What to do when you bring you car or bike to Bangalore ?

This guide is intended for people who bring their vehicle to Bangalore or any other town/city in Karnataka from other States in India. We will discuss in detail when to avail NOC, pay road tax and get your vehicle re-registered (KA Number plate) in Karnataka.

Change of Address

When you bring your vehicle to Bangalore, Change of address in RC book has to be done within 30 days before the Jurisdictional Regional Transport Office. Bangalore is divided into multiple zones and every zone has dedicated RTO. So you have to find your nearest RTO and submit it.

Follow the below steps to update address in your RC book.

-

Visit the nearest Jurisdictional RTOs along with the Original Registration Certificate, Insurance and Emission Testing Certificate.

-

Approach the Help Desk or the Public relation officer, who will guide to the concerned officer/counter.

-

At the counter, you will be guided about the procedure, forms to be filed, tax and fees to be paid.

-

The tax to be paid will be assessed on the basis of the age and cubic capacity of the vehicle as on the date of migration in respect of cars and motorcycles.

Road Tax Payment

When you buy a vehicle anywhere in India, you need to pay road tax to the respective state government. This tax is proportional to the invoice amount of your vehicle. Now when you move your vehicle from one state to another for a period of more than a year, you are supposed to pay the lifetime road tax again in the new state.

So, if you have migrated to Karnataka, you should pay Road Tax. Road tax to be paid depends on the price, type and purchase date of your vehicle. The older your vehicle, lower will be the purchase date. This tool will help you to find the road tax to be paid in Karnataka.

Road Tax Calculator in Karnataka

You can check this video to calculate the road tax to be paid in Karnataka.

Follow the below steps to pay road tax in Bangalore.

-

Find the correct RTO as per your residential zone. Bangalore is divided into multiple zones and every zone has dedicated RTO. So you have to find your nearest RTO.

-

Fill the FORM 14 (KMV- T14). This form is required for Life Time Tax (LTT) calculation. The Original Invoice and NOC should be accompanied with this.

-

Obtain the acceptance of the tax assessing officer and pay it in the cash counter.

-

If tax is less than INR 3000, payment can be made over the counter. If tax is more than INR 3000, a demand draft for the tax amount needs to be paid in favor of RTO.

Once you have paid the road tax in Bangalore, you can get a refund of road tax earlier paid in your home state. The tool mentioned above helps you to calculate the refund amount as well.

Please note that NOC is not a requirement for payment of tax.

