YSR Rythu Bharosa Scheme

- Sections

- Objectives of YSR Ryuthu Bharosa

- Benefits of YSR Rythu Bharosa Scheme in Andhra Pradesh

- Eligibility Criteria of YSR Rythu Bharosa Scheme in Andhra Pradesh

- Documents Required for YSR Rythu Bharosa Scheme in Andhra Pradesh

- Exclusions from YSR Ryuthu Bharosa Scheme

- How to Check Payment Status Online for YSR Ryuthu Bharosa Scheme?

- Application Process of YSR Rythu Bharosa Scheme in Andhra Pradesh

- Modalities for Transfer of Benefit under YSR Ryuthu Bharosa Scheme

- References

- FAQs

Quick Links

| Name of the Service | YSR Rythu Bharosa Scheme in Andhra Pradesh |

| Department | Department Of Agriculture and Farmer Welfare |

| Beneficiaries | Citizens of Andhra Pradesh |

| Application Type | Online/Offline |

| FAQs | Click Here |

The government of Andhra Pradesh has announced YSR Rythu Bharosa Scheme to support the poor and marginal farmers in the state. Rhytu Bharosa Scheme provides financial assistance of INR 13,500 per farmer family per year to support the cultivators in meeting the investment during the crop season to enable them to timely sourcing of quality inputs and services for higher crop productivity.

All farmers (including tenant farmers) will get INR 13,500 a year as an incentive or input subsidy before the sowing (Rabi and Kharif) seasons begin.

Objectives of YSR Ryuthu Bharosa

The Government of Andhra Pradesh is implementing, “YSR RYTHU BHAROSA” from October 15th, 2019 for providing financial assistance to the farmer families including tenant farmers across the state @ Rs.12,500/- per farmer family per year to support the cultivators in meeting the investment during the crop season with a view to enable them to timely sourcing of quality inputs and services for higher crop productivity.

Benefits of YSR Rythu Bharosa Scheme in Andhra Pradesh

Following are the benefits under YSR Ryuthu Bharosa Scheme in Andhra Pradesh.

-

The land owning farmer families who collectively own cultivable land irrespective of size of land holdings will be provided a benefit of Rs.13,500/- per year per family duly including Rs.6,000/- from the Government of India under PM-KISAN in three installments. The existing validated landownership database will be used for identification of beneficiaries under this category of the Scheme.

- The benefit of Rs.13,500/- will be extended to the eligible landowner farmer in 3 installments as detailed below;

-

1st installment @Rs.7500/- during the month of May (including Rs.2000/- from PM-KISAN)

-

2nd installment @Rs.4000/- during the month of October (including Rs.2000/- from PM-KISAN)

- 3rd installment @Rs.2000/- during the month of January (Exclusively of PM-KISAN scheme).

-

Financial assistance will also be provided to landless tenant farmers & ROFR Cultivators belonging to SC, ST, BC, Minority categories in the State @13,500/-, per year, from the budget of the Government of Andhra Pradesh.

-

For Landless Tenant farmers including ROFR Cultivators, the benefit of Rs.13,500/- will be extended in 3 installments from the State Government budget as detailed below;

-

1st installment @Rs.7500/- during the month of May.

-

2nd installment @Rs.4000/- during the month of October.

- 3rd installment @Rs. 2000/- during the month of January.

Eligibility Criteria of YSR Rythu Bharosa Scheme in Andhra Pradesh

Following are the eligibility criteria of YSR Ryuthu Bharosa Scheme in Andhra Pradesh.

- The applicant should be a permanent resident of Andhra Pradesh

-

Total family Income should be less than Rs.10,000/- per month inRural areas.

-

A farmer family is defined as a family comprising of husband, wife, and children. Married children are considered as Separate Unit. forconsidering assistance.

-

No family member should be a government employee or Government pensioner. The families of Sanitary workers are exempted.

-

No family member should be an income tax payee.

