Who pays stamp duty for gift deed registration of immovable property?

Answered on August 09,2022

In Gift deed, the stamp Duty and Registration charges are paid either by Donor or Donee

The important is to pay all government charges including stamp duty and link the payment reference number to registered gift deed

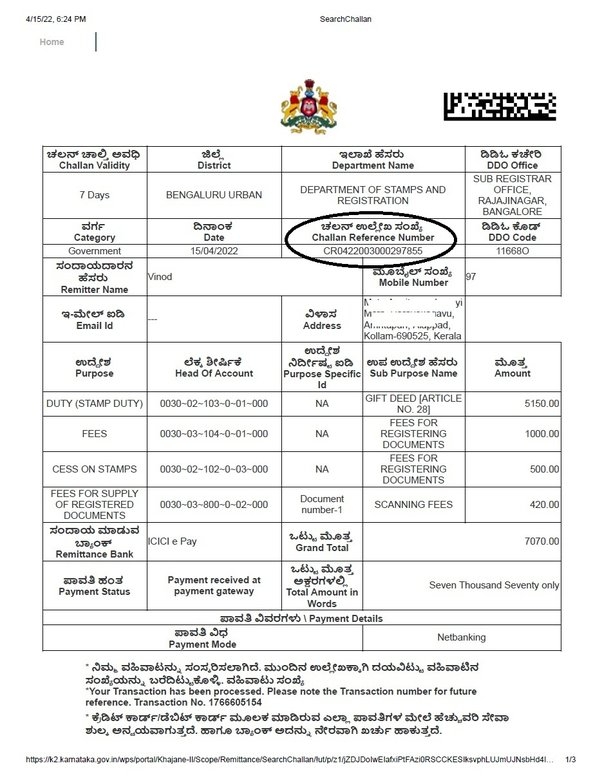

For Example: In Bangalore, the government charges are paid on K2 website and generate Challan reference number. We encircled the challan reference number in below image

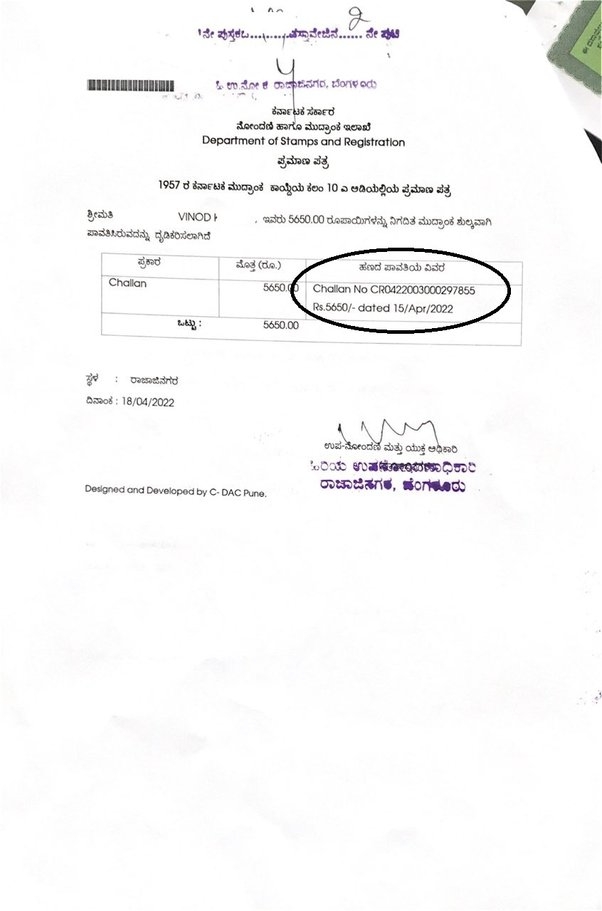

As per the above image, my challan reference number is CR0422003000297855, the same number is linked to my below-registered gift deed.

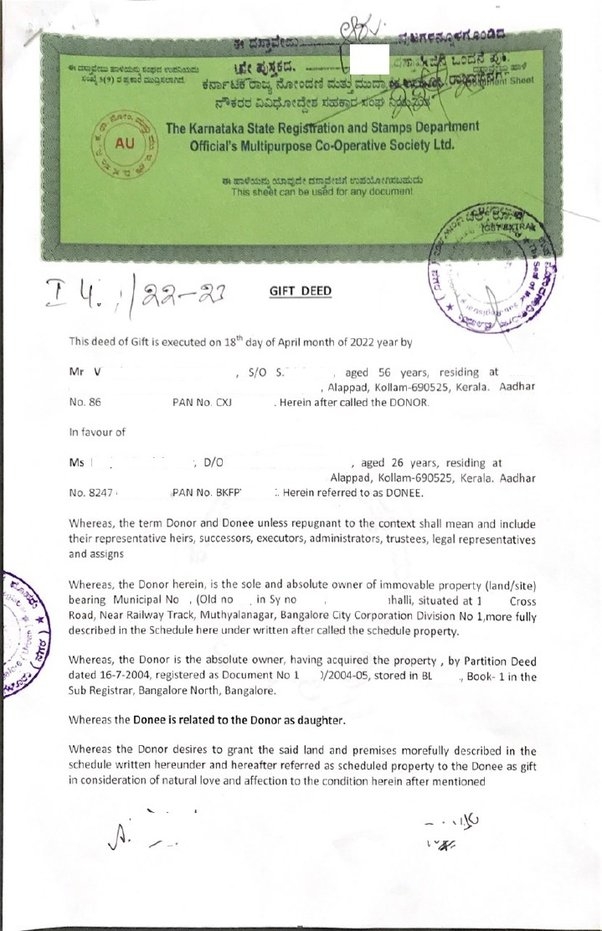

Encircled the challan number in the below-registered gift deed:

In the above example, the stamp duty and all the government charges were paid by donor.

For gift deed, government charges are paid either by donor or donee.

It's important for us to make sure that payment reference number is linked to registered gift deed.

---------------

In Bangalore, we provide end-to-end assistance to register the gift deed, To opt for our service, please Whatsapp to + 9 1 - 9 7 4 2 4 7 9 0 2 0.

Thank you for reading…

Karnataka Voter List 2024 - Search By Name, Download

Empowering citizens to exercise their democratic rights is crucial, especially in the vibrant state of Karnataka. This concise guide offers clear steps for downloading the voter list, searc..Click here to get a detailed guide

Share

Share

Clap

Clap

431 views

431 views

1

1 1791

1791