Pradhan Mantri Mudra Yojana (Mudra Loan)

- Sections

- Eligibility Criteria for Pradhan Mantri Mudra Yojana

- Documents Required for Pradhan Mantri Mudra Yojana

- Mudra Card

- Purpose of Mudra Loan

- How to Apply for Mudra Loan?

- Amount of Assistance under Pradhan Mantri Mudra Loan

- Tenor of Assistance under Pradhan Mantri Mudra Loan

- Application Form for Mudra Loan

- References

- FAQs

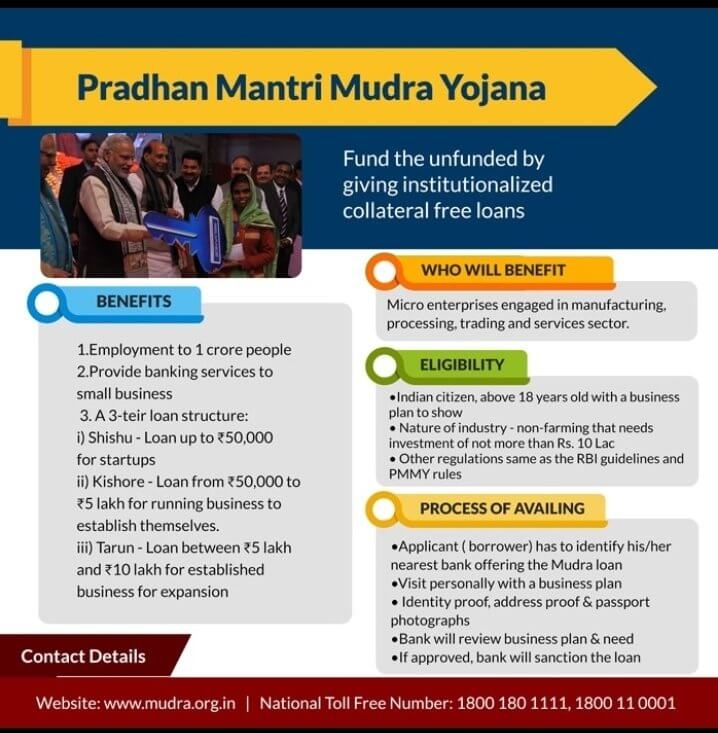

Pradhan Mantri MUDRA Yojana (PMMY) is a scheme for providing loans upto INR 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY.

These loans are given by Commercial Banks, Regional Rural Banks, Small Finance Banks, Cooperative Banks, MFIs and NBFCs.

Under the aegis of Pradhan Mantri Mudra Yojana (PMMY), MUDRA has created products / schemes. The interventions have been named 'Shishu', 'Kishor' and 'Tarun' to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth to look forward to :

The micro enterprises loans upto INR 10 lakh are collateral free and they can be covered under Credit Guarantee Fund for Micro Units (CGFMU) operated by National Credit Guarantee Trustee Company Limited (NCGTC).

Eligibility Criteria for Pradhan Mantri Mudra Yojana

Following are the eligibility criteria for Mudra Loan

-

Applicant must be an Indian citizen

-

Applicant must have a business plan for a non-farm income generating activity such as manufacturing, processing, trading or service sector

-

Loan amount should be quoted under the maximum limit of Rs. 10 lakh

-

Eligible borrowers

-

Individuals

-

Proprietary concern

-

Partnership Firm

-

Private Ltd. Company

-

Public Company

-

Any other legal forms

-

-

The applicant should not be defaulter to any bank or financial institution and should have a satisfactory credit track record.

-

The individual borrowers may be required to possess the necessary skills/experience/ knowledge to undertake the proposed activity. The need for educational qualification, if any, need to be assessed based on the nature of the proposed activity, and its requirement.

Documents Required for Pradhan Mantri Mudra Yojana

Following documents are required for availing Mudra loan.

-

Proof of Identity - Self certified copy of Voter’s ID card / Driving License / PAN Card / Aadhar Card/Passport.

-

Proof of Residence - Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card & Passport of Proprietor/Partners/Directors.

-

Proof of SC/ST/OBC/Minority.

-

Proof of Identity/ Address of the Business Enterprise -Copies of relevant licenses / registration certificates /other documents pertaining to the ownership, identity and address of business unit.

-

Applicant should not be defaulter in any Bank/Financial institution.

-

Statement of accounts (for the last six months), from the existing banker, if any.

-

Last two years balance sheets of the units along with income tax / sales tax return (Applicable for all cases from Rs.2 Lacs and above).

-

Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loan (Applicable for all cases from Rs.2 Lacs and above).

-

Sales achieved during the current financial year up to the date of submission of application.

