How do we calculate the stamp duty and registration charges of property in Bangalore?

Answered on August 24,2021

Let me explain two different methods of calculation for stamp duty & registration charges.

METHOD - 1:

The following is the step by step procedure

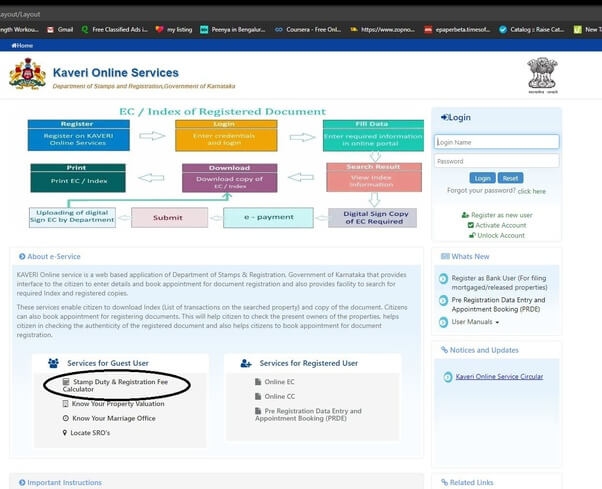

(Kaveri Online is a government initiative for stamps & registration)

Step 1: Open the website Kaveri Online Services

Step 2: Click “Stamp Duty & Registration Fee Calculator”. Refer to the below image in the circle for your reference.

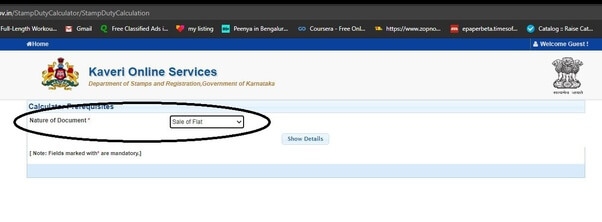

Step 3: Select “Nature of the document” from the drop-down list. The nature of the document is different for building, flat, and land.

In this answer, let me take an example that my flat in Sobha Garrison apartment which is located in Nagasandra, Comes under bbmp limit. Though it is a flat So I select “Sale of flat” in the nature of the document. Below image in circle for your reference.

And click “Show details”

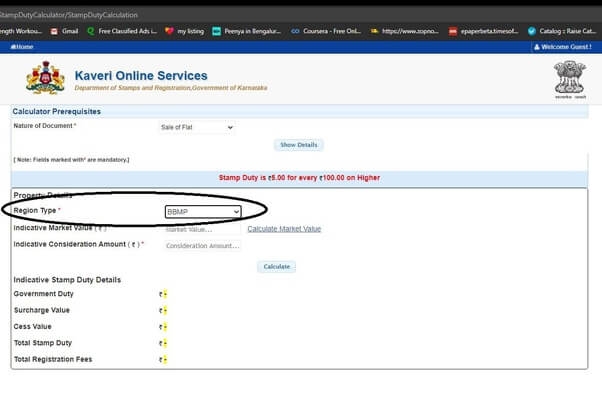

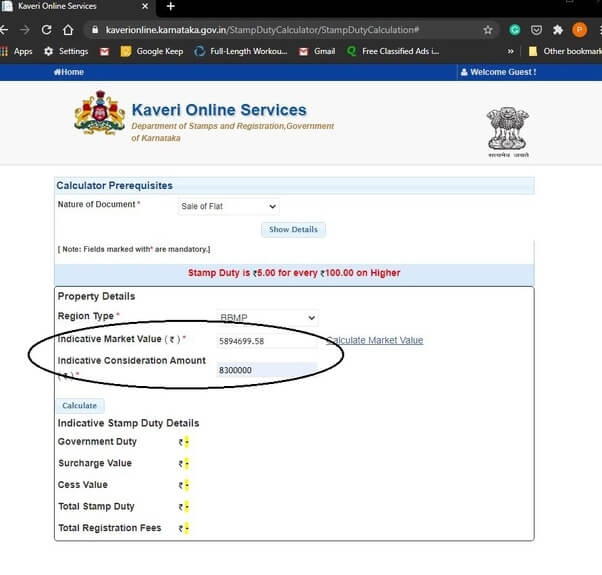

Step 4: Select “Region Type” from the drop-down list.

Region is the municipality where the property located. My property located in BBMP municipality hence I select BBMP from drop-down list. Below image in circle for your reference.

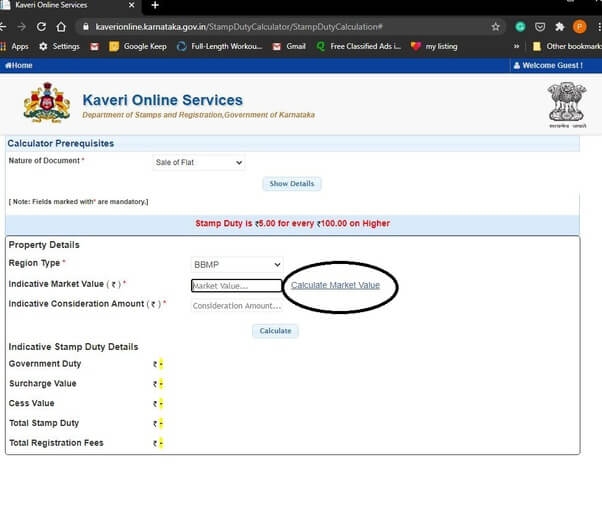

Step 5: Mention “Indicative market value” or know as guidance value or circle value.

