What is Pradhan Mantri Jan Dhan Yojana ?

Balan

BalanAnswered on March 23,2019

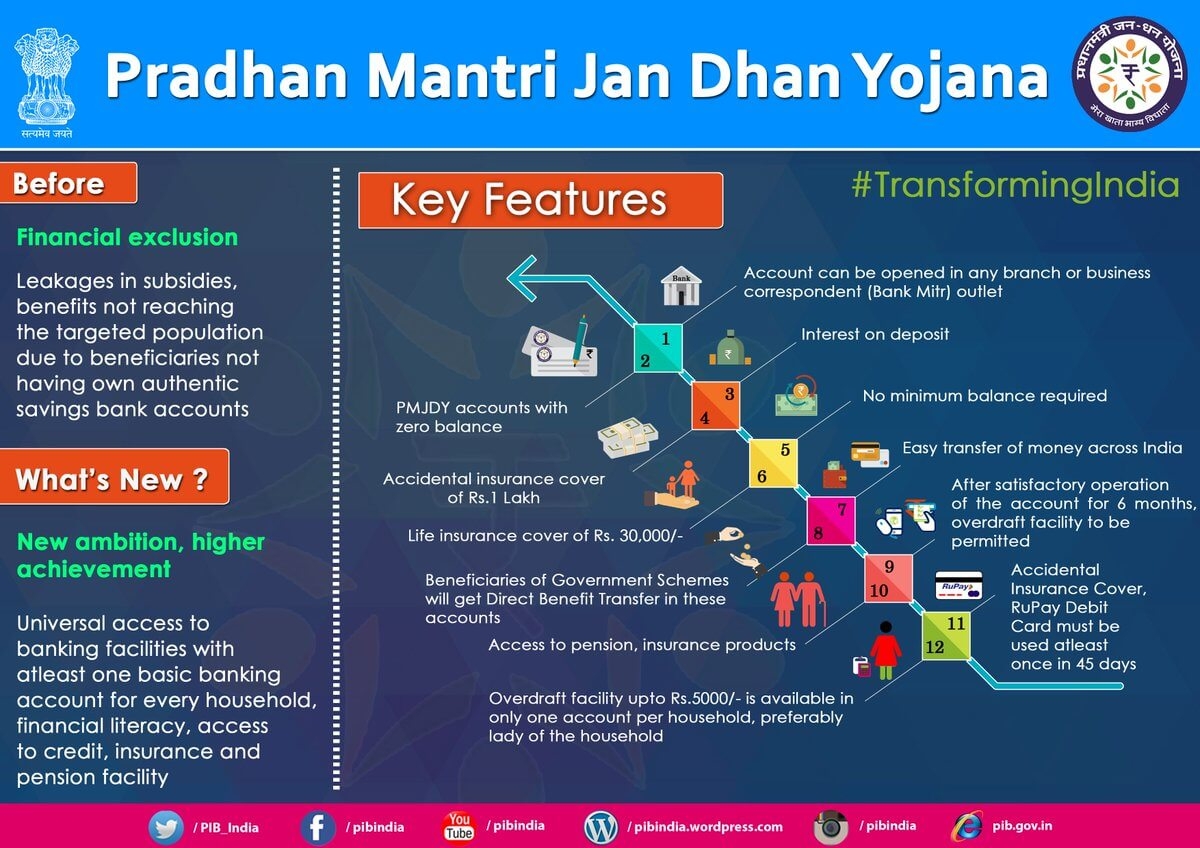

Pradhan Mantri Jan Dhan Yojana (PMJDY) is a Financial Inclusion scheme to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance and Pension in an affordable manner.

