How to pay home loan MODT charges in Karnataka?

Answered on March 10,2022

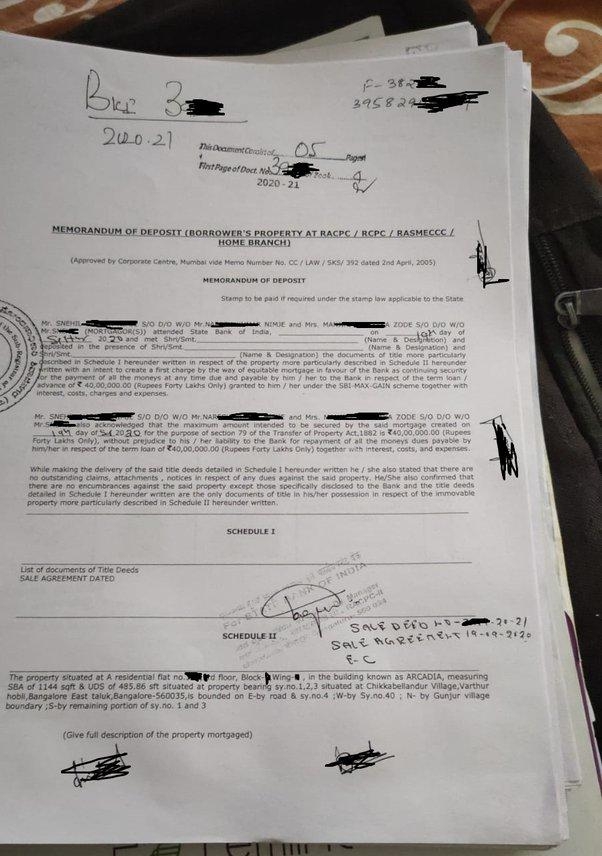

The term MODT means “Memorandum of Deposit of Title Deed”

Memorandum of Deposit of Title Deed or MODT is applicable for all home loan borrowers.

It is essentially an undertaking given by you that you are depositing title documents of the property with the bank of your own free will in return for a loan.

Following are title documents deposited in the bank under MODT

- Mother deed

- Sale deed

- Sale Agreement

- Encumbrance certificate

- Tax paid receipt

- Khata certificate & extract

- Occupation certificate

- and additional documents applicable for land like RTC, layout plan, building plan, etc.

You may ask your banker if MODT registration is necessary or not. The most bank does MODT registration and few banks don’t do MODT registration.

For Example, All SBI does MODT registration. Few HDFCs doesn’t do MODT registration.

If MODT is registered, the bank’s name reflects in the encumbrance certificate. If MODT is not registered, the bank’s name doesn’t reflect in the encumbrance certificate.

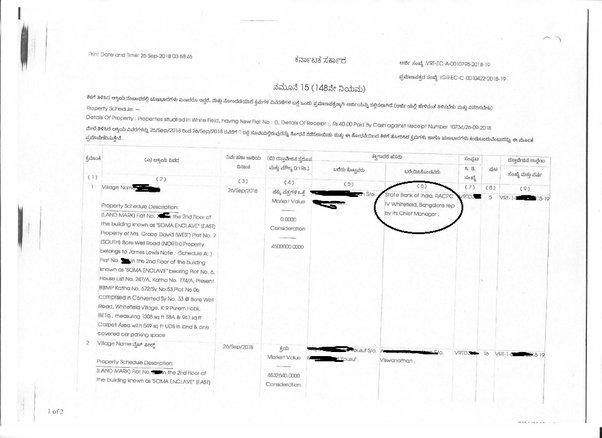

In the below encumbrance certificate, we encircled the bank details for your reference.

However, Irrespective of MODT is registered or not, the bank collects all the title documents, which include sale deed, sale agreement, and latest encumbrance certificate.

MODT is part of state government requirement, MODT charges differ from state to state in India.