Land Owner Farmer Families:

-

The benefit of the scheme shall be provided to all the landholder farmer families who collectively own cultivable land irrespective of the size of land holdings @Rs.13,500/- per annum (Rs.7500/- under YSR RYTHU BHAROSA and Rs.6000/-under PM-KISAN) per family as per land records, subject to exclusions.

-

Farmer families Cultivating under ROFR lands and D Patta Lands (which are duly incorporated in the relevant records ) are eligible for benefit under YSR Rythu Bharosa.

-

Farmers cultivating Acquired Lands for which compensation was not paid are eligible for benefit under the scheme.

-

In the case of joint holding, the benefit will be transferred to the bank account of the person within the family with the highest quantum of landholding.

-

If the quantum of cultivable land owned by two or more individual family members is the same, the benefit will be transferred to the bank account of the elder/eldest, as the case may be, of such members of that farmer family.

-

The cut-off date for the determination of eligibility of beneficiaries under the scheme shall be 30.09.2019.

Land Less Cultivators

-

The tenant farmer/family member shall not have any Agriculture/Horticulture/ Sericulture Land of his own.

-

Support will not be extended for lease agreements within the family.

-

The minimum Area to be taken for lease by a single individual Landless Tenant is as follows.

| Sl.No. | Crop | Minimum Economical Lease Extent (acres) |

| 1 | All Agriculture, Horticulture and Sericulture Crops | 1.0 Acre (0.4 Ha) |

| 2 | Vegetables, Flowers and Fodder crops | 0.5 Acre ( 0.2 Ha) |

| 3 | Betel Vine | 0.1 Acre (0.04 Ha) |

-

Irrespective of the Size of Holding, the benefit will be extended to only one cultivator per Land Owner family between whom there will be a lease agreement.

-

Only One Tenant / Cultivator belonging to SC, ST, BC and Minority Category will get benefit along with Land Owner Farmers. In the case of multiple tenants to a single landowner, preference is given to the ST tenant for providing financial benefit followed by SC, BC, Minority tenants in the order of preference as per the existence of such categories.

-

In Tribal areas, as per the Statute, only Tribal Cultivators/ tenants are recognized.

-

A Land Less Tenant / Cultivator having multiple lease agreements is eligible to get benefits as a single unit.

-

The lease agreement entered between Landless Tenant/ Cultivator and a Marginal Farmer who is residing in the same village will not be entertained.

-

Cultivators/ Tenants cultivating the lands of Owners of excluded categories are eligible for the benefit under Rythu Bharosa.

-

Tenants cultivating Inam lands/ Endowment lands will be extended benefit as per the recorded evidence available with the Department of Endowments.

Documents Required for YSR Rythu Bharosa Scheme in Andhra Pradesh

Following documents are required for YSR Ryuthu Bharosa Scheme in Andhra Pradesh.

-

Income certificate

-

Identity proof – Applicant has to produce their identity proof such as an Aadhaar card or voter ID card or ration card.

- Residence Proof

-

Bank account details –The farmers have to submit bank-related documents such as the name of the applicant, IFSC code, and other details. The bank account would be linked to credit the amount to the linked bank account.

Exclusions from YSR Ryuthu Bharosa Scheme

The following categories of beneficiaries of higher economic status shall not be eligible for benefit under the scheme:

-

All Institutional Landholders ; and

-

Farmer families in which one or more of its members belong to the following categories

-

Former (ex) and present holders of constitutional posts,

-

Former (ex) and present Ministers/ State Ministers and former/present Members of Lok Sabha/ Rajya Sabha/ State Legislative Assemblies/ State Legislative Councils, former and present Mayors of Municipal Corporations, former and present Chairpersons of District Panchayats, All serving or retired officers and employees of Central/ State Government Ministries /Offices/Departments and its field units Central or State PSEs and Attached offices /Autonomous Institutions under Government as well as regular employees of the Local Bodies (Excluding Multi Tasking Staff / Class IV/Group D employees),

-

-

All superannuated/retired pensioners whose monthly pension is Rs.10,000/- or more(Excluding Multi Tasking Staff / Class IV/Group D employees) of the above category.