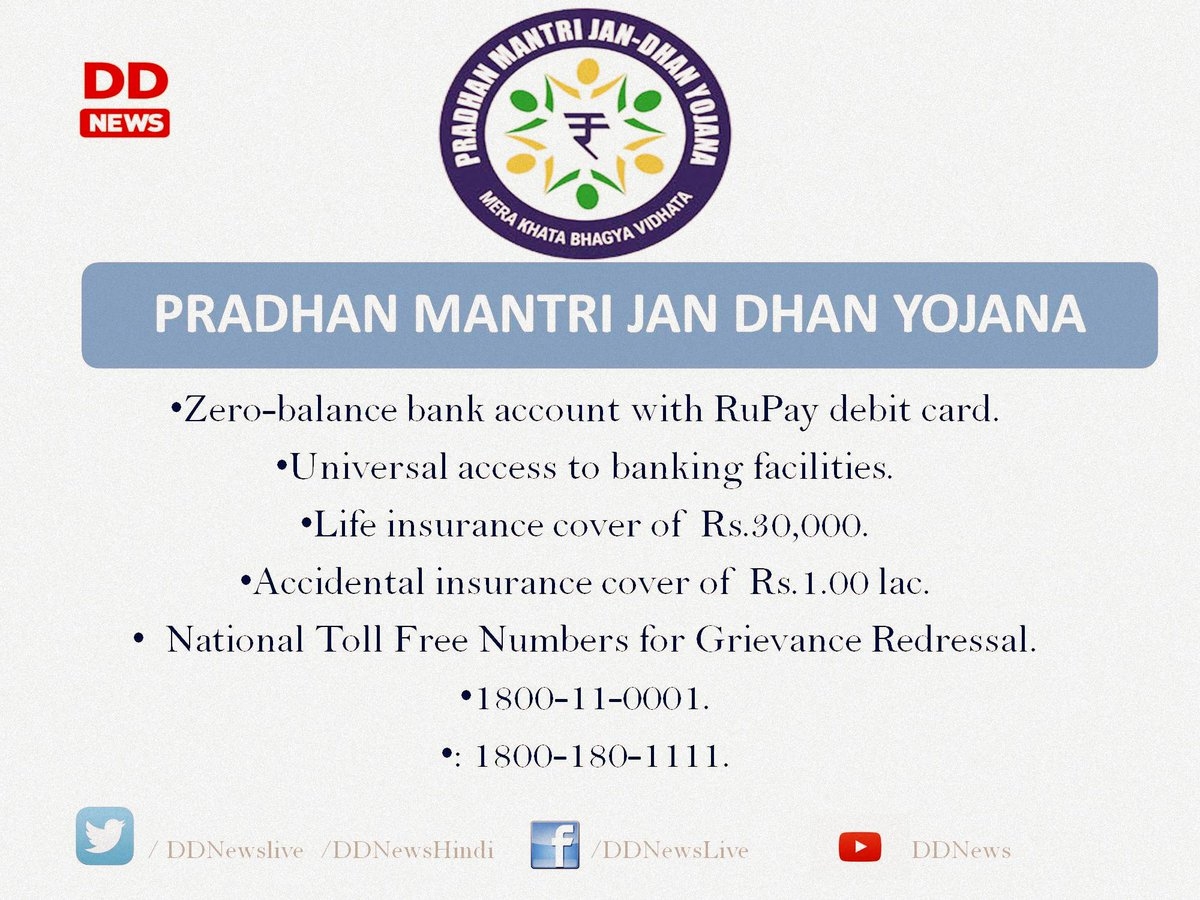

Benefits attached to the Pradhan Mantri Jan Dhan Yojana scheme are:

- Interest on deposit.

- Accidental insurance cover of Rs.1.00 lac

- No minimum balance required. However, for withdrawal of money from any ATM with Rupay Card, some balance is advised to be keptin account.

- Life insurance cover of Rs. 30,000/-

- Easy Transfer of money across India

- Beneficiaries of Government Schemes will get Direct Benefit Transfer in these accounts.

- After satisfactory operation of the account for 6 months, an overdraft facility will be permitted

- Access to Pension, insurance products.

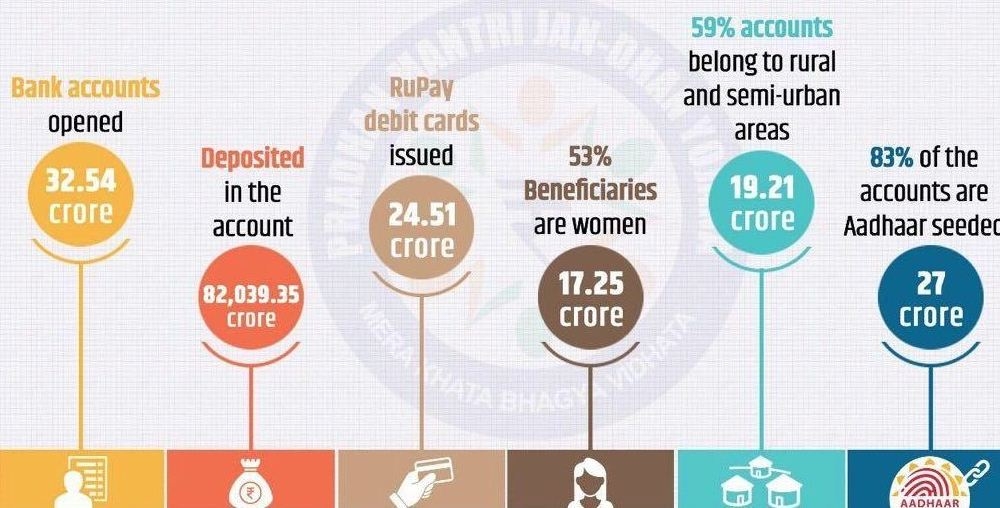

Current status of the scheme is as follows.

Jayan

JayanAnswered on March 23,2019

Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched in August 2014 as a step towards overall financial inclusion. The objective of the scheme was to ensure that every individual/family should have at least one bank account. This would give every citizen access to not just banking facilities, but also to various financial subsidies passed by the government.

Under this Scheme, Basic Savings Bank Deposit Account (BSBDA) can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet.

To open a Basic Savings Bank Deposit Account (BSBDA) with zero balance under PMJDY, you need to fulfill the below conditions:

- Be a citizen of India

- Age: 10 years and above

- Do not have bank account

Salient features of Jan Dhan Account are provided below.

- There is no requirement of minimum balance.

- The services available include deposit and withdrawal of cash at bank branch as well as ATMs; receipt/credit of money through electronic payment channels or by means of collection/deposit of cheques.

- Maximum of 4 withdrawals a month including ATM withdrawal. No such limit for deposits.

- Facility of ATM card or ATM-cum-Debit card.

- These facilities are to be provided without any extra cost.

Share

Share

Clap

Clap

630 views

630 views

1

1 460

460