Can I sell a property below the circle rate/guidance value?

Answered on March 24,2024

Guidance value is the minimum amount for which a property can be registered. We can sell a property below the guidance value but the registration cost would be based on the guidance value or selling price, whichever is higher

A Property registration incurs the following costs:

- Stamp Duty

- Surcharge

- Cess

- Registration fee

- TDS

let me share my experience of selling a property below the guidance value

Context:

My client lives in Texas, USA and owns a flat in Bangalore. The idea is to sell his property in Bangalore and use this fund to buy a new property in USA. My client had very short time to finalize the sale.

The property guidance value is Rs. 80.45 lakh and our listed price is Rs. 85 lakh. We set 30 days to find the buyer. We received multiple offers in the range of Rs. 50–60 lakhs despite our best efforts to meet the target of Rs. 85 lakhs

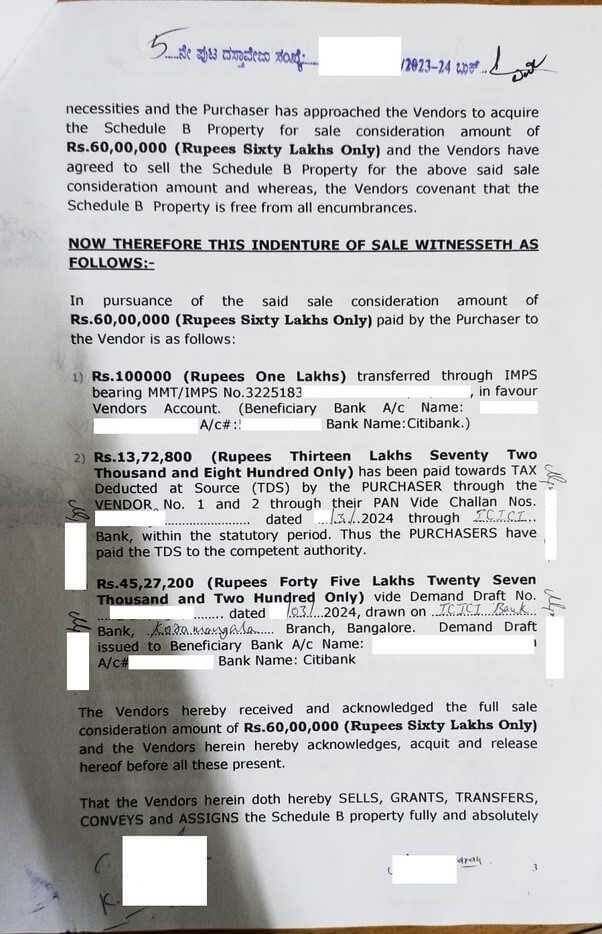

We zeroed an offer of Rs. 60 lakhs which seemed better than other offers we received. The other main reason to accept this offer is that buyer is self-financing (without opting for home loan) which gave us the advantage of expediting the time because home loan would take another 1–2 months to realize the payment. We skipped the sale agreement and projected to register the sale deed within two weeks from today.

We collected the advance of Rs.1 lakh from buyer to confirm the deal and exchanged the property documents for verification

Our selling price is Rs. 60 lakhs, below the guidance value of Rs. 80.45 lakhs. The seller is an NRI and the TDS rate is 22.88% including surcharge & Cess. Buyer should deduct the TDS from buying price and deposit the same in e-filing portal of Income tax Department.

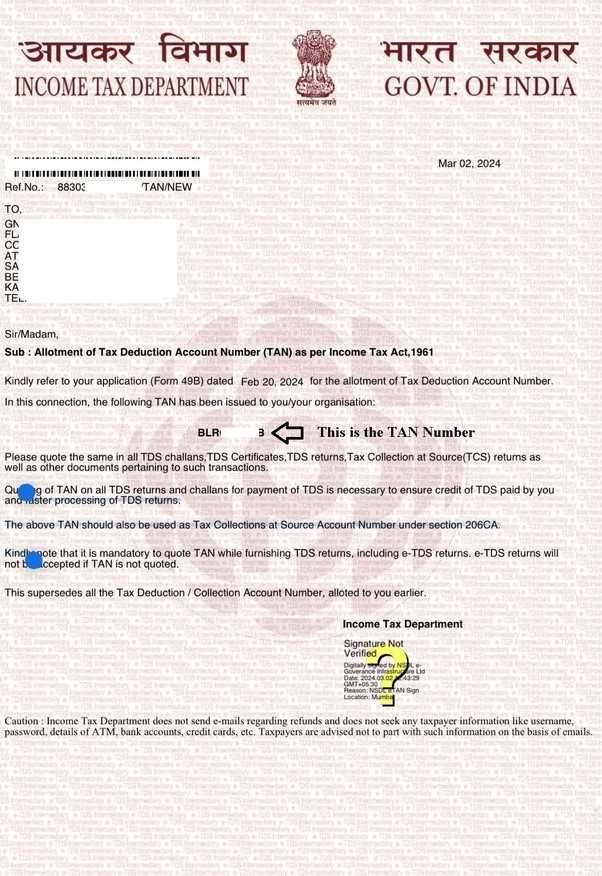

The buyer should have a TAN to pay the TDS. We applied for TAN, which cost us Rs.150 and seven working days. we downloaded the TAN, refer to the below image.

