Where can I find the SAS application number for my property in Bangalore? I don’t have a PID number too. I am not sure if my builder has paid any tax ever.

Answered on May 18,2021

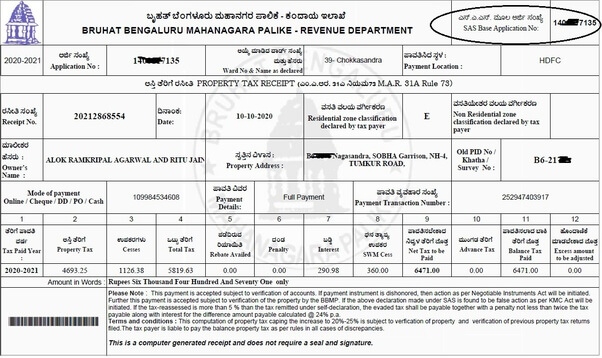

Find the SAS application number in the current or previous tax paid receipt.

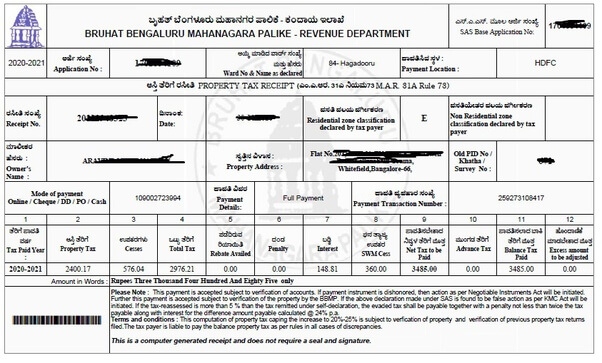

In the below tax receipt, we encircled the SAS application number for your consideration. (top right corner)

Generally, builders may not obtain PID number for your flat unless if specified in sale agreement, sale deed or exclusively paid for it to get the PID done.

If you don’t have a PID number, you should consider applying for a PID in the BBMP office of your property jurisdiction.

Below is the step by step procedure to obtain a PID number in Bangalore,

Step 1: Required documents

-

Photocopy of sale deed

-

Photocopy of encumbrance certificate

-

Photocopy of tax paid receipt from a builder (project tax paid receipt)

Step 2: Locate your municipality limit, your municipality limit could be any one of the below

-

BBMP

-

BDA

-

City municipality (CMC)

-

Panchayat limit

(municipality details should be in the schedule of your sale deed or project property tax receipt provided by builder)

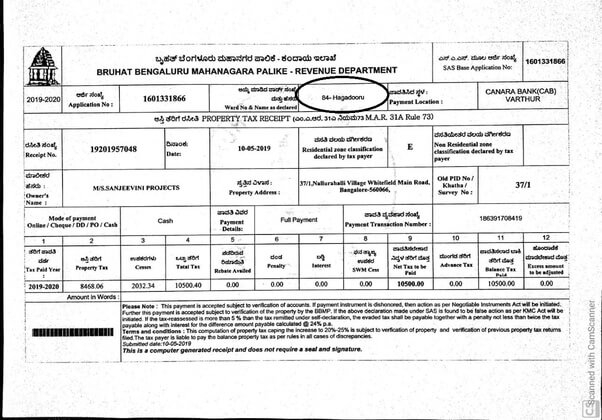

As per the tax receipt provided by my builder, my property in BBMP limit and ward is “Hagadooru” and my ward number is 84. Ward details are encircled in the below image.

Step 3: Approach the BBMP office with the above-said document (Refer to step 1 for documents).

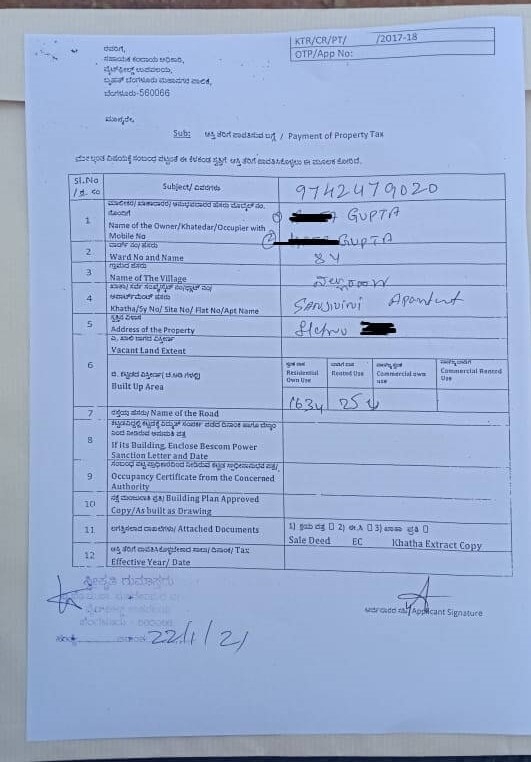

Fill the property tax application form. Below is the image of the application form which we filled recently

Submit the application to BBMP officer

Step 4: Generally BBMP office takes 15 working days to generate PID number.

