Pradhan Mantri Jan Dhan Yojana

- Sections

- Benefits of Pradhan Mantri Jan Dhan Yojana

- Documents Required for Opening Jan Dhan Account

- Eligibility Criteria for Pradhan Mantri Jan Dhan Yojana

- Life Insurance Eligibility

- Personal Accident Insurance Eligibility

- Death Benefit Eligibilty

- Ineligibile Categories for Pradhan Mantri Jan Dhan Yojana

- Apply for Jan Dhan Yojana Scheme

- Application Forms

- Claim Settlement under Pradhan Mantri Jhan Dhan Yojana

- References

- FAQs

Pradhan Mantri Jan Dhan Yojana (PMJDY) is a Financial Inclusion scheme to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance and Pension in an affordable manner.

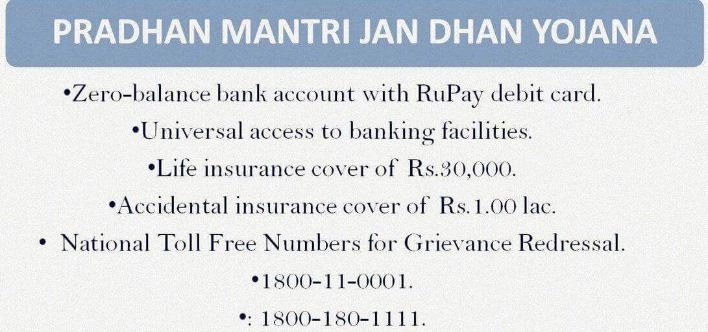

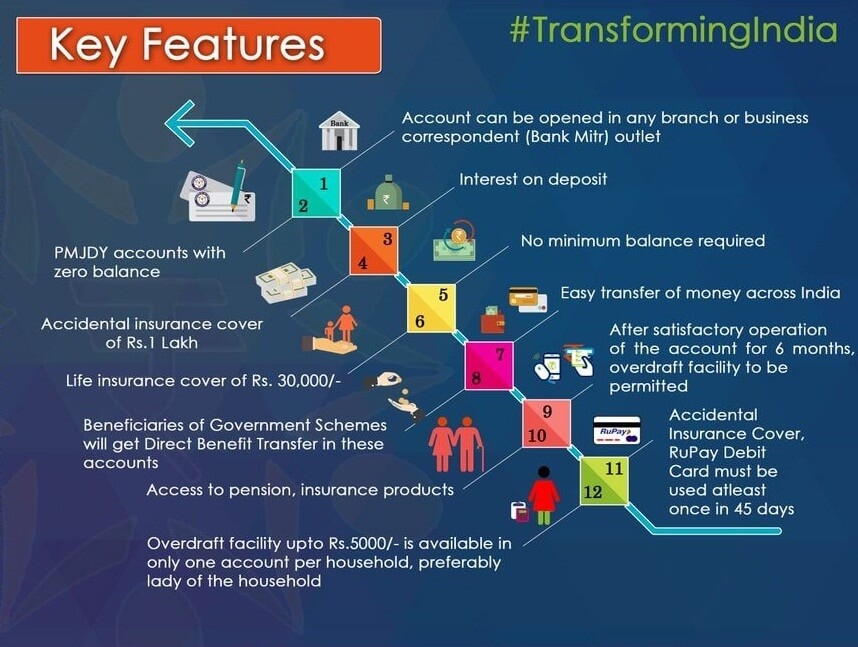

Benefits of Pradhan Mantri Jan Dhan Yojana

Benefits attached to the Pradhan Mantri Jan Dhan Yojana scheme are:

-

One basic savings bank account is opened for unbanked person.

-

There is no requirement to maintain any minimum balance in PMJDY accounts.

-

Interest is earned on the deposit in PMJDY accounts.

-

Rupay Debit card is provided to PMJDY account holder.

-

Accident Insurance Cover of Rs.1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018) is available with RuPay card issued to the PMJDY account holders.