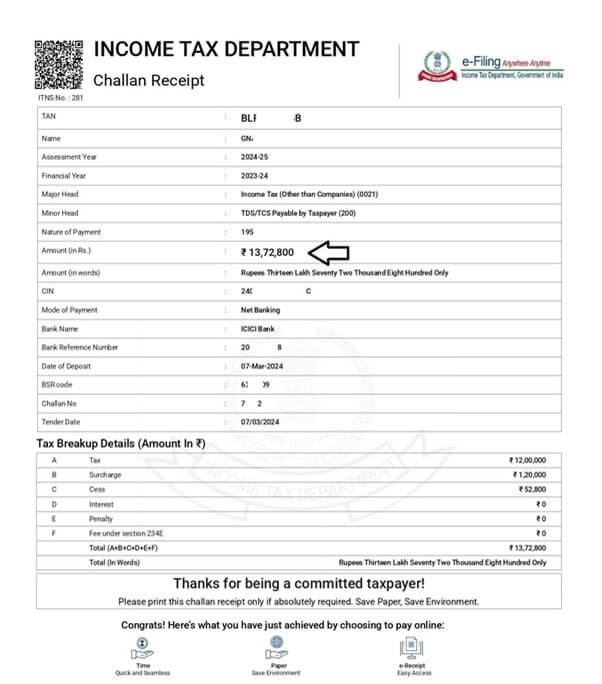

The buyer was not aware of the concept called “Guidance Value”. Since our selling price is less than the guidance value, buyer should pay the TDS based on the guidance value instead buyer paid the TDS based on selling price

Buyer paid the TDS of Rs. 60 lakhs X 22.88% = 13,72,800 instead of Rs. 80.45 Lakhs X 22.88% = 18,40,696. The buyer made a short payment of Rs. 4,67,896. Refer to the below TDS challan, we highlighted the payment

For property registration in Bangalore, we applied online on Kaveri Online Service. The application submission includes the supporting documents of deed draft, ID proofs, tax receipt, Khata and TDS challan. Our application went through the verification and received the approval in 3 days.

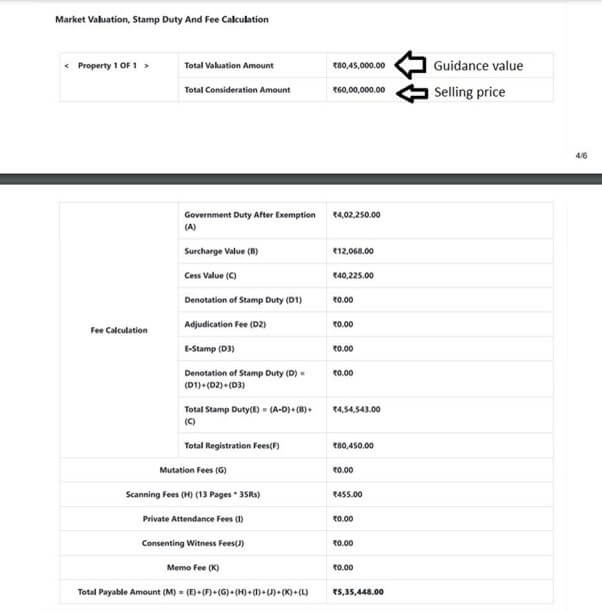

Once the application is approved, we can pay the registration cost online in Kaveri Online Services. The registration cost is automated and we don’t have option to edit or underpay. Our cost was auto-calculated based on the guidance value and we needed to click on the “Make Payment” button and make our payment through Internet banking.

Below is our auto-calculation and we highlighted the guidance & selling price in the below image.

We made the payment and below is our transaction receipt:

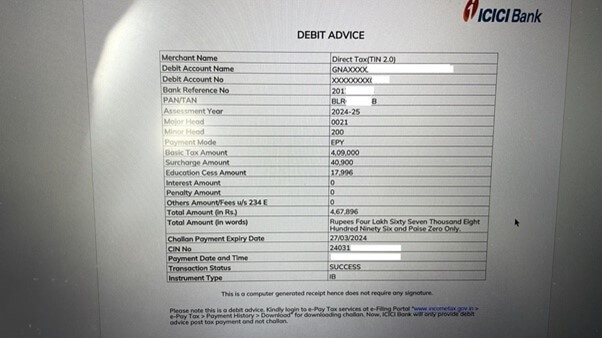

At the time of registration, an approved summary is the final checkpoint in the registration process. The staff at the registration counter found that buyer short-paid TDS while cross-checking the summary report. She held our registration and told the buyer to pay the difference in TDS. The buyer immediately paid the difference of Rs. 4,67,896 and submitted the challan at the registration counter.

Refer to the below debit transaction.

The staff resumed our registration. I must thank the staff for highlighting the short payment or the buyer would have received the tax notice with the hefty penalty and interest amount.

My client sent the Special Power of Attorney (SPOA) and signed sale deed from the USA. The SPOA holder presented the documents in sub-registrar office on behalf of seller and completed the registration.

Below is our transaction page from sale deed.

We can bring down the TDS rate by obtaining low tax/Nil tax certificate from income tax department, we need a sale agreement and around 30 working days to obtain it. Since we don’t have sale agreement and short of time, we paid the TDS as per the general rate and now working on the refund in ITR.

We may sell a property below the guidance value to save tax. Buyers may save stamp duty up to the level of guidance value

We assist with property registration. Please WhatsApp to +91-97424-79020

Thank you for reading…

Share

Share

Clap

Clap

19 views

19 views

1

1 3

3