NOC Certificate

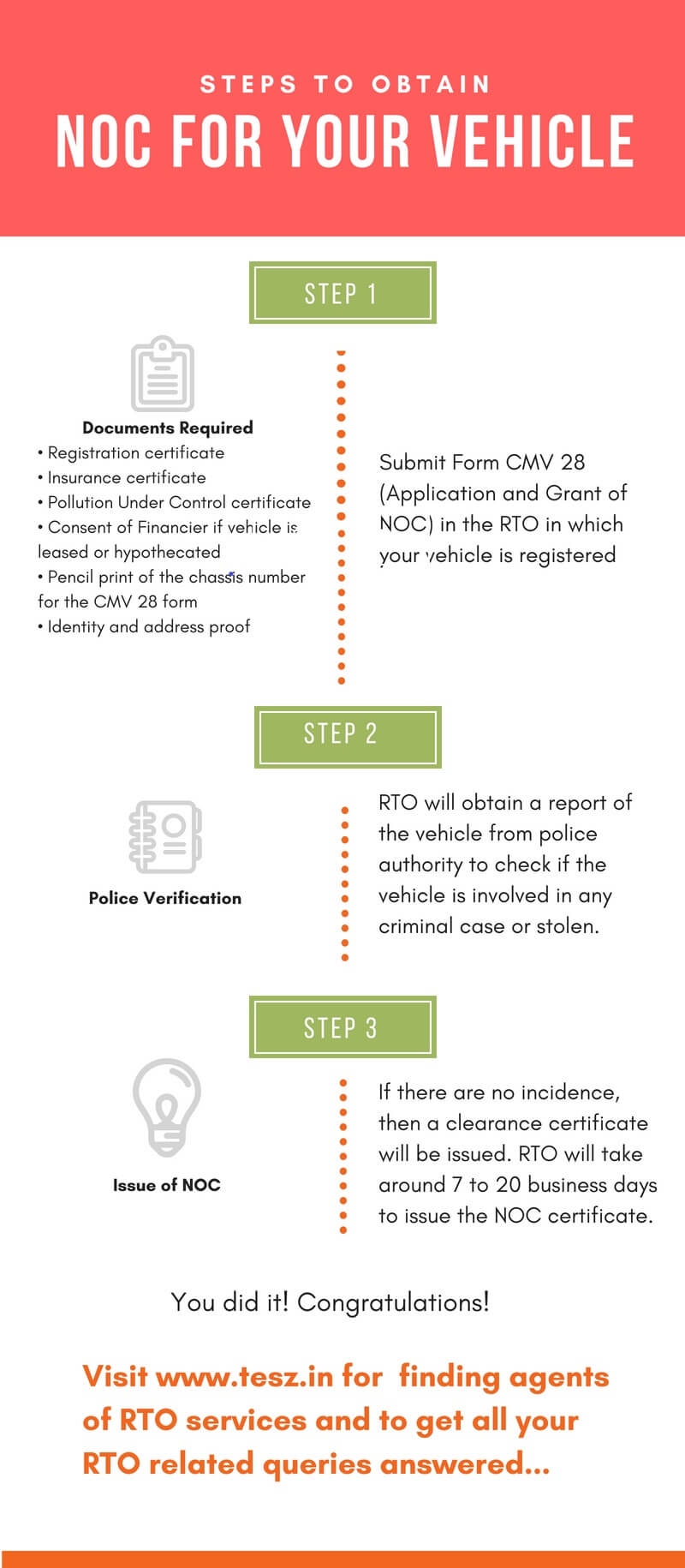

NOC is a No Objection Certificate issued from the RTO where your vehicle is registered. An NOC certifies that there are no dues of tax on the vehicle.

NOC is required in the following cases.

-

When you want to obtain a new registration mark in migrated state.

-

When you transfer the ownership of vehicle to another person. NOC is required in this case to check whether vehicle is involved in any incident.

An NOC is valid only for 6 months. So you need to get re-registration of vehicle or transfer the ownership of vehicle with in this period. Following documents are required for NOC of vehicles.

-

Registration certificate

-

Insurance certificate

-

Pollution Under Control certificate

-

Consent of Financier on CMV form 28 (if the vehicle is covered by Hypothecation, HPA or a lease agreement)

-

Permit and fitness certificate (applicable for commercial vehicles)

-

Pencil print of the chassis number for the CMV 28 form

-

Photo identity and address proof.

Steps to obtain NOC is represented in infographics here.

Vehicle Re-registration

In Karnataka, a Vehicle is not permitted to ply with other state registration mark beyond 11 months from the date of migration. So you should apply and obtain the Karnataka Registration mark before that period. Re-registration of vehicle involves the following tasks.

1. Get NOC for your Vehicle from RTO where it is registered

2. Pay Life Time Tax (Road Tax) in Bangalore

3. Get Registration Certificate of your Vehicle and New Vehicle Number from RTO in Bangalore

Following steps are discussed in detail here.

1. Get NOC for your Vehicle from where it is registered

Before transferring a vehicle from one state to another , NOC is required from the RTO where vehicle is registered . In case NOC has not been obtained at the time of migration, the registered owner is required to apply in CMV Form 28 to the parent RTO along with documents for issue of NOC. In case, no reply is received from the previous RTO even after 30 days, the registered owner shall submit a copy of applied CMV Form 28, along with the postal acknowledgment for having submitted the required forms to previous RTO, and a declaration stating that the application for “NOC has neither been rejected nor any reply received from the previous registering authority” to whom the application has been made.

Steps to obtain NOC is provided above.

2. Pay Life Time Tax (Road Tax) in Bangalore

Details about payment of road tax is provided above.

3. Get Registration Certificate of your Vehicle and New Vehicle Number from RTO in Bangalore

Following documents are required to obtain new vehicle number from RTO.

-

Copy of LTT payment

-

FORM-14 which had the Tax calculation on it

-

Form KMV 27: This form is required for informing RTO about migration of your vehicle to Karnataka

-

Form CMV 33: This form is required for informing RTO about change of address of your vehicle

-

Form CMV 27: This form is required for obtaining the Karnataka Registration mark

-

Address Proof: If you are new to Bangalore, you can get a notarized affidavit stating your local address as rental agreement is not accepted by RTO

-

Insurance Copy

-

PUC copy

-

ID proof

-

Attach the self-addressed envelope with required postal stamps

FAQs

Q: What is the procedure for obtaining Fitness Certificate for Transport Vehicle ? Renewal of Fitness Certificate ?

