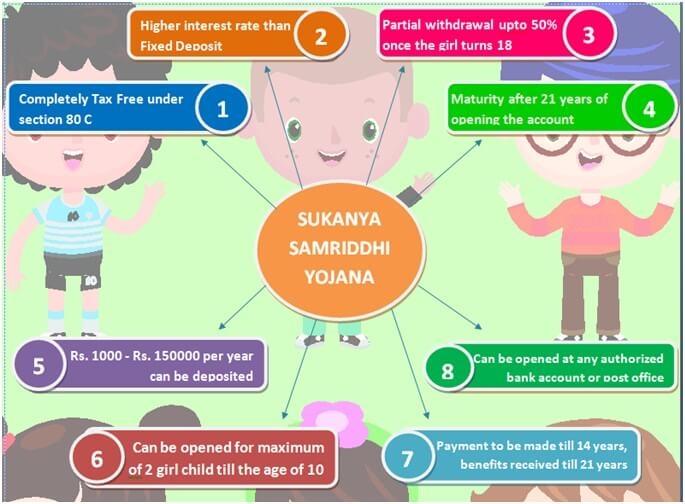

Benefits of Sukanya Samriddhi Yojana Scheme

Following are the benefits of Sukanya Samriddhi Yojana

-

Higher Interest Rate.

-

Tax Benefit under Section 80C.

-

Payment on maturity to girl child. Interest payment even after maturity if the account is not closed.

-

Transferable anywhere in India.

-

Even a girl child can operate the account after she attains the age of 10 years.

-

Deposits may be made in the account till the completion of a period of fifteen years from the date of opening of the account.

- Under the scheme, a minimum of Rs 1000 and a maximum of Rs 1,50,000 can be deposited. Some of the benefits associated with opening the account under the yojana includes high interest rate, savings on income tax, lock in period, when account reaches the maturity age account balance including the interest rate will be paid to the policy holder and lastly the policy holder receives interest even when the scheme reaches maturity.

Eligibility Criteria of Sukanya Samriddhi Yojana Scheme

Following are the eligibility criteria under Sukanya Samriddi Yojana.

-

The guardian can open the account immediately after the birth of the girl child till she attains the age of 10 years.

-

Only one account is allowed per child.

- An account under this Scheme may be opened for a maximum of two girl children in one family (Provided that more than two accounts may be opened in a family if such children are born in the first or in the second order of birth or in both, on submission of an affidavit by the guardian supported with birth certificates of the twins/triplets regarding the birth of such multiple girl children in the first two orders of birth in a family; Provided further that the above proviso shall not apply to girl child of the second order of birth, if the first order of birth in the family results in two or more surviving girl children)

Documents Required for Sukanya Samriddhi Yojana Scheme

Following documents are required to open a Sukanya Samriddhi Yojana Account

-

Birth certificate of the girl child (account beneficiary)

-

Identity proof of the depositor (parent or legal guardian), i.e., PAN card, ration card, driving license, passport.

-

Address proof of the depositor (parent or legal guardian), i.e., passport, ration card, electricity bill, telephone bill, driving license.

-

3 Photos of parents/legal guardian (if other than parents) and 3 photos of the child.

How to Apply for Sukanya Samriddhi Yojana Scheme?

Currently, bank branches or post offices are not allowed for opening Sukanya Samriddhi Yojana accounts online.

But once the account is opened, you can set the standing instructions online.

Follow the below steps to apply for the Sukanya Samriddhi Yojana scheme

-

Go to the nearest bank or post office and get the application form

-

Fill out the application form

-

Submit the application form along with the required documents

-

Pay an initial deposit amount(Rs. 250 to Rs. 1.5 lakh) Bank/post office will give the passbook

-

You can give a standing instruction at the branch or you can set up automatic credit to the SSY account through Net Banking

Opening Account

A Sukanya Samriddhi Yojana (SSY) account can be opened in any authorized post office branch or authorized branches of commercial banks. Generally, all banks that provide the Public Provident Fund (PPF) facility will offer one account for Sukanya Samriddhi Yojana (SSY).

-

The Account may be opened by the guardian in the name of a beneficiary who has not attained the age of ten years as on the date of opening of the Account: Provided that nothing in these rules shall affect a beneficiary bom on or after the 2nd December, 2003, whose Account was opened on or before the 2nd December, 2015.

-

Every beneficiary shall have a single Account under these rules.

