What is the tax we have to pay for vehicle transfer from another state to karnataka?

Answered on April 30,2022

As is the case with most RTO services, there are a number of documents that must be gathered and then submitted for the transfer of a vehicle registration from one state to another in India. Please ensure that the correct documents are collected, filled, and submitted for a successful transfer.

| Individual Documents Required | PAN Card – 1 Self-Attested Copy Address Proof – 1 Self-Attested Copy Passport-Size Photographs – 2 Self-Attested Copies |

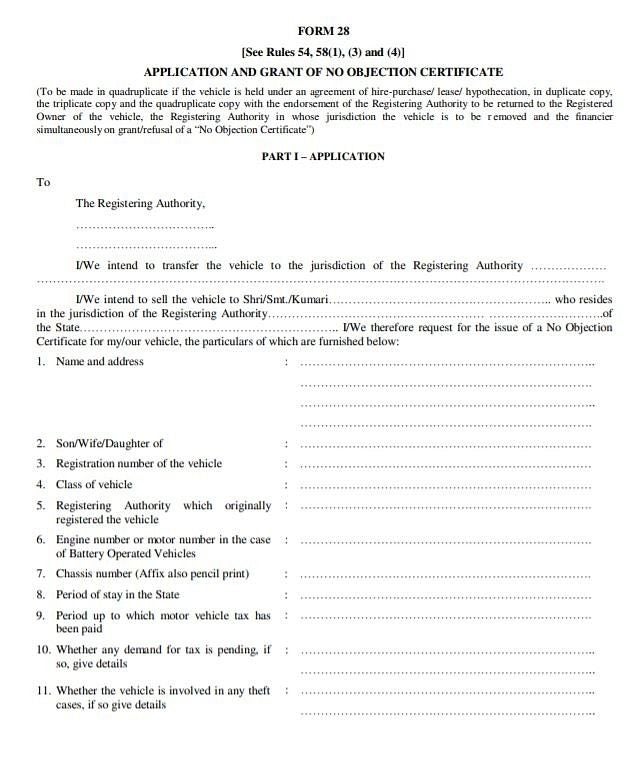

| RTO Documents Required | Form 28 – 3 Copies Form 29 – 2 Copies Form 30 – 2 Copies Form 35 & NOC – 1 Copy with Bank Stamp Sale Affidavit – 1 Copy Clearance Certificate – 1 Copy |

| Car Documents | RC (Registration Certificate) PUC (Pollution under Control) InsuranceInsurance Transfer Application – In case insurance is transferred to buyer Invoice of the car – In case of RC detail mismatch |

Step-by-Step Process for Interstate Vehicle Registration Transfer

Whether you’re selling a car or a motorcycle, the transfer process for a vehicle registration remains the same. For a seller, the procedure is given below and should be followed very strictly.

Step 1: In case there is a bank loan involved in the vehicle purchase, a No Objection Certificate (NOC) has to be procured from the bank from where the loan was taken. Along with that, a NO Crime Record Certificate has to be got from the RTO from where the vehicle is registered.

Step 2: When the vehicle is purchased from another state, a NOC must be readied from the RTO from where the vehicle was first registered. Sellers should contact the RTO for more information as processes can change from RTO to RTO.

Step 3: Once the NOC is submitted, the vehicle must be re-registered in the new state’s RTO. The new Registration Certificate will have the name of the new owner and other details of the owner as well. To get this done, Forms 29 and 30 must be submitted from the RTO.

Step 4: If a vehicle is registered in one state and the Road tax has been paid there but the vehicle is transferred to another state, the owner can apply for Road Tax refund from the original RTO where the vehicle was registered.

After completing all the above-mentioned steps, the vehicle can be driven in the new state legally. These steps can be followed by both sellers and the buyers from another state. As soon the NOC for the new state is acquired, the holder must be submitted to the new RTO so that the police can verify the details. After the verification process, the new owner must register the car in the new state and then they will be free to drive in the state. The time it takes for obtaining a NOC is about five weeks whereas the documentation might take about six months to process.

While most people complete all the necessary paperwork and documentation before taking the vehicle to another state, there might be some cases where the vehicle is taken to a new state without the above-mentioned processes completed. In this case, here is what has to be done:

- If the NOC was acquired but the vehicle could not be transferred to the new state in time, the NOC has to be cancelled by visiting the RTO and paying for the cancellation.

