Unemployment Insurance Scheme UAE

- Sections

- Benefits of the Unemployment Insurance Scheme in UAE

- Eligibility Criteria to get Unemployment Insurance Scheme in UAE

- Beneficiaries of Unemployment Insurance Scheme in UAE

- Not Eligible to get Unemployment Insurance Scheme in UAE

- Monthly Insurance Premium Installment

- Insurance Premium Payment Options Subscription/ Premium Collection Channels

- How to buy Unemployment Insurance Scheme policy online?

- How to file for Compensation when you lose your job?

- Cost of Unemployment Insurance Scheme Subscription

- Suspension of the compensation

- FAQs

Unemployment Insurance Scheme provides security for employees who lost their jobs due to reasons other than disciplinary action or resignation until they find a new job.

The insurance scheme aims to:

-

provide the insured with income for a limited period of time during his/her unemployment

-

enhance the competitiveness of Emiratis in the labour market

-

provide social protection to ensure continued decent living for the unemployed

-

achieve a competitive knowledge economy by attracting and retaining best international talent.

Benefits of the Unemployment Insurance Scheme in UAE

Following are the benefits of Unemployment Insurance Scheme in UAE

The Monthly compensation is 60% of the average basic salary over the most recent 6 months prior to the Involuntary Loss of Employment.

For Category A: Maximum Claim Benefits: 10,000 AED per month

For Category B: Maximum claim Amount: 20,000 AED per month

Maximum compensation for any one claim: 3 consecutive months

Maximum Period of Benefits: During the Insurance Period over the entire work life of the Insured in the United Arab Emirates the aggregate Claim Payment shall not exceed 12 monthly benefits (regardless of the number of Claims submitted).

Eligibility Criteria to get Unemployment Insurance Scheme in UAE

To be eligible for the compensation, the worker must have been paying the monthly premium for at least 12 consecutive months.

Cash benefit shall be provided for maximum 3 consecutive months for a claim only for the workers who pay the monthly premium for at least 12 consecutive months.

The eligible employees will be compensated with a Monthly cash benefit up to 60% of their average basic salaries of the 6 months prior to loss of employment.

Beneficiaries of Unemployment Insurance Scheme in UAE

Emiratis and residents working in the federal and private sectors are the beneficiaries of Unemployment Insurance Scheme in UAE.

Employees working in free zones and semi-government entities can also register.

Not Eligible to get Unemployment Insurance Scheme in UAE

The scheme applies to all workers in the private and federal sector except:

-

investors, business owners who own and manage their business themselves

-

domestic workers

-

employees on a temporary basis

-

juveniles under the age of 18

-

retirees who receive pension and have joined a new employer.

Monthly Insurance Premium Installment

-

Category A: 5 AED per month if the Basic Salary/Wage is 16,000 AED or less

-

Category B: 10 AED per month if the Basic Salary/Wage is greater than 16,000 AED

Insurance Premium Payment Options Subscription/ Premium Collection Channels

You can subscribe to the Unemployment Insurance Scheme through following channels

- Insurance Pool Website and smart application

-

Kiosks and ATMs

-

Businessmen Service Centers

-

Exchange Companies

-

Banks and Banking Applications application

-

Telecom Companies Bill (DU and Etisalat)

-

SMS

-

Any other channel agreed between the Ministry and the Insurance Pool

How to buy Unemployment Insurance Scheme policy online?

Follow the below steps to apply online for Unemployment Insurance Scheme for Individual users working in a private company in UAE.

-

Under Individual section, click on the "Private" option to purchase a policy.