-

All Persons who paid Income Tax in last assessment year Professionals like Doctors, Engineers, Lawyers, Chartered Accountants and Architects registered with Professional bodies and carrying out profession by undertaking practices.

-

Persons owning farmlands converted into House sites. Aquaculture or any other non-agriculture usage is either updated or not updated in the Revenue Records. Necessary ground-truthing shall be done by the village level functionaries of Revenue and Agriculture Departments.

-

Persons paid Commercial Tax/ Professional Tax/ GST during the last assessment year.

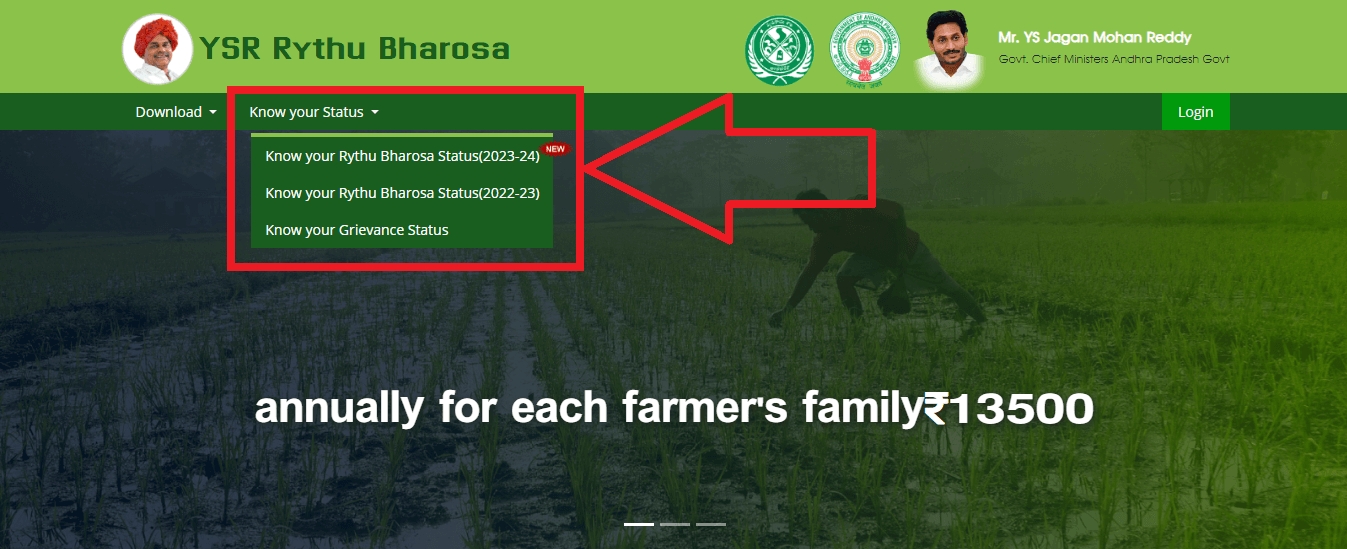

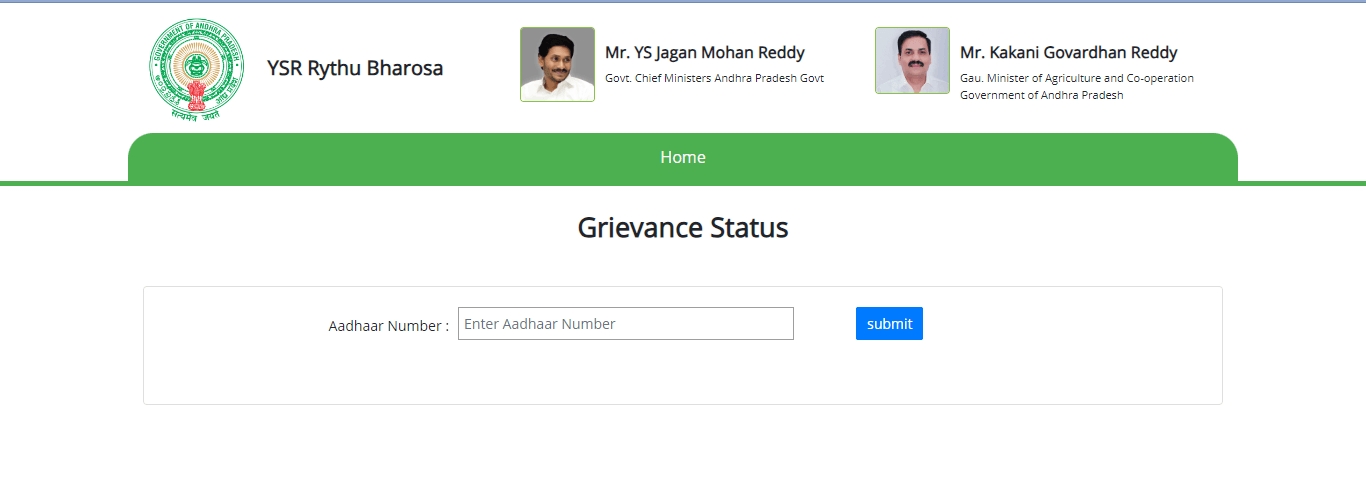

How to Check Payment Status Online for YSR Ryuthu Bharosa Scheme?

Follow the below steps to check the payment status online.

-

Visit YSR Rhytu Bharosa portal.

-

Click on either of the three options.

-

Enter Aadhaar Number.

-

Click on Submit to view the payment status.

You can check this video for checking the payment status of the YSR Rythu Bharosa scheme.

Application Process of YSR Rythu Bharosa Scheme in Andhra Pradesh

Government officials of your State will include you in the scheme based on whether your name appears in the land ownership records or not.

The responsibility of identifying the landholder farmer family eligible for benefit under the scheme shall be of the State/UT Government. The existing land-ownership record in the concerned States/UTs will be used for the identification of beneficiaries. Those whose names appear in land records as of 01.02.2019 shall be eligible for the benefit. If a Landholder Farmer Family (LFF) has land parcels spread across different village/revenue records, then the land will be pooled for determining the benefit.

