Collection of Professional Tax in Tamil Nadu

Professional tax is a tax collected by the state government in India. All the working professionals or salaried individuals in India had required to pay professional tax.

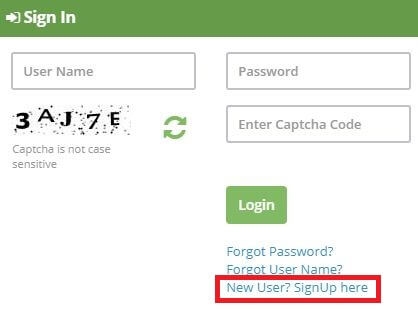

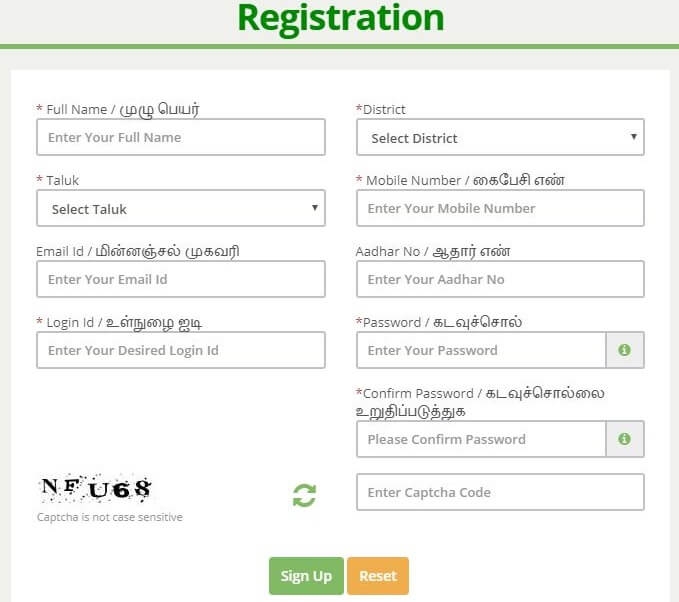

TNeSevai Registration

Follow the below steps to register in the eSevai portal.

-

Visit TN eSevai portal

-

Click on “Citizen Login”

-

If you are a new user, click on "New User"

-

Enter the required details.

-

You will receive an OTP in your registered mobile number to register in the esevai portal.

Collection of Professional Tax in Tamil Nadu

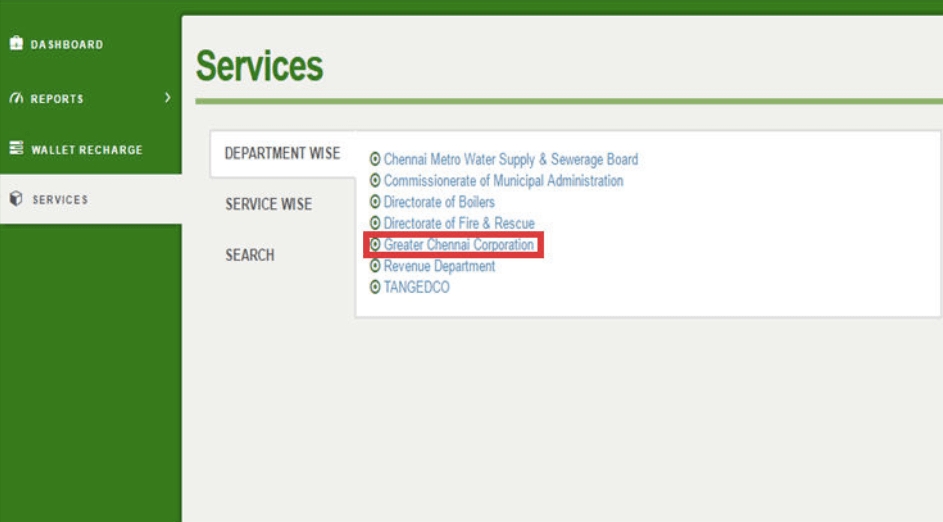

After TN eSevai registration, follow the below steps to apply for the collection of professional tax in Tamil Nadu.