-

An overdraft (OD) facility up to Rs. 10,000 to eligible account holders is available.

-

PMJDY accounts are eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

Documents Required for Opening Jan Dhan Account

Any of the following documents are required for opening Jan Dhan account.

- If Aadhaar Card/Aadhaar Number is available then no other documents is required. If address has changed, then a self certification of current address is sufficient.

-

Passport

-

Driving license,

-

Permanent Account Number (PAN) Card,

-

Voter’s Identity Card issued by Election Commission of India,

-

Job card issued by NREGA duly signed by an officer of the State Government,

-

Letter issued by the Unique Identification Authority of India containing details of name, address and Aadhaar number, or

-

Any other document as notified by the Central Government in consultation with the Regulator:

-

Identity card with applicant's Photograph issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks, and Public Financial Institutions;

-

Letter issued by a Gazetted officer, with a duly attested photograph of the person.

Those persons who do not have any of the ‘officially valid documents’ can open “Small Accounts” with banks.

A “Small Account” can be opened on the basis of a self-attested photograph and putting his/her signatures or thumb print in the presence of officials of the bank. Such accounts have limitations regarding the aggregate credits (not more than Rupees one lakh in a year), aggregate withdrawals (nor more than Rupees ten thousand in a month) and balance in the accounts (not more than Rupees fifty thousand at any point of time).

These accounts would be valid normally for a period of twelve months. Thereafter, such accounts would be allowed to continue for a further period of twelve more months, if the account-holder provides a document showing that he/she has applied for any of the Officially Valid Document, within 12 months of opening the small account.

Eligibility Criteria for Pradhan Mantri Jan Dhan Yojana

Following is the eligibility Criteria for Pradhan Mantri Jan Dhan Yojana

-

Person opening Bank account for the first time, with RuPay Card in addition, during the period from 15-08-14 to 26-01-15, or any additional period as may be extended further by Government of India.

-

The person should normally be head of the family or an earning member of the family and should be in the age group of 18 to 59 (i.e. person should be at least 18 years old, and should not have turned 60). In case the head of family is 60 years or more of age, the second earning person of the family in the above mentioned age group will be covered, subject to eligibility.

-

Person must have a RuPay Card and Bio – Metric Card linked to bank account or in process of being linked to bank account if not already there.

-

The account can be any bank account including a small account.

-

For the coverage to be effective the above RuPay Card should be valid and in force.

- Only one person in the family will be covered in the Bima Scheme and in case of the person having multiple cards / accounts the benefit will be allowed only under one card i.e. one person per family will get a single cover of Rs.30,000/-, subject to the eligibility conditions.

-

The life cover of Rs 30,000/- under the scheme will be initially for a period of 5 years, i.e. till the close of financial year 2019-20. Thereafter, the scheme will be reviewed and terms and condition of its continuation, including the issue of future payment of premium by the insured thereafter, would be suitably determined

Life Insurance Eligibility

The conditions for life insurance eligibility under the Jan Dhan Yojana are a lot more stringent than they are for basic qualification for the scheme. Life insurance coverage is only offered to one member of a household, and you must either be the head of your household or, if the head of the house is over 60 years of age, then you must be the second oldest earning member.

You must also be between 18 to 59 years of age, and must have opened a bank account for the first time between 15th August, 2014 and 31st January 2015. Your bank account must be bio-metric linked and you must also hold a RuPay card. You are not eligible for insurance coverage if you are a State or Central Government employee, public sector employee, have a taxable income, or have life insurance from any other scheme.

Personal Accident Insurance Eligibility

Accident cover pays out up to Rs.1 lakh in the case of accidental death. To be eligible, you must have a RuPay card with at least one successful financial or non-financial transaction within 90 days prior to the date of the accident.

Death Benefit Eligibilty

The nominee of the accountholder will be entitled to receive death benefit of Rs.30,000/- in case of the unfortunate death of the accountholder on account of any cause.