- If the NOC was obtained and the vehicle was used in the new state but the Road Tax was not paid, the owner must fill and submit a Non-Migration Certificate at the RTO along with the penalty for driving the vehicle with Road Tax.

- If the new owner wishes to sell the vehicle in the new state, a NOC must be submitted in the new state’s RTO along with the new Road Tax Receipt. Once these documents are submitted successfully, the vehicle can be sold in the state.

NMC and NOC Charges and the Validity:

| STATES | NMC AMOUNT | NMC VALIDITY | NOC CANCELLATION AMOUNT | NOC CANCELLATION VALIDITY |

| Delhi | Rs. 5,000 | 30 Days | Rs. 5,000 | 30 Days |

| Maharashtra | Rs. 3,000 | 7 Days | – | 10 Days |

| Karnataka | Rs. 6,500 | 7 Days | Rs. 12,500 | 10 Days |

| Uttar Pradesh | Rs. 10,000 | 7 Days | Rs. 7,000 | 10 Days |

| Hyderabad | Rs. 3,000 | 7 Days | Rs. 4,000 | 10 Days |

| Haryana | Rs. 1,500 | 7 Days | Rs. 3,000 | 10 Days |

In every state, the Road Tax differs and is made according to the price of the vehicle. The Road Tax is calculated according to the ex-Showroom price of the vehicle. Listed below is some the Road Tax amounts for some of the states in India and some of the additional charges that can be levied.

| STATE | ROAD TAX | ADDITIONAL CHARGES | |

| PETROL | DIESEL | ||

| Delhi | Under 6 Lakhs – 4% 6 to 10 Lakhs – 7% Above 10 Lakhs – 10% | Under 6 Lakhs – 5% 6 to 10 Lakhs – 8.75% Above 10 Lakhs – 12.5% | |

| Andhra Pradesh | Under 10 Lakhs – 12% Above 10 Lakhs – 14% | Under 10 Lakhs – 12% Above 10 Lakhs – 14% | 2% RTO Tax for the second car purchased in the state |

| Karnataka | Under 5 Lakhs – 15% 5 to 10 Lakhs – 16% 10 to 20 Lakhs – 19% Above 20 Lakhs – 20% | Under 5 Lakhs – 15% 5 to 10 Lakhs – 16% 10 to 20 Lakhs – 19% Above 20 Lakhs – 20% | |

| Punjab | 6% on all vehicles | 6% on all vehicles | |

| Maharashtra | Under 10 Lakhs – 9% 10 to 20 Lakhs – 10% Above 20 Lakhs – 11% | Under 10 Lakhs – 11% 10 to 20 Lakhs – 12% Above 20 Lakhs – 13% | CNG Vehicles Under 10 Lakhs – 5% CNG Vehicles 10-20 Lakhs – 6% |

| Haryana | Under 6 Lakhs – 5% 6 to 20 Lakhs – 8% Above 20 Lakhs – 10% | Under 6 Lakhs – 5% 6 to 20 Lakhs – 8% Above 20 Lakhs – 10% | Regional fees per village or town may apply |

| Chandigarh | Below 20 Lakhs – 6% Above 20 Lakhs – 8% | Below 20 Lakhs – 6% Above 20 Lakhs – 8% | |

| Uttar Pradesh | Under 10 Lakhs – 8% | Under 10 Lakhs – 8% |

Complete Guide to RTO Services in Karnataka

Regional Transport Office (RTO) is a government organization responsible for issuing vehicle related certificates in India. RTO in Karnataka provides the following services. No Objectio..Click here to get a detailed guide

Other State Vehicle in Karnataka: RTO Rules, NOC, Address Change, Road Tax, Registration [2024]

When you take a vehicle from any other State to Karnataka, you need to do either or all of the following based on your period of stay in Karnataka. Get NOC Certificate from Other..Click here to get a detailed guide

Sarthi Parivahan Sewa 2024- Driving License, Vehicle Information

The Ministry of Road Transport & Highways (MoRTH) has been instrumental in automating more than 1300 Road Transport Offices (RTOs) nationwide. These RTOs issue essential documents, inclu..Click here to get a detailed guide

Karnataka Voter List 2024 - Search By Name, Download

Empowering citizens to exercise their democratic rights is crucial, especially in the vibrant state of Karnataka. This concise guide offers clear steps for downloading the voter list, searc..Click here to get a detailed guide

Share

Share

Clap

Clap

13473 views

13473 views

2

2 1557

1557