-

Login to TN eSevai portal.

-

Click on "Services"

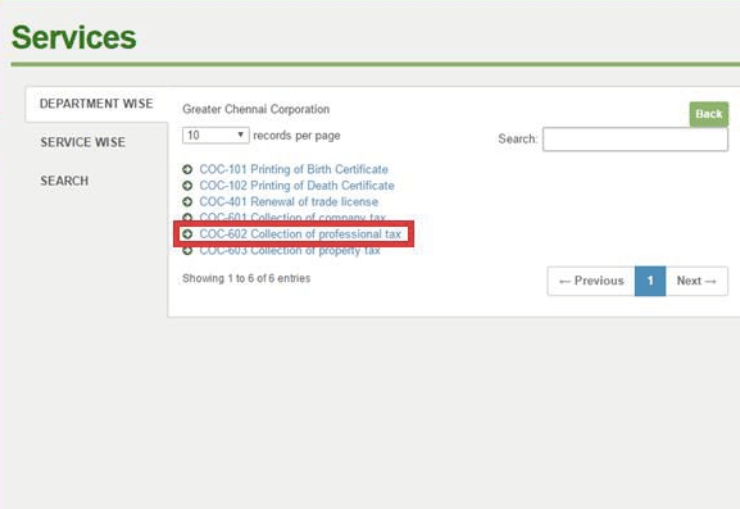

- Click on "Greater Chennai Corporation"

-

Click on “COC-602 Collection of professional tax”

-

Click “Proceed”

-

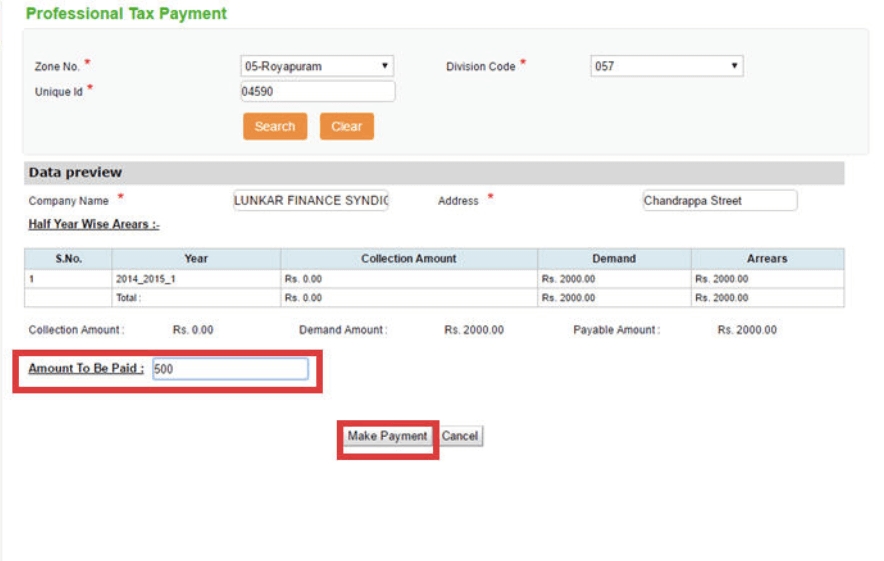

Enter the “Zone no”, “Division Code”, “Category” and “Unique ID"

-

Click on “Search”

-

Basic details for the requested “Professional Tax Number” will appear pre-filled in the form. Verify the details.

-

Enter the amount wants to pay on “Amount to be Paid”

-

Click on “Make Payment”

-

After Making Payment, Click on “Get Receipt” to download the receipt.

Charges

Following are the charges for the collection of professional tax.

| Department Charges | Service Charge |

| Up to 1000 | 15 |

| 1001-3000 | 25 |

| 3001-5000 | 40 |

| 5001-10000 | 50 |

| 10001 and above | 60 |

FAQs

You can find a list of common Income Tax queries and their answer in the link below.

Income Tax queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share