Pradhan Mantri Suraksha Bima Yojana

- Sections

- Benefits of Pradhan Mantri Suraksha Bima Yojana

- Eligibility Criteria of Pradhan Mantri Suraksha Bima Yojana

- Documents Required for Pradhan Mantri Suraksha Bima Yojana

- How to Apply for Pradhan Mantri Suraksha Bima Yojana?

- Process to Claim Insurance under Pradhan Mantri Suraksha Bima Yojana

- Renewal Procedure of Pradhan Mantri Suraksha Bima Yojana

- Termination of Accident Cover Insurance under Pradhan Matri Suraksha Bima Yojana

- Appropriation of Premium under Pradhan Mantri Suraksha Bima Yojana

- Enrolment Period and Modality of Pradhan Mantri Suraksha Bima Yojana

- References

- FAQs

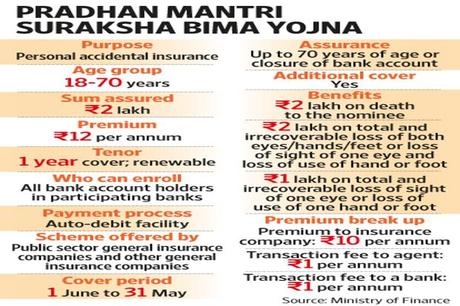

Pradhan Mantri Suraksha Bima Yojana (PMSBY) is aimed at covering the population who are not covered in any insurance plans. This scheme is available at an highly affordable premium of just Rs.12/- per year. The Scheme will be available to people in the age group 18 to 70 years with a savings bank account who give their consent to join and enable auto-debit on or before 31st May for the coverage period 1st June to 31st May on an annual renewal basis.

|

The scheme is a one year cover Personal Accident Insurance Scheme, renewable from year to year, offering protection against death or disability due to accident. |

Benefits of Pradhan Mantri Suraksha Bima Yojana

Benefits of Pradhan Mantri Suraksha Bima Yojana are provided below.

-

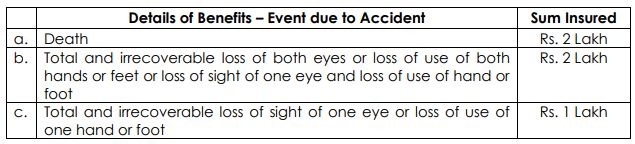

Risk coverage of Rs. 2 Lakhs for accidental death and permanent total disability.

-

Risk coverage of Rs. 1 Lakh for permanent parital disability.

-

To assure a hassle free claim settlement experience for the claimants a simple and subscriber friendly administration & claim settlement process has been put in place.

-

This scheme is focused on achieving penetration of insurance down to the weaker sections of the society, ensuring them and their family's financial security.

-

Claim settlement will be made to the bank account of the insured or his nominee in case of death of the account holder.

-

An IT enabled, web based system is in the process of being established to keep the claimants informed seamlessly about the progress and status of the claim, till it’s settlement.

Eligibility Criteria of Pradhan Mantri Suraksha Bima Yojana

-

People in the age group of 18 - 70 years

-

All individual (single or joint) account holders of participating banks / Post office

-

In case of multiple accounts held by an individual in one or different banks/ Post offices, the person is eligible to join the scheme through one bank / Post office account only

Documents Required for Pradhan Mantri Suraksha Bima Yojana

In case of Death claim, documents required are the following.

-

Complete filled & signed Pradhan Mantri Suraksha Bima Yojana Claim Form

-

Attested Copy of death certificate

-

Attested Copy of post mortem report

-

Original copy of First Information report/ Panchnama

-

Discharge voucher certificate submitted by the nominee

-

Legal heir certificate/ succession certificate from the competent court/ authority (in case of death of insured wherein he has not named his/ her nominee).

-

KYC details/Certification from Bank on the Insured/nominee demographic details.

In case of Permanent Total Disability/ Partial Permanent Disability, documents required are the following.

-

Complete filled & signed Pradhan Mantri Suraksha Bima Yojana Claim Form

-

Original copy of First Information report/ Panchnama

-

Certificate of disability issued by a Civil Surgeon

-

Discharge voucher certificate submitted by the nominee

How to Apply for Pradhan Mantri Suraksha Bima Yojana?

Follow the below steps to apply for Pradhan Mantri Suraksha Bima Yojana.

-

Visit the Jan Suraksha Portal.

-

Click on ‘Forms’.

-

Click on ‘Pradhan Mantri Suraksha Bima Yojana’.

-

Click on ‘Application Forms’.

-

Click on the form of your desired language.

-

Bangla

-

English

-

Gujarati

-

Hindi

-

Kannada

-

Punjabi

-

Telugu

-

Download and print the form.

-

Fill all the required details in the application form.

- Submit the application form to the participating bank/ post office along with all the necessary documents.

Process to Claim Insurance under Pradhan Mantri Suraksha Bima Yojana

Follow the below steps to claim insurance under Pradhan Mantri Suraksha Bima Yojana.