If you don’t know the market value. use the market value calculator beside, refer the below image in circle for your reference.

We wrote a detailed answer about how to calculate market value, Here is the link to the answer How can I get the government's guidance for the value of land/home property in a location In India?

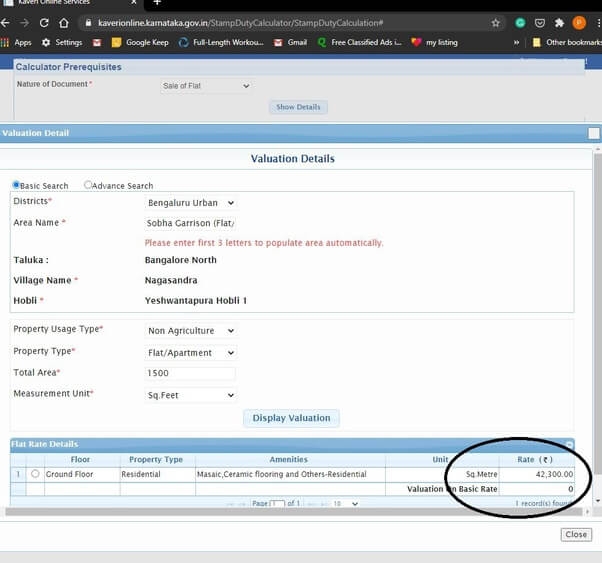

The market value of my flat is Rs.42,300/- per square meter. Refer to the below image in circle for your reference.

So, the market value of my 1500 sq.ft flat is Rs. 58,94,699

Step 6: Indicate consideration amount or selling price of property.

I want to sell my property at the price of Rs. 83,00,000/-so I write Rs.83 Lakh in consideration amount. Below image in the circle for your reference.

Click the button “Calculate”

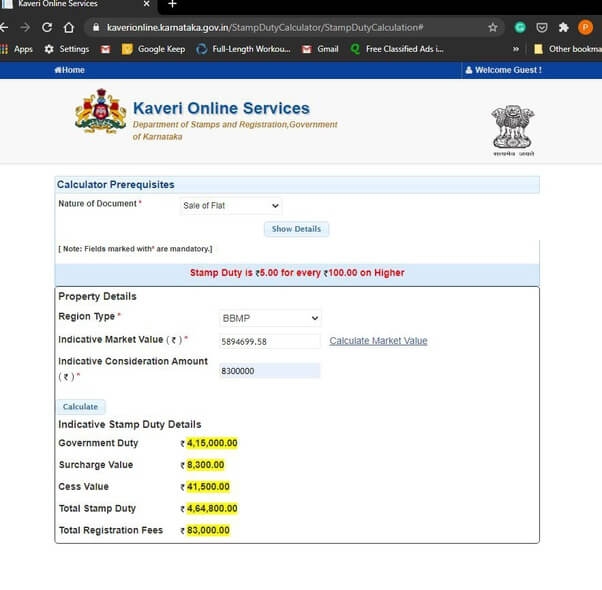

Step 7: The stamp duty and registration charges will display. (Below image with yellow color strained for your reference)

This completes method -1 of calculation.

METHOD - 2

This method of calculation is very simple and straight forward.

Below is the formula for calculation.

-

Stamp duty: 5% of consideration amount

-

Surcharge : 0.1% of consideration amount

-

Cess Value : 0.5% of consideration amount

-

Total Stamp Duty = stamp duty + Surcharge + Cess value

-

Total Registration Fees : 1% of consideration amount

Using the above formula, we made a mock calculation based on my consideration price of Rs. 83 lakh.

You can cross-check that the below figures are matching to above screenshot which we calculated through Kaveri online service.

-

Stamp duty : 5% of consideration amount - Rs. 83,00,000 X5% = 4,15,000/-

-

Surcharge : 0.1% of consideration amount - Rs.83,00,000 X 1% = 8,300/-

-

Cess Value : 0.5% of consideration amount - Rs. 83,00,000 X0.5% =41,500/-

-

Total Stamp Duty is Rs. 4,15,000+8300+14500 = 4,64,800/-

-

Total Registration Fees : 1% of consideration amount - Rs.83,00,000 X 1% = 83,000/-

Additional information:

At the time of sale deed registration, you can offset the surcharge 0.1% of consideration value if franking is done for “Agreement of sale”.

Offset is applicable for only franking mode of stamp duty and not for e-stamp.

I hope, my answer gave you some insight.

For assistance please whastapp to 9 7 4 2 4 7 9 0 2 0.

Thank you for reading…

Bhoomi RTC - Land Records in Karnataka

Bhoomi (meaning “land”) is an online portal for the management of land records in the state of Karnataka. Bhoomi portal provides the following information. Land owners..Click here to get a detailed guide

Karnataka Voter List 2024 - Search By Name, Download

Empowering citizens to exercise their democratic rights is crucial, especially in the vibrant state of Karnataka. This concise guide offers clear steps for downloading the voter list, searc..Click here to get a detailed guide

Share

Share

Clap

Clap

951 views

951 views

1

1 58

58