A: All transport vehicles shall carry valid fitness certificate to ply on road. The owner shall apply for issue of fitness certificate in form KMV 20 along with prescribed fee, Registration Certificate, Insurance Certificate, Tax Card, Pollution Under Control Certificate, Permit and produce the vehicle for inspection in a good condition. The Senior /Inspector of motor vehicle will inspect the vehicle particularly on following aspects:

-

Front axle and steering

-

Front spring

-

Fuel system

-

Electric system

-

Engine performance

-

Silencer, transmission

-

Rear springs

-

Tyres

-

Chassis frame

-

Body

-

Brakes

-

Compulsory equipment

-

Requisite equipment

-

Cleanliness

-

Weighment of vehicle

Any other observations or defects worth mentioning.

The validity of renewal of Fitness certificate is one year at a time.

Q: Should the vehicle be produced for inspection for recording change of address/ transfer of ownership in respect of an other state vehicle ?

A: Yes, it is mandatory for the vehicle to be produced for inspection.

Q: Should the Registered owner appear in person for change of address/ transfer of ownership in respect of an other state vehicle ?

A: Yes, it is mandatory for the applicant to appear in person .

Q: What forms to be filed for Transfer of ownership ?

A: Form CMVR 29 in duplicate , CMVR 30 , CMVR 27, KMVT 14 are to be filled up

One photo has to be affixed on form CMVR 27 .

Q: What forms are to be filed for Change of Address ?

A: Form CMVR 33, CMVR 27, KMVT 14 are to be filled up

One photo has to be affixed on form CMVR 27 .

Q: If I don't Receive the NOC , What I have to do ?

A: If you do not receive the NOC even after 30 days from the date of acknowledging your application, You can approach the RTO along with your 4 th copy of form CMVR 28 and acknowledgement and file a declaration giving details of your application for NOC and stating that

“ Neither I have received any reply from the concerned RTO nor my application has been rejected by them”

In such cases your application for Reassignment / Transfer of ownership will be considered.

Q: I Could not obtain NOC at the time of shifting of my vehicle, I have paid tax, and obtained change of address in the certificate of registration in Karnataka , Is there a way to obtain NOC from previous registering authority ?

A: Yes . You fill form CMVR 28 in quadruplicate with pencil print of the chassis no. on all the forms , and send form CMVR 28 in triplicate to the previous registering authority along with original registration certificate, Insurance, emission testing certificate BY RPAD. Keep the acknowledgement from the previous Registering authority for having received your application and the 4 th copy of NOC application safely . You will receive the NOC from the concerned Registering Authority.

Q: What documents are accepted as age proof at RTO?

A: Any one of the following;

-

School Certificate

-

Birth Certificate,

-

Certificate Granted by registered Medical Practitioner not below the rank of Civil surgeon

-

Passport

-

LIC policy

-

Voter’s ID card,

-

Electoral Roll

Q: What is the procedure for obtaining of Noting/Terminating of Hire Purchase/Terminating of Hire Purchase/Hypothecation/Lease?

A: The following documents have to be produced for noting NOTING OF HIRE PURCHASE/HYPOTHECATION/LEASE.

-

Application form CMV 34.

-

Registration Certificate (RC Book).

-

Fitness Certificate / Permit in case of Transport vehicle.

-

Tax Card.

-

Insurance Certificate.

-

Pollution Under Control Certificate.

-

Prescribed fee.

All the related applications shall be filed before the Registering Authority

Q: What is the procedure for renewal of registration of non-transport vehicle (Personal vehicles motor cycles, car, jeep etc.)

A: The owner shall obtain renewal of registration certificate in respect of Non-Transport vehicles after 15 years from the date of its registration.

Application for renewal of registration certificate shall be made in form CMV 25 not more than SIXTY (60) DAYS before the date of its expiry along with documents viz. Registration Certificate, Insurance Certificate, Tax Card, Pollution Under Control Certificate, Prescribed fee and produce the vehicle for inspection in a good condition.

Registration Certificate will be renewed for a period of FIVE YEARS .

FAQs

You can find a list of common Karnataka RTO queries and their answer in the link below.

Karnataka RTO queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share