One District One Product Scheme

Government of Uttar Pradesh has launched One District One Product scheme, on August 10, 2018, to promote visibility and sale of indigenous and specialized products/crafts of Uttar Pradesh.

In this scheme, one particular product is selected from every district of Uttar Pradesh. The selected product under ODOP is traditionally famous for their production and manufacturing from that particular district (e.g Lucknow is famous for zari-zardozi and chikankari). Many of these products are GI-tagged, which means they are certified as being specific to that region in Uttar Pradesh.

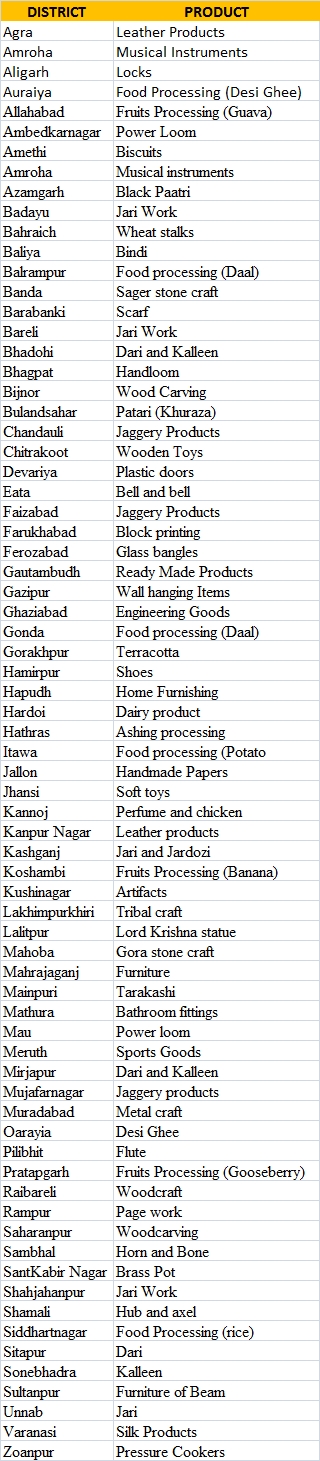

Product List

Following are the district wise selected product as part of One District One Product scheme.

Aim

-

This scheme aims to create a large number of employment opportunities for the youth and strengthen the inclusive and sustainable development of Uttar Pradesh.

-

Under the ODOP scheme, Government of Uttar Pradesh has set a goal of providing employment to 25 lakh people in 5 years through the financial assistance of Rs 25,000 crores. In addition to this, the scheme could raise the GDP of the state by as much as 2%.

Benefits

-

Preservation and development of local craftsman skills and promotion of the art.

-

Increase in income and local employment

-

Improvement in product quality and skill development.

-

Transforming the products in an artistic way with attractive packaging and branding.

-

To connect the production with tourism through live demo and sales outlet - gifts and souvenir.

-

To resolve the issues of economic difference and regional imbalance.

-

To take the concept of ODOP to national and international level after successful implementation at the state level.

Eligibility Criteria

-

The age of the applicant should be a minimum of 18 years

-

The applicant should be the resident of Uttar Pradesh

Schemes Under ODOP

Following are the subschemes under One District One Product Scheme.

-

Common Facility Centre Scheme

-

Skill Development Scheme

-

Marketing Development Assistance Scheme

-

Finance Assistance Scheme (Margin Money Scheme)

Common Facility Centre Scheme

To establish a Common Facility Centre (CFC) which would encompass the following activities:

-

Testing Lab

-

Design Development and Training Centre

-

Technical research and Development Centre

-

Product exhibition cum Selling Centre

-

Raw Material Bank / Common Resource Centre

-

Common Production / Processing Centre

-

Common Logistics Centre

-

Information, Communication and Broadcasting Centre

-

Packaging, Labelling and Barcoding facilities

-

Other such facilities related to missing link of value chain

Eligibility Criteria to set up CFC

Entities or organisations that can participate in the establishment of CFC include NGOs (Non-Governmental Organizations), Volunteer Organizations, Self Help Groups, Producer Companies, Private Limited Companies, Limited Liability Partnership, and Cooperatives

Process of establishing a CFC

-

A Special Purpose Vehicle (SPV) to be created by any of the entities, as mentioned in Section II

-

The SPV shall comprise of minimum 20 members. Out of the total members, a minimum of two-third members shall be related to the ODOP programme

-

The SPV should be registered with appropriate registration authorities

-

The SPV must include ODOP product related stakeholders and a State government representative

-

No single member should hold more than 10% of the total SPV’s shares

-

The SPV shall be responsible for the management, operation and maintenance of the CFC and no recurrent expenditure would be borne by the state under the scheme

-

EOI (Expression of Interest) would be invited from interested parties

Incentives to setup CFC

-

For CFCs of project cost up to Rs. 15 crores, the State government shall provide a financial assistance up to 90% of the project cost, while a minimum of 10% would be borne by the SPV

-

Financial assistance would also be given for CFCs of project cost more than Rs 15 crores, provided the State’s share would be calculated on Rs 15 crores only

-

The State government can also sanction capital for the projects of similar nature, previously approved by the Central & the State governments, which are incomplete due to the lack of funds. For supporting such incomplete projects, proper justification would be provided.

