How I will get Mudra loan from SBI and what are the documents required ?

Lijo

LijoAnswered on October 14,2019

Pradhan Mantri MUDRA Yojana (PMMY) loan application form is to be submitted to SBI branch with copies of the required documents. The documents required are provided below. List is only indicative and not exhaustive and depending upon the local requirements at different places addition could be made as per necessity.

Documents Required

CHECKLIST: SHISHU

-

Proof of identity - Self-certified copy of Voter’s ID card / Driving License / PAN Card / Aadhaar Card/Passport/Photo Ids issued by Govt. authority etc.

-

Proof of Residence - Recent telephone bill, electricity bill, property tax receipt, Voter’s ID card, Aadhaar Card, Passport of Individual/ Proprietor/Partners, Certificate issued by Govt. Authority/ Local Panchayat / Municipality etc.

-

Applicant’s Recent Photograph (2 copies) not older than 6 months.

-

Proof of SC/ST/OBC/Minority, if applicable.

-

Proof of Identity / Address of the Business Enterprise –if available.

-

Statement of Account from the existing Banker for the last six months, if any.

-

Quotation of Machinery / other items to be purchased.

CHECKLIST: KISHORE & TARUN

-

Proof of identity - Self-certified copy of Voter’s ID card / Driving License / PAN Card / Aadhar Card/Passport.

-

Proof of Residence - Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card & Passport of Proprietor/Partners/Directors.

-

Proof of SC/ST/OBC/Minority.

-

Proof of Identity/Address of the Business Enterprise -Copies of relevant licenses/registration certificates/other documents pertaining to the ownership, identity and address of business unit.

-

Applicants should not be a defaulter in any Bank/Financial institution.

-

Statement of accounts (for the last six months), from the existing banker, if any.

-

Last two years balance sheets of the units along with income tax/sales tax return etc. (Applicable for all cases from Rs.2 Lacs and above).

-

Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loan (Applicable for all cases from Rs.2 Lacs and above).

-

Sales achieved during the current financial year up to the date of submission of application.

-

Project report (for the proposed project) containing details of technical & economic viability.

-

Memorandum and articles of association of the company/Partnership Deed of Partners etc.

-

In absence of third party guarantee, Asset & Liability statement from the borrower including Directors & Partners may be sought to know the net-worth.

-

Photos (two copies) of Proprietor/ Partners/ Directors.

Eligibility Criteria

-

Borrower should be residing in the same locality at least for the last two years.

-

Borrower should not be a defaulter to any financial institution.

-

Borrowers having some training experiences viz. RSETI will be preferred.

Manoj

ManojAnswered on October 14,2019

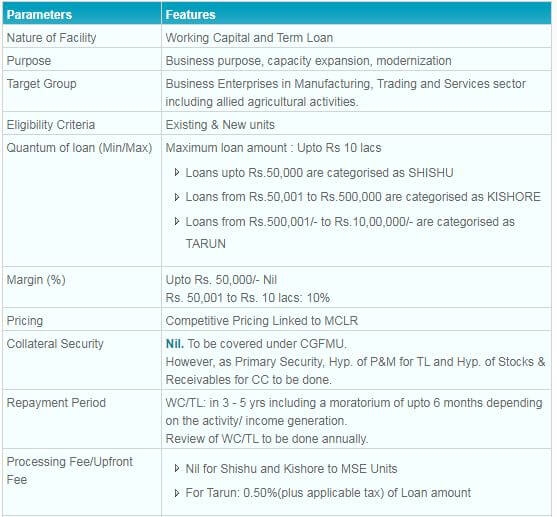

SBI provides a collateral-free loan up to Rs. 10 lacs under Mudra loan with these conditions.

Other Conditions

-

The loans under Mudra Scheme are guaranteed by Credit Guarantee for Micro Units (CGFMU) and the same is provided through National Credit Guarantee Trustee Company (NCGTC).

-

The guarantee cover is available for five years and hence for advances granted under Mudra Scheme the maximum period is 60 months.

-

Leads are now available in Udyami Mitra Portal. Site can be accessed by Branches with Username and Password

-

All Branches to issue MUDRA RuPay Card for all the eligible CC accounts.

Share

Share

Clap

Clap

698 views

698 views

1

1 456

456