-

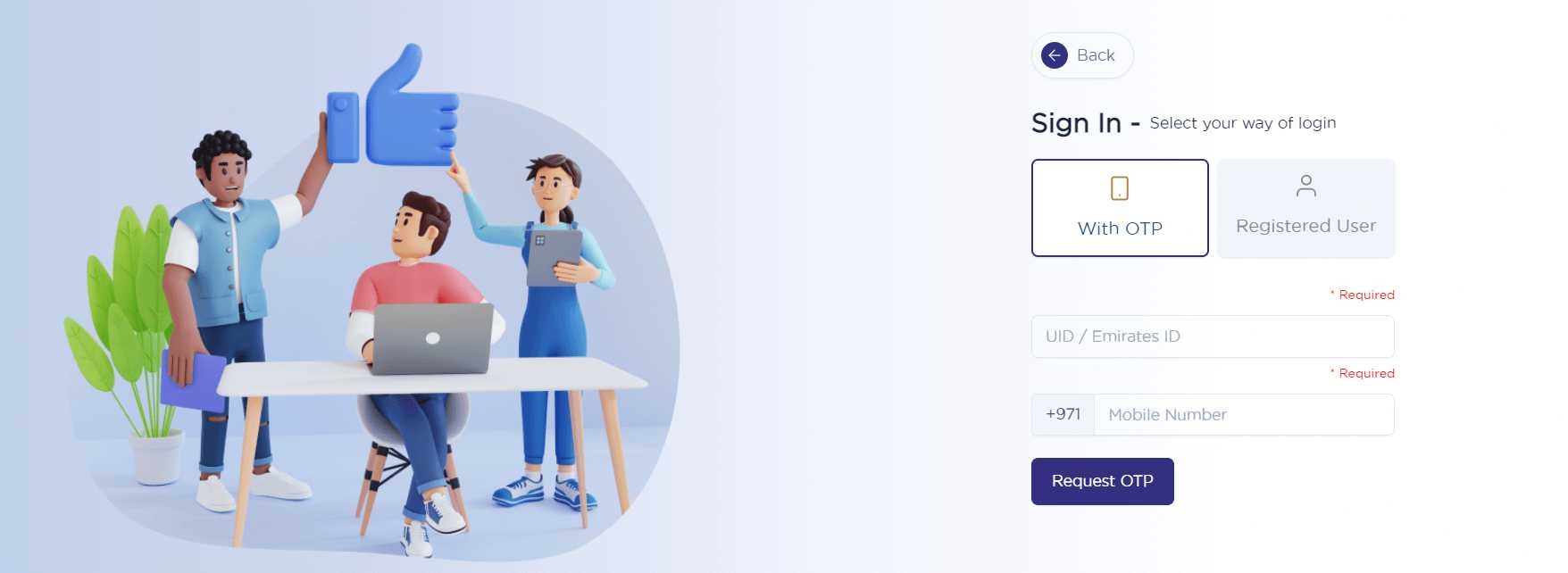

Two Login options (Login with OTP & Registered Users) are available.

-

Choose "OTP CARD” and Enter Valid ID/Mobile number, then Click "Request OTP"

-

Enter the received OTP from your registered mobile number and click the "Submit" button.

-

Popup message will be displayed to confirm user details. Upon checking that click "Ok" to proceed further

-

Confirm the personal details and click the check box, if required

-

Click drop-down list to select the policy period and payment duration tenure.

-

Select the mandatory check box and Click "Pay Now"

-

Providing your Email id is optional & System will share the COI copy to mail.

-

Click "Ok" to proceed further.

-

Make the required payment.

-

Click Home icon to view Dashboard & Print option is available to Download duplicate COI copy.

-

Home Screen will display “View policy details” & “View statement options”.

How to file for Compensation when you lose your job?

The worker must submit the claim within 30 days from the date of his/her unemployment. The insurance company has two weeks, from receiving the claim, to transfer the compensation to the insured's account.

You can file for compensation from any of these channels.

-

Insurance Pool website (www.iloe.ae)

-

The smart application of the Insurance Pool (iloe)

-

Al Ansari Exchange

-

Kiosk machines

-

Telecommunication bills

-

Bank ATMs and applications

-

Businessmen service centers

The insurance providers must process the insurance claims in accordance with the terms and conditions of the insurance policy and the applicable legislations of the Central Bank of the UAE.

Compensation will be paid from the date he/she loses the job and will be paid for 3 months or until he/she finds a job, whichever is earlier.

MoHRE will report any breach to the terms and conditions of the insurance policy by the insurance companies.

With respect to the employees of the federal government, Federal Authority for Government Human Resources will implement the mechanism of the ‘Unemployment Insurance Scheme’ in coordination with Ministry of Finance.

Cost of Unemployment Insurance Scheme Subscription

Workers with a basic salary of AED 16,000 or less will need to pay a monthly insurance premium of AED 5, i.e. AED 60 annually. The compensation for this category must not exceed a monthly amount of AED 10,000.

Those with a basic salary exceeding AED 16,000 will need to pay AED 10 per month, i.e. AED 120 annually. The compensation for this category must not exceed AED 20,000 monthly.

The worker may choose to pay the premium on a monthly, quarterly, half-yearly or on an annual basis.

The insured worker may, in coordination with the insurance company, subscribe to additional benefits in addition to the above basic package.

The value of the insurance policy is subject to VAT.

Suspension of the compensation

The insured worker will lose his/her eligibility for compensation if any of the following situations occur:

-

he/she was dismissed from work for disciplinary reasons

-

there has been fraud or deceit involved in his/her claim

-

the establishment where he/she works is fictitious.

FAQs

You can find a list of common Unemployment Insurance Scheme UAE queries and their answer in the link below.

Unemployment Insurance Scheme UAE queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share