Please be noted, some officers are gentle in processing the document but for few others, we should have rigorous follow-up and reminders to get this done as the whole process is offline and not a time-bound online process.

Step 5: Collect the 10 digit application number from BBMP officer.

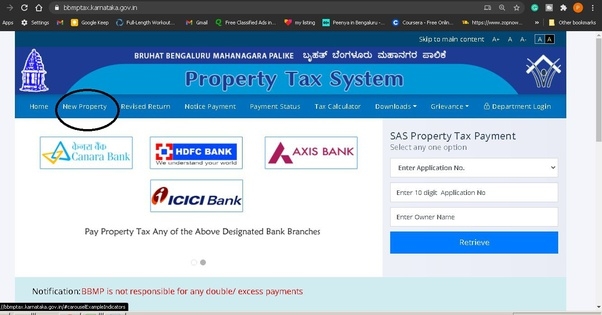

Step 6: Login to the BBMP website. (To know the website address, refer to the address bar in the below image of step 7)

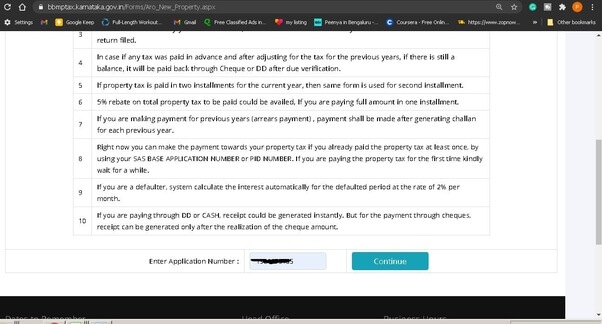

Step 7: Click on the “New Property” in the menu. Refer to the below image in the circle

Step 8: Enter the 10 digit application number and click continue. Below image for your reference

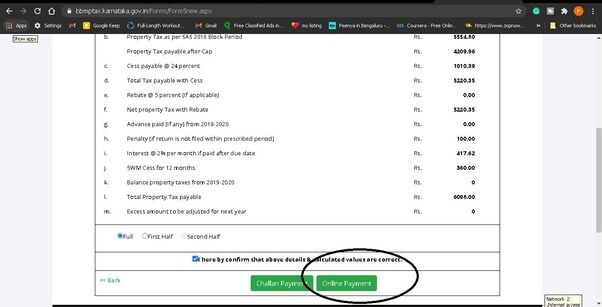

Step 9: Outstanding tax due displays and click pay online. Below image for your reference

Complete payment (payment through UPI, credit, and debit card available)

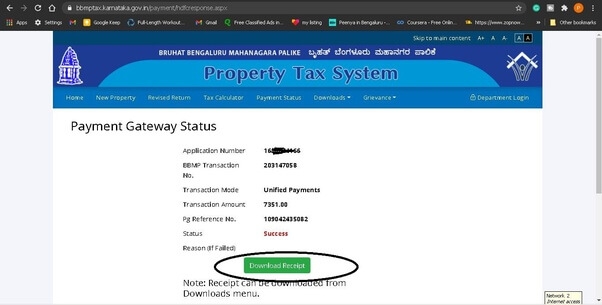

Step 10: Download your 1st tax-paid receipt. Refer to the below image in circle to download the receipt.

A tax-paid receipt looks like the below image.

This completes the process of applying PID number in Bangalore. Once the PID is done, apply for Khata transfer as well.

--------------------

We provide assistance in getting your PID and khata transfer in Bangalore. To opt for our service, please WhatsApp to +91- 9 7 4 2 4 7 9 0 2 0.

Thank you for reading…

Bhoomi RTC - Land Records in Karnataka

Bhoomi (meaning “land”) is an online portal for the management of land records in the state of Karnataka. Bhoomi portal provides the following information. Land owners..Click here to get a detailed guide

Karnataka Voter List 2024 - Search By Name, Download

Empowering citizens to exercise their democratic rights is crucial, especially in the vibrant state of Karnataka. This concise guide offers clear steps for downloading the voter list, searc..Click here to get a detailed guide

Share

Share

Clap

Clap

8687 views

8687 views

1

1 2436

2436