-

Project report (for the proposed project) containing details of technical & economic viability.

-

Memorandum and articles of association of the company/Partnership Deed of Partners etc.

-

In absence of third party guarantee, Asset & Liability statement from the borrower including Directors& Partners may be sought to know the net-worth.

-

Photos (two copies) of Proprietor/ Partners/ Directors.

Mudra Card

MUDRA Card is a debit card issued against the MUDRA loan account, for working capital portion of the loan. The borrower can make use of MUDRA Card in multiple withdrawal and credit, so as to manage the working capital limit in a most efficient manner and keep the interest burden minimum. MUDRA Card will also help in digitalization of MUDRA transactions and creating credit history for the borrower.

National Payment Corporation of India (NPCI) has given RuPay branding to MUDRA Card and also separate BIN / IIN for the same, by which credit history can be tracked.

MUDRA Card can be operated across the country for withdrawal of cash from any ATM / micro ATM and also make payment through any ‘Point of Sale’ machines.

Purpose of Mudra Loan

Mudra loan is extended for a variety of purposes which provide income generation and employment creation. The loans are extended mainly for :

-

Business loan for Vendors, Traders, Shopkeepers and other Service Sector activities

-

Working capital loan through MUDRA Cards

-

Equipment Finance for Micro Units

-

Transport Vehicle loans

Following is an illustrative list of the activities that can be covered under MUDRA loans:

Transport Vehicle

Purchase of transport vehicles for goods and personal transport such as auto rickshaw, small goods transport vehicle, 3 wheelers, e-rickshaw, passenger cars, taxis, etc.

Community, Social & Personal Service Activities

Saloons, beauty parlours, gymnasium, boutiques, tailoring shops, dry cleaning, cycle and motorcycle repair shop, DTP and Photocopying Facilities, Medicine Shops, Courier Agents, etc.

Food Products Sector

Activities such as papad making, achaar making, jam / jelly making, agricultural produce preservation at rural level, sweet shops, small service food stalls and day to day catering / canteen services, cold chain vehicles, cold storages, ice making units, ice cream making units, biscuit, bread and bun making, etc.

Textile Products Sector / Activity

Handloom, powerloom, khadi activity, chikan work, zari and zardozi work, traditional embroidery and hand work, traditional dyeing and printing, apparel design, knitting, cotton ginning, computerized embroidery, stitching and other textile non garment products such as bags, vehicle accessories, furnishing accessories, etc.

Business loans for Traders and Shopkeepers

Financial support for on lending to individuals for running their shops / trading & business activities / service enterprises and non-farm income generating activities with beneficiary loan size of upto 10 lakh per enterprise / borrower.

Equipment Finance Scheme for Micro Units

Setting up micro enterprises by purchasing necessary machinery / equipments with per beneficiary loan size of upto 10 lakh.

Activities allied to agriculture

'Activities allied to agriculture', e.g. pisciculture, bee keeping, poultry, livestock, rearing, grading, sorting, aggregation agro industries, diary, fishery, agriclinics and agribusiness centres, food & agro-processing, etc.(excluding crop loans, land improvement such as canal, irrigation and wells) and services supporting these, which promote livelihood or are income generating shall be eligible for coverage under PMMY in 2016-17.

How to Apply for Mudra Loan?

Follow the below steps to get Mudra loan.

-

Applicant should approach any of those banks that are listed by scheme as loan providers

-

Complete business details should be provided to the bank.

-

Bank will categorise your requirement in to any of the 3 schemes

-

Then a form for loan has to be filled along with current account opening in the Bank.

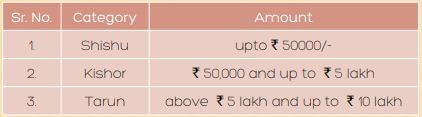

Amount of Assistance under Pradhan Mantri Mudra Loan

Upto to 10 lakh in three categories viz. Shishu, Kishore and Tarun.

-

Shishu: Covering loans up to Rs. 50,000/-

-

Kishor: Covering loans from Rs. 50,001 to Rs. 5,00,000/-

- Tarun: Covering loans from Rs. 5,00,001 to Rs. 10,00,000/-

Tenor of Assistance under Pradhan Mantri Mudra Loan

Based on the economic life of the assets created and also the cash flow generated. However, MUDRA’s refinance assistance will be for a maximum tenor of 36 months which will also be aligned to terms of allotment of MUDRA funds by RBI from time to time.

Application Form for Mudra Loan

References

While crafting this guide, we have consulted reliable and authoritative sources, including official government directives, user manuals, and pertinent content sourced from government websites.

FAQs

You can find a list of common Mudra Loan queries and their answer in the link below.

Mudra Loan queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share