Skill Development Scheme

The ODOP Skill Development and Tool Kit Distribution Scheme is aimed at fulfilling current and future requirements of skilled work force in the entire value chain of ODOP products, across the state of Uttar Pradesh. Additionally, the scheme intends to equip the artisans / workers through distribution of relevant advanced tool kits.

Eligibility Criteria for Skill Development Scheme

-

The age of the applicant should be a minimum of 18 years

-

The applicant should be the resident of Uttar Pradesh

-

Educational qualification is not mandatory

-

The applicant shall not have availed any benefit with respect to the toolkit from either the GoI or the State Government in last 2 years

-

As per the scheme, the applicant or any of its family member shall be eligible to apply for the scheme only once. For the purpose of this scheme, husband and wife constitute a family

-

An affidavit is to be presented for meeting the eligibility criteria under the scheme

Incentives under Skill Development Scheme

-

Artisan who are already skilled shall be imparted required training through RPL (Recognition of Prior Learning) and shall be certified through relevant Sector Skill Councils (SSCs)

-

Unskilled artisans shall be provided a 10-day training. Post completion of training, these artisans shall also be certified under RPL

-

All the trainees shall receive an honorarium of Rs. 200 per day during the training period

-

An advanced toolkit, free of cost, shall be provided by the department to the trained artisans

Marketing Development Assistance Scheme

A Market Development Assistance Scheme is currently operated by the Ministry of Commerce with a view to encourage exporters (including MSME exporters) to access and develop overseas markets. The scheme offers funding for participation in international fairs, study tours abroad, trade delegations, publicity, etc. Direct assistance under MDA for small- scale units is given for individual sales-cum-study tours, participation in fairs/exhibitions and publicity. SIDBI operates a scheme of direct assistance for financing activities relating to marketing of MSME products.

The scheme offers funding for:

-

Participation by manufacturing Small & Micro Enterprises in International Trade Fairs/ Exhibitions under MSME India stall.

-

Sector specific market studies by Industry Associations/ Export Promotion Councils/ Federation of Indian Export Organisation.

-

Initiating/ contesting anti-dumping cases by MSME Associations and

-

Reimbursement of 75% of one time registration fee (w.e.f. Ist January 2002) and 75% of annual fees (recurring) (w.e.f. Ist June 2007) paid to GSI (Formerly EAN India) by Small & Micro units for the first three years for bar code.

Margin Money / Financial Assistance Scheme

-

Under this scheme, all nationalized banks, regional rural banks and other scheduled banks will finance the business and the Department of Micro, Small and Medium Enterprises and Department of Export Promotion shall release the ODOP margin money subsidy against all applications submitted under the scheme.

-

For enterprises with project cost upto INR 25 lakhs, 25% of the entire project cost subject to a maximum of INR 6.25 lakhs, whichever is less, shall be payable under the margin money scheme.

-

For enterprises with project cost between INR 25 lakhs to 50 lakhs, INR 6.25 lakhs or 20% of the project cost whichever is more, shall be payable under the margin money scheme.

-

For enterprises with project cost between INR 50 lakhs to 150 lakhs, INR 10 lakhs or 10% of the project cost, whichever is more, shall be payable under the margin money scheme.

-

For enterprises with project costs exceeding INR 150 lakhs, 10% of the entire amount subject to maximum of INR 20 lakhs, whichever is less, shall be payable under the margin money scheme.

FAQs

You can find a list of common Government Schemes queries and their answer in the link below.

Government Schemes queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Anyone can contact the toll free number 1800-1800-888 and/or visit their nearest DIC for more assistance.

There is no specific ODOP scheme designated for women only. However, women entrepreneurs can apply for benefits under Stand Up India scheme.

No. Benefits are only available to applicants who are involved in the production of district wise enlisted products.

One member per family can avail this benefits of the ODOP schemes.

The applicant will not be eligible for the schemes under ODOP, if he/she has already availed benefits from similar type of schemes. However, kindly refer the specific scheme for more clarity.

The applicant can ask for the reason of denial from bank manager and if no appropriate/satisfactory answer is received he/she can take help from the Banking Ombudsman. Any complaint related to banks will be addressed by Banking Ombudsman.

Share

Share