Below are the government charges for MODT registration (in Karnataka)

- Stamp duty: 0.2% of loan sanctioned amount

- Registration: 0.1% of loan sanctioned amount

- Scanning Rs. 350 (approx.)

In Karnataka, below is the step by step procedure to pay MODT charges

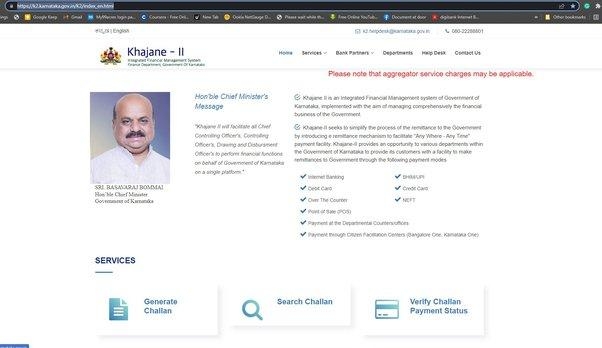

Step 1: Open the K2 website Khajane II

The home page looks like the below image

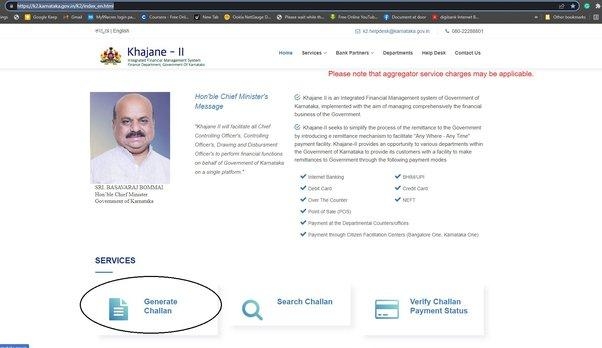

Step 2: Click on “Generate Challan”. Refer to the below image in a circle

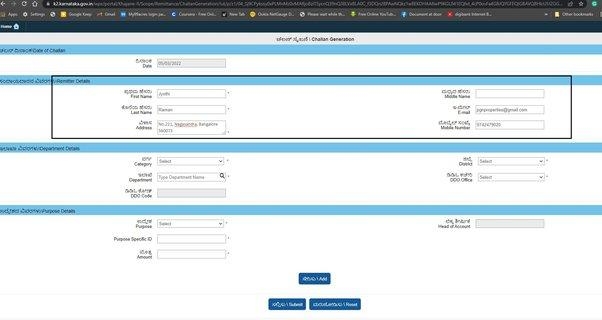

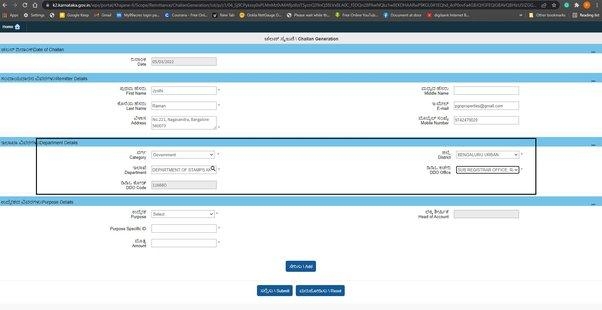

Step 3: Remitter Details:

Provide your personal details which include your name, address, email, and mobile number. Refer to the below

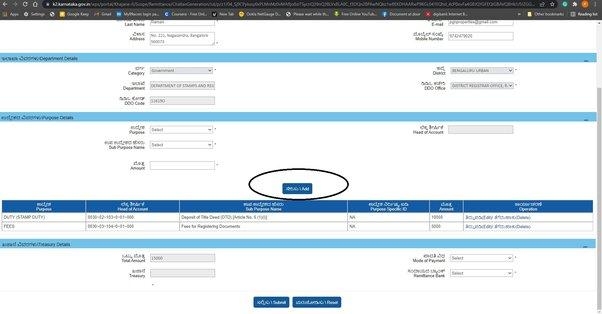

Step 4: Department Details:

- In category, select “Government” from the dropdown list

- In District, select your district from the drop-down list, I selected Bengaluru Urban in the below image

- In Department, type DEPARTMENT OF STAMPS AND REGISTRATION

- In DDO Office, select your sub-registrar office, I selected Sub-registrar Rajajinagar in the dropdown list, refer to below image

- DDO Code, popup automatically. No action is required.