-

An application for opening of an Account in the Post Office or the Bank under these rules shall be accompanied with the birth certificate of the beneficiary in whose name the Account is to be opened, along with other documents relating to identity and residence proof of the guardian.

- An Account under these rules shall be opened for a maximum of two girl children in one family.

Provided that more than two Accounts may be opened for girl children in a family if such children are bom in the first and/or in the second order of birth, on production of a certificate to this effect from the competent medical authority regarding the birth of such multiple girl children in the first two orders of birth in a family.

Provided further that the above proviso shall not apply to girl children of the second order of birth if the first order of birth in a particular family results in two or more surviving girl children.

Here is the list of banks

-

Allahabad Bank

-

Oriental Bank of Commerce

-

Andhra Bank

-

Punjab National Bank

-

Axis Bank

-

Punjab & Sind Bank

-

Bank of Baroda

-

State Bank of India

-

Bank of India

-

State Bank of Patiala

-

Bank of Maharashtra

-

State Bank of Bikaner & Jaipur

-

Canara Bank

-

State Bank of Travancore

-

Central Bank of India

-

State Bank of Hyderabad

-

Corporation Bank

-

State Bank of Mysore

-

Dena Bank

-

Syndicate Bank

-

ICICI BankCO Bank

-

IDBI Bank

-

Union Bank of India

-

Indian Bank

-

United Bank of India

-

Indian Overseas Bank

-

Vijaya Bank

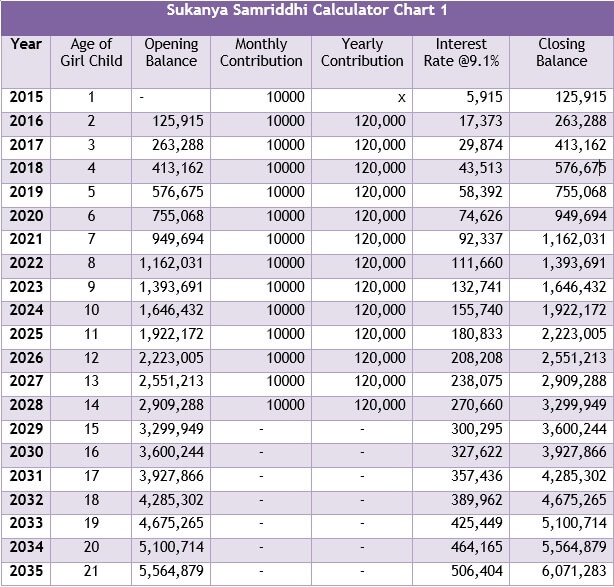

Interest Rate Calculation

As notified by the Government of India, the interest is compounded annually.

An example is given below.

Withdrawal Criteria

-

The first withdrawal possible from Sukanya Samriddhi Yojana Account is when the girl child reaches the age of 18 years for higher education purposes.

-

At that time, 50% of the amount deposited to date can be withdrawn

-

The account will be matured in two cases

-

After 21 years of opening the account

-

On the marriage date of the girl child

-

-

In the case of marriage, the account holder should request such premature closure for reasons of the marriage of the Account holder. She must submit the age proof confirming that the applicant will not be less than eighteen years of age on the date of marriage.

Interest on Deposit

The interest on deposit shall be compounded yearly at the rate notified by the Government in the Official Gazette from time to time and shall be credited, rounded off to the nearest rupee, to the Account of the beneficiary at the end of each financial year

The interest shall be calculated for the calendar month on the lowest balance in an Account on the deposits made between the close of the tenth day and the end of the month.

Closing of Sukanya Samriddhi Yojana Account

The account can be closed in the following cases.

-

The account will be closed immediately in case of the unfortunate death of the girl child. Then guardian must produce the death certificate as proof. The amount deposited till the last month will be paid back to the guardian with interest.

-

If there is no further legal guardian to continue the deposit of the account after the death of the depositor, the account can be closed by writing an application to the account opening authority.

-

In any other case, due to not being able to manage cash to maintain a minimum balance or some urgent cash requirement due to extreme health conditions etc. the account can be closed by submitting the due application form.

References

While crafting this guide, we have consulted reliable and authoritative sources, including official government directives, user manuals, and pertinent content sourced from government websites.

FAQs

You can find a list of common Savings Scheme queries and their answer in the link below.

Savings Scheme queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share