Pradhan Mantri Jeevan Jyoti Bima Yojana

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a one year life insurance scheme, renewable from year to year, offering coverage for death due to any reason and is available to people in the age group of 18 to 50 years( life cover upto age 55) having a savings bank account who give their consent to join and enable auto-debit.

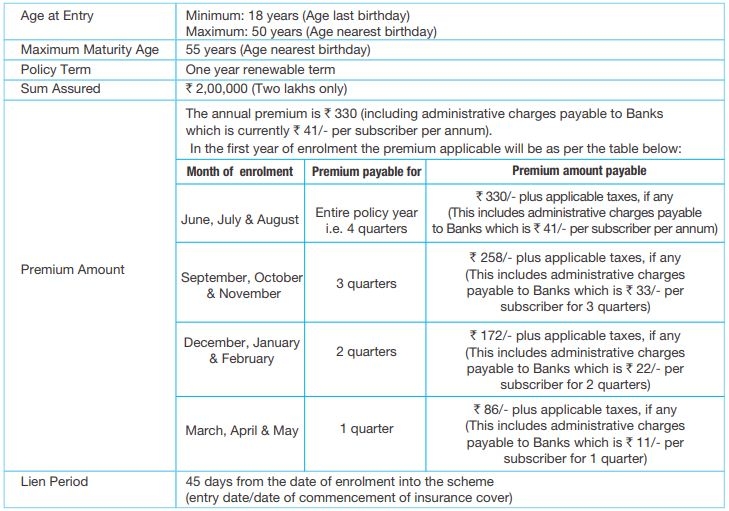

Under PMJJBY scheme, life cover of Rs. 2 lakhs is available for a one year period stretching from 1st June to 31st May at a premium of Rs.330/- per annum per member and is renewable every year. It is offered / administered through LIC and other Indian private Life Insurance companies. For enrolment banks have tied up with insurance companies. Participating Bank is the Master policy holder.

Details of the Jeevan Jyoti Bima Yojana are provided below.

Benefits

Benefits of Jeevan Jyothi Beema Yojana are as follows.

-

Death Benefit- In case of demise of the insured person the PMJJBY provides a death coverage of Rs 2,00,000 to the beneficiary of the policy.

-

Maturity Benefit- As this is pure term insurance plan, PMJJBY does not offer any maturity or surrender benefit.

-

Tax Benefit- The premium paid towards the policy is eligible for tax deduction under section 80Cof Income Tax Act. In case the insurance holder fails to submit form 15 G/15 H then any life insurance proceeds exceeding Rs. 1,00,000 will be taxable by 2%.

-

Risk Coverage- PMJJBY provides a risk coverage of 1 year. Nevertheless, as this is renewable policy it can be renewed yearly. Moreover, the policyholder can also opt for a longer duration more than a year by auto debit option linked to your saving bank account.

Eligibility Criteria

Eligibity criteria of Jeevan Jyothi Beema Yojana are as follows.

-

Any person aged between 18- 50 years having a saving bank account can join this scheme through participating banks.

-

Even if you have multiple bank accounts, you can subscribe this scheme by only one saving bank account.

-

In order to avail the benefits offered by the policy, it is mandatory to link your adhaar card to the participatory bank account.

-

Insurance buyers joining the scheme after the primary enrolment period ranging from 31st August 2015- 30th November 2015 will have to submit a self-attested medical certificate as a proof that he/she is not suffering from any critical illness mentioned in the policy declaration form.

Termination of the Jeevan Jyoti Bima Yojana

The assurance on the life of the member shall terminate / be restricted accordingly on any of the following events:

-

On attaining age 55 years (age near birth day), subject to annual renewal up to that date (entry, however, will not be possible beyond the age of 50 years).

-

Closure of account with the Bank or insufficiency of balance to keep the insurance in force.

-

In case a member is covered through more than one account and premium is received by LIC / insurance company inadvertently, insurance cover will be restricted to Rs. 2 Lakh and the premium paid for duplicate insurance(s) shall be liable to be forfeited.

Frequently Asked Questions

-

Are NRIs eligible for coverage under Jeevan Jyothi Beema Yojana ?

-

For Jeevan Jyothi Beema Yojana, How will the premium be paid ?

Related Links

FAQs

You can find a list of common Government Schemes queries and their answer in the link below.

Government Schemes queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share