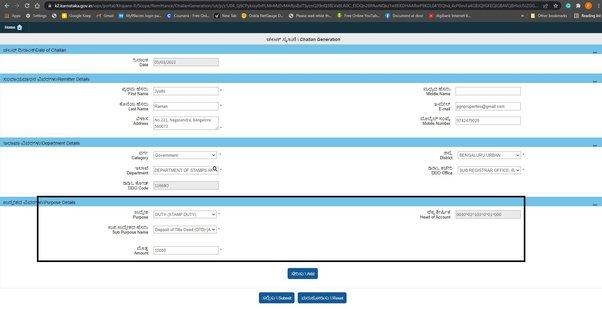

Step 5: Purpose Details:

- In purpose, select “DUTY (STAMP DUTY)” from the dropdown list

- In Sub Purpose Name, select “Deposit of Title Deed (DTD) [Article No 6 (1)(i)]” from the dropdown list

- In Amount, enter 0.2% of loan sanctioned amount.

For example: The loan sanctioned amount is Rs. 50 Lakh.

The MODT stamp duty is Rs. 50,00,000 X 0.2% = 10,000

Enter Rs. 10,000 in the amount

- In Head of Account, popup automatically. No action is required. Refer to the below image

Click on “Add”. Refer to the below image

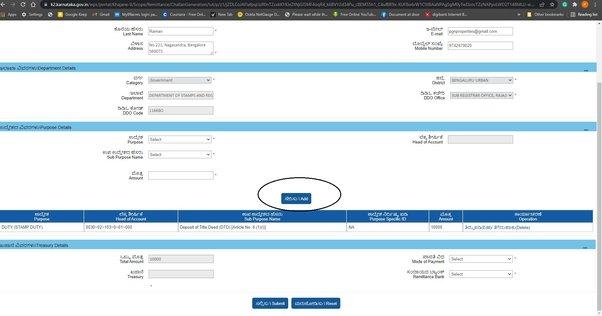

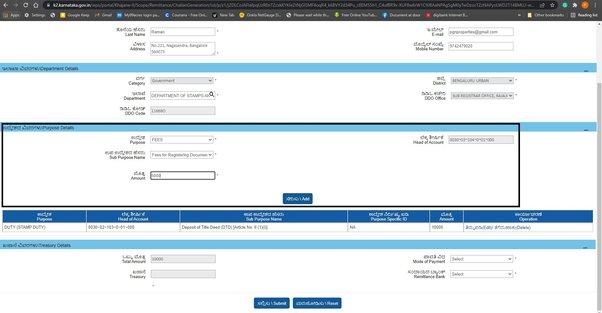

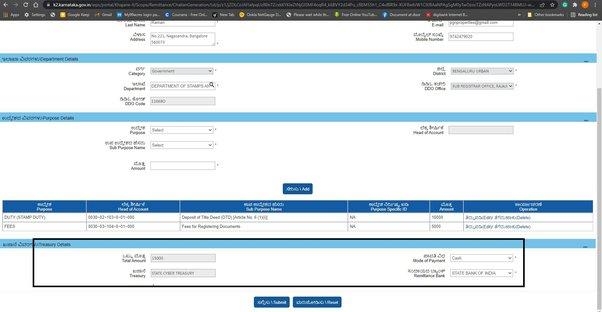

Step 6: Again in Purpose Details:

- In purpose, select “FEES” from the dropdown list

- In Sub Purpose Name, select “Fees for Registering Documents” from the dropdown list

- In Amount, enter 0.1% of loan sanctioned amount

For example : The loan sanctioned amount is Rs. 50 Lakh.