Ineligibile Categories for Pradhan Mantri Jan Dhan Yojana

Following categories are ineligible for pradhan mantri jan dhan yojana.

-

Central Government and State Government employees (in service or retired) and their families.

-

Employees (in service or retired) of Public Sector Undertakings, Public Sector Banks, any entity owned by Central Government, any entity owned by a State Government or any entity jointly owned by the Central Government and any State Government, and their families.

-

Persons whose income is taxable under I.T. Act 1961 or are filing the yearly Income Tax return or in whose case TDS is being deducted from the income, and their families.

-

Persons who are included in the Aam Aadmi Bima Yojana covering 48 occupations defined under the Scheme, and their families.

-

Otherwise eligible account holders, who have life cover on account of any other scheme of the Bank against the account, shall have to choose between the two schemes and derive benefit from only one.

-

All persons who do not fulfill the basic eligibility conditions of the scheme.

Apply for Jan Dhan Yojana Scheme

In order to open a Jan Dhan Bank Account, you need to fill the following application form.

Following details are required to be filled in Jan Dhan Yojana account.

-

Bank details: This is the section where you need to provide all the relevant information of the bank so that you can start a Jan Dhan bank account. Fill in information about the name of your bank branch, the name of your town, your sub-district and block name, your district, your state, SSA code, village code and town code.

-

Scheme applicant’s details: This section requires you to fill in all relevant personal information about yourself. This would involve entering personal details like your full name, marital status,name of father/spouse, address, pin code, telephone number, Aadhaar card number, MNREGA job card number, occupation, annual income, number of dependents, asset details, existing bank account number and Kisan Credit Card details.

-

Nominee details: This section needs you to provide details about the nominee that you want to select. Carefully fill in the details about the name of the nominee, relationship, age, date of birth and details about the person authorisedto receive the funds in event of the nominee’s death.

After that, submit it to any of the banks below.

Government Banks

-

State Bank of India (and its affiliated banks)

-

Bank of Baroda

-

Bank of India

-

Allahabad Bank

-

Vijaya Bank

-

Central Bank of India

-

Punjab National Bank

-

Dena Bank

-

Bhartiya Mahila Bank

-

Punjab and Sindh Bank

-

Oriental Bank of Commerce

-

Canara Bank

-

Bank of Maharashtra

-

Corporation Bank

-

Indian Bank

-

Union Bank of India

-

Andhra Bank

-

IDBI Bank

-

Syndicate Bank

Private banks

-

HDFC Bank

-

ICICI

-

YES Bank

-

Karnataka Bank

-

Kotak Mahindra Bank

-

Axis Bank

-

Dhanlaxmi Bank

-

Federal Bank

-

Induslnd Bank

-

ING Vyasa Bank

Application Forms

Application form for opening Jan Dhan Bank Account (English)

Application form for opening Jan Dhan Bank Account (Hindi)

Application form for availing Life Insurance cover under Jan Dhan Bank Account

Claim Settlement under Pradhan Mantri Jhan Dhan Yojana

- The Claim amount of Rs.30,000/- is payable to the nominee(s) of the accountholder. The Risk cover will be provided to the person from his age of 18 (Completed) till he attains the age of 60 years completed i.e. eligibility will cease on turning 60 years and he will exit the scheme on the day the person turn 60.

- The claim settlement process will be decentralized to the Offices of LIC. The Process followed will be as follows:

- Claim papers will be collected by the District Branch / Nodal Branch of the concerned Bank and submitted to the Pension & Group Scheme Units of LIC for processing of Claims.

- The Claim will be paid to the nominee who is the nominee in the Bank Account

- The Claim amount will be credited to Bank account of the nominee through APBS/NEFT.

References

While crafting this guide, we have consulted reliable and authoritative sources, including official government directives, user manuals, and pertinent content sourced from government websites.

FAQs

You can find a list of common Jan Dhan queries and their answer in the link below.

Jan Dhan queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share