-

Immediately after the occurrence of an accident which may give rise to a claim under the policy, the insured or the nominee (in case of death of the insured) shall contact the bank branch where the insured person held the underlying Bank Account from which the premium for the policy was auto debited and submit a duly completed claim form.

-

The claim form may be obtained from the above bank branch or any other designated source like insurance company branches, hospitals, PHCs, BCs, insurance agents etc., including from designated websites. The insurance companies concerned shall ensure wide availability of forms at all such locations. Supply of the form shall not be denied to any person requesting the same.

-

The Claim form shall be completed by the insured or, as the case may be ,by the nominee and submitted to the above bank branch preferably within 30 days of the occurrence of the accident giving rise to the claim under the policy.

-

The Claim form shall be supported, in case of death of the insured, by the Original FIR/ Panchnama, Post Mortem Report and Death Certificate and in case of permanent disablement, by Original FIR/ Panchnama and a Disability Certificate issued by a Civil Surgeon. A discharge certificate in the enclosed format shall also be submitted by the claimant / nominee.

-

The authorised official of the Bank shall check the account / auto-debit particulars and verify the account details, nomination, debiting of premium / remittance to insurer and certify the correctness of the information given in the claim form, and forward the case to the insurance company concerned within 30 days of the submission of the claim.

-

Insurer will verify and confirm that premium has been remitted for the insured and the insured is included in the list of insured persons in the master policy.

-

Claim shall be processed by the insurance Company which has issued the master policy for the Bank within 30 days of its receipt from the Bank.

-

The admissible Claim amount will be remitted to the Bank Account of the insured or the nominee, as the case may be.

-

In case of death of an insured who has not named his/ her nominee the admissible claim amount shall be paid to the legal heirs of the insured on production of Succession Certificate/ Legal Heir certificate from the Competent Court/ authority.

-

Maximum time limit for Bank to forward duly completed claim form to Insurance Company is thirty days and maximum time limit for Insurance Company to approve claim and disburse money thereafter is thirty days.

Renewal Procedure of Pradhan Mantri Suraksha Bima Yojana

Subscribers who wish to continue beyond the first year will be expected to give their consent for auto-debit before each successive May 31st for successive years, irrespective of their date of enrollment. Delayed renewal subsequent to this date will be possible on payment of full annual premium and submission of a self-certificate of good health.

Individuals who exit the scheme at any point may re-join the scheme in future years by paying the annual premium and submitting a self declaration of good health.

Termination of Accident Cover Insurance under Pradhan Matri Suraksha Bima Yojana

The accident cover of the member shall terminate / be restricted accordingly on any of the following events:

-

On attaining age 70 years (age nearer birth day)

-

Closure of account with the Bank or insufficiency of balance to keep the insurance in force.

-

In case a member is covered through more than one account and premium is received by the insurance company inadvertently, insurance cover will be restricted to one account and the premium shall be liable to be forfeited

-

If the insurance cover is ceased due to any technical reasons such as insufficient balance on due date or due to any administrative issues, the same can be reinstated on receipt of full annual premium, subject to conditions that may be laid down. During this period, the risk cover will be suspended and reinstatement of risk cover will be at the sole discretion of the Insurance Company.

-

Participating banks will deduct the premium amount in the same month when the auto debit option is given, preferably in May of every year, and remit the amount due to the Insurance Company in that month itself.

Appropriation of Premium under Pradhan Mantri Suraksha Bima Yojana

-

Insurance Premium payable to Insurance Company: Rs. 20/- per annum per member

-

Commission payable to Business Correspondents, agents, etc. by the insurer: Re.1/- per member (for new enrolments only).

- Administrative expenses payable to participating Bank by insurer: Re.1/- per annum per member

The amount of commission payable to Business Correspondents, agents, etc. as specified in point 2 saved in case of voluntary enrolment by an account holder through electronic means shall be passed on as a benefit to the subscriber by correspondingly reducing the amount of the Insurance Premium payable specified in point 1.

Enrolment Period and Modality of Pradhan Mantri Suraksha Bima Yojana

The cover shall be for the one-year period stretching from 1st June to 31st May for which option to join / pay by auto-debit from the designated bank/ Post office account on the prescribed forms will be required to be given by 31st May of every year. Joining subsequently on payment of full annual premium would be possible. However, applicants may give an indefinite / longer option for enrolment / auto-debit, subject to continuation of the scheme with terms as may be revised on the basis of past experience. Individuals who exit the scheme at any point may rejoin the scheme in future years through the above modality. New entrants into the eligible category from year to year or currently eligible individuals who did not join earlier shall be able to join in future years while the scheme is continuing.

References

While crafting this guide, we have consulted reliable and authoritative sources, including official government directives, user manuals, and pertinent content sourced from government websites.

FAQs

You can find a list of common Pradhan Mantri Suraksha Bima Yojana queries and their answer in the link below.

Pradhan Mantri Suraksha Bima Yojana queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share