The MODT Registration fee is Rs. 50,00,000 X 0.1% = 5,000

Enter Rs. 5,000 in the amount

- In Head of Account, popup automatically. No action is required. Refer to the below image

Click on “Add”. Refer to the below image

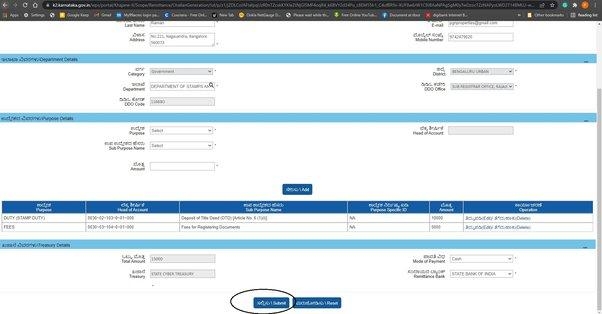

Step 7: In Treasury Details

- The total amount shows automatically, no action require

- Select Mode of Payment from the dropdown list, you have options to pay by cash, credit/debit card, net banking. I have selected cash in the below image

- In Remittance Bank, select the bank name where you want to pay by cash

- In Treasury, no action is required. Refer to the below image

Click on “Submit”. Refer to the below image at the bottom

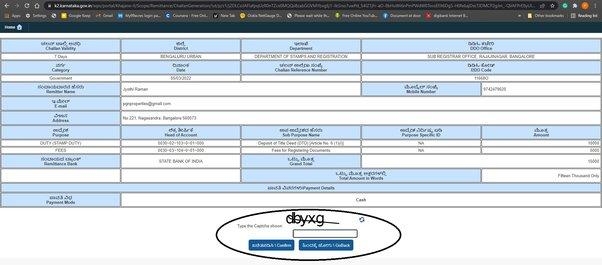

Enter the Captcha and click “Confirm”, Refer to the below image

The challan number will be generated, refer to below image

Click on “Ok”, the page directs to challan summary

Click on “Print” to take a printout or save it in PDF format. The K2 challan looks like the below image

Step 8: Carry the printout of your K2 challan to the nearest SBI bank and pay the government charges in cash. Bank seal & sign in the challan as acknowledgement, carry the acknowledged challan at the time of MODT registration. (you can avoid this step if you paid the government charges through online net banking)

Step 9: You and the bank’s representative presence are mandatory for MODT registration in the sub-registrar office.

Usually, MODT is registered immediately after the sale deed registration in the same sub-registrar office.

The registered MODT looks like below image

Note:

- We advise you to pay the MODT charges online net banking because very few bank branches accept K2 challan payment.

- A challan is valid for 7 days from the day of challan generation. Hence complete the payment within 7 days of challan generation.

- A challan is valid for 90 days from the day of payment. Hence register MODT within 90 days from the day of payment completion. In case expires, it's cumbersome to claim a refund.

- If lost or misplaced the K2 challan, can search and download challan on the K2 website by using challan number.

- As soon as you enter the sub-registrar office for MODT registration. It is important to get your challan authenticated with a sub-registrar sign to move further step for MODT registration. (mainly the sub-registrar authenticates the payment success).

- Government charges are paid separately for the sale deed and MODT registration. In Karnataka, a separate K2 challan is required for the sale deed and MODT registration.

We provide consultation, to opt for our service, please WhatsApp to +91-9742479020.

Thank you for reading…

Bhoomi RTC - Land Records in Karnataka

Bhoomi (meaning “land”) is an online portal for the management of land records in the state of Karnataka. Bhoomi portal provides the following information. Land owners..Click here to get a detailed guide

Karnataka Voter List 2024 - Search By Name, Download

Empowering citizens to exercise their democratic rights is crucial, especially in the vibrant state of Karnataka. This concise guide offers clear steps for downloading the voter list, searc..Click here to get a detailed guide

Share

Share

Clap

Clap

2107 views

2107 views

1

1 58

58