Pradhan Mantri Garib Kalyan Yojana

Pradhan Mantri Garib Kalyan Yojana (PMGKY) provides an opportunity to declare unaccounted wealth and black money in a confidential manner and avoid prosecution after paying a fine of 50% on the undisclosed income. An additional 25% of the undisclosed income is invested in the scheme which can be refunded after four years, without any interest.

Scheme will be valid from December 16, 2016 to March 31, 2017.

The scheme can only be availed to declare income in the form of cash or bank deposits in Indian bank accounts and not in the form of jewellery, stock, immovable property, or deposits in overseas accounts

Not declaring undisclosed income under the PMGKY will attract a fine of 77.25% if the income is shown in tax returns. In case the income is not shown in tax returns, it will attract a further 10% penalty followed by prosecution

Features of Pradhan Mantri Garib Kalyan Yojana

-

Any person willing to declare their undisclosed income in the form of cash or deposits in the account with bank or post office or specified entity can opt for this scheme.

-

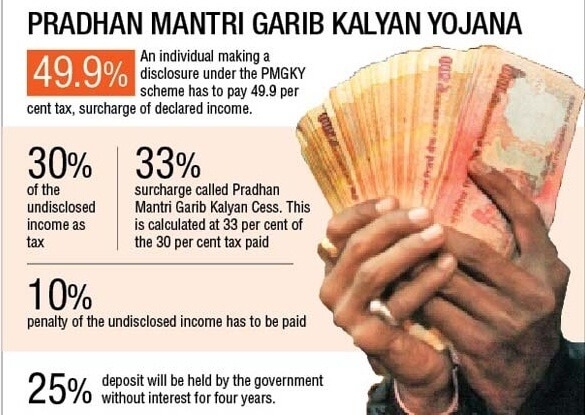

On the declared undisclosed income, tax at 30% of income, surcharge at 33% of tax, penalty at 10% of income is payable by such person, totalling to 49.9% of the income declared

-

This deposit scheme has a lock-in period of four years, and the scheme shall not pay interest on the amount deposited.

-

The taxes, surcharge and penalty need to be paid before filing the declaration in Form-1 under the scheme, and proof of payment has to accompany the declaration.

-

The amount of undisclosed income declared under this scheme shall not be included in the total income of the declarant under the Incometax Act, 1961 (the Act) for any assessment year (AY).

-

The scheme shall apply to the undisclosed income deposited in accounts maintained in a bank or post office (PO) like savings account, current account, recurring deposit account, fixed deposit account, public provident fund account, senior citizen saving scheme account, monthly income scheme account, and Jan Dhan Yojana account as per section 199C of the Scheme. Only Banks and POs are specified entities as of now.

-

The scheme is not available for declaration of income which is represented in the form of any asset other than cash, and deposits like jewellery, stock or immovable property.

-

A declaration under this scheme can be filed in respect of inter-bank transfers for deposits made in an account maintained with a specified entity by any mode such as cash, cheque, RTGS, NEFT or any other electronic transfer system

-

This scheme can be availed by any person to whom below notices under any of the following provisions of the Act have been issued for any AY.

-

142(1) – Inquiry before assessment;

-

143(2) – Assessment;

-

148 – Issue of notice where income has escaped assessment;

-

153A – Assessment in case of search or requisition;

-

153C – Assessment of income of any other person.

-

-

The scheme can be availed by any person against whom a search/ survey operation has been initiated, and cash seized during search/ survey can also be declared.

-

Any advance taxes paid, taxes withheld or taxes collected at source (TCS) on the declared undisclosed income under this scheme shall not be given credit against the taxes to be paid at the rate of 49.9%.

-

The scheme shall not apply to undisclosed income in the form of deposits in foreign bank account, as that is chargeable to tax under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

-

The scheme can be availed on the deposits made in bank accounts prior to the financial year (FY) 2016-17 also.

-

The scheme can be availed on cash deposits made in an account during the period 01 April, 2016 to 15 December, 2016 (i.e., prior to effective date of this scheme). The same shall attract tax at the rate of 49.9% on the declared undisclosed income. Also, amended provisions of section 115BBE (i.e., tax at the rate of 77.25% on income in respect of unexplained cash credit/ income, investment, expenditure, etc.,) of the Act shall apply if not declared under this scheme before 31 March, 2017.

-

The scheme can also be availed for the undisclosed income deposited or repaid against an overdraft account/ cash credit account/ any loan account maintained with a bank or any specified entity

-

Cash seized by the Department during search/ seizure operation and deposited in the Public Deposit Account may be allowed to be adjusted for making payment of tax at the rate of 49.9% under the scheme, on the request of a person from whom the cash is seized. However, the amount shall not be allowed to be adjusted for making at least 25% deposit under PMGKD scheme

-

Any person (i.e., buyer) can declare an amount under this scheme which is received back from the seller earlier paid for procurement of goods (other than immovable property) or services. However, no penalty under section 271D (i.e., penalty for failure to comply with the provisions of section 299SS) or 271E (i.e., penalty for failure to comply with the provisions of section 269T) of the Act shall be attracted on such transaction in case of the seller.

Status

Black money worth Rs 4,900 crore was disclosed by 21,000 people under the Pradhan Mantri Garib Kalyan Yojna (PMGKY)

FAQs

You can find a list of common Government Schemes queries and their answer in the link below.

Government Schemes queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share