The details of farmers are being maintained by the States/UTs either in electronic form or in manual register. Further, State/UT Governments would also expedite the progress of digitization of the land records and link the same with Aadhaar as well as bank details of the beneficiaries.

Modalities for Transfer of Benefit under YSR Ryuthu Bharosa Scheme

Under YSR Ryuthu Bharosa Scheme,

-

RTGS shall support Department of Agriculture in development of web portal and mobile application for YSR Rythu Bharosa (YSSRB) program, building upon the database of PM KISAN program towards validating/finalizing beneficiaries under YSRRB through ground truthing/grama sabhas and also in ensuring payment to the beneficiaries directly to their bank accounts through Direct Benefit Transfer (DBT)

-

The Department of RTGS shall enable payments directly through DBT via a sponsor bank through a state account managed by O/o Commissioner and Director Agriculture.

-

The Department of RTGS shall provide support to the Commissioner, Agriculture in redressal of Grievances on YSRRB through its call centre. Citizens can reach out to Toll Free Nos 1100 or 1902 for raising a grievance and the same shall be redressed in coordination with Dept. of Agriculture. There shall be State/District/Mandal level grievance redressal committees.

-

Beneficiaries would be intimated about the credit amount to his account by Short Messaging Service (SMS) via the destination bank and also through Village Volunteers .

References

While crafting this guide, we have consulted reliable and authoritative sources, including official government directives, user manuals, and pertinent content sourced from government websites.

FAQs

You can find a list of common YSR Rythu Bharosa Scheme queries and their answer in the link below.

YSR Rythu Bharosa Scheme queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share