Can NRI give power of attorney to collect documents from bank after closing home loan?

Answered on July 03,2022

Yes, NRI can give power of attorney to collect documents from bank after closing home loan

Below is the step-by-step procedure to give Power of Attorney (POA):

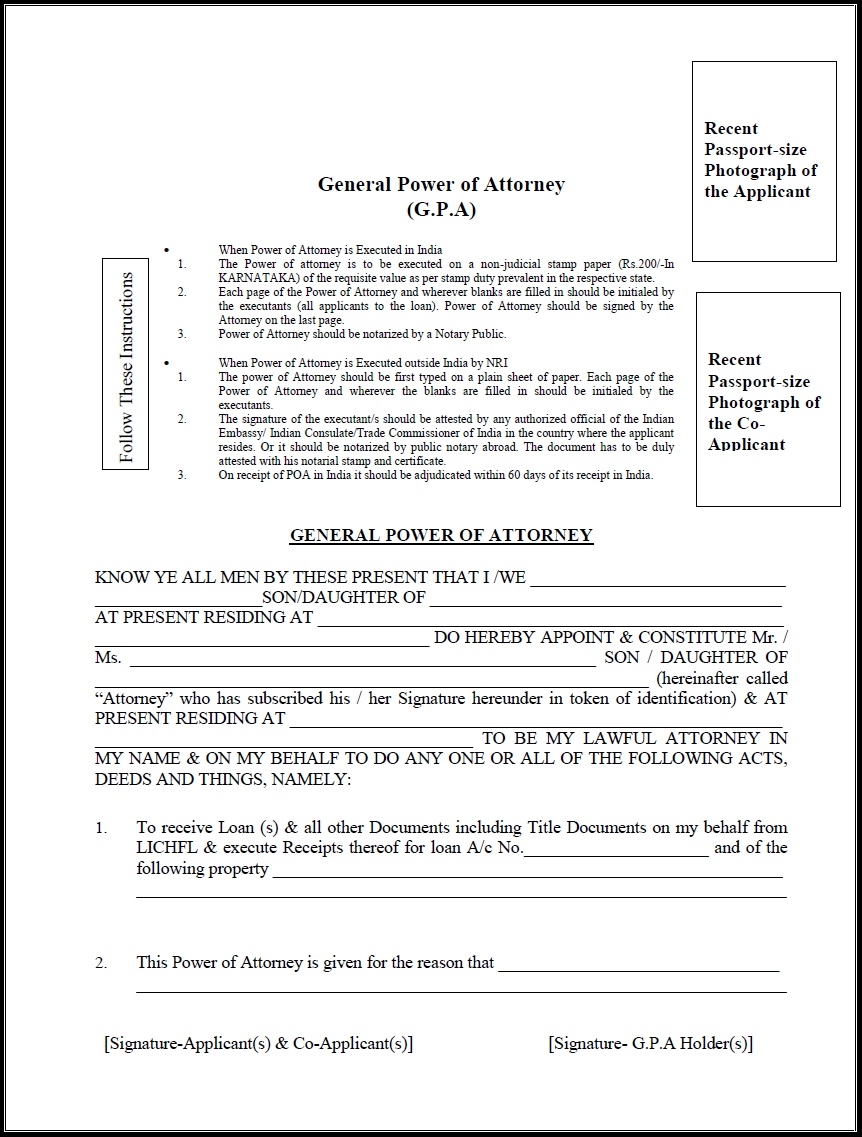

Step 1: Each bank has its own POA draft, hence request the draft from your bank’s representative or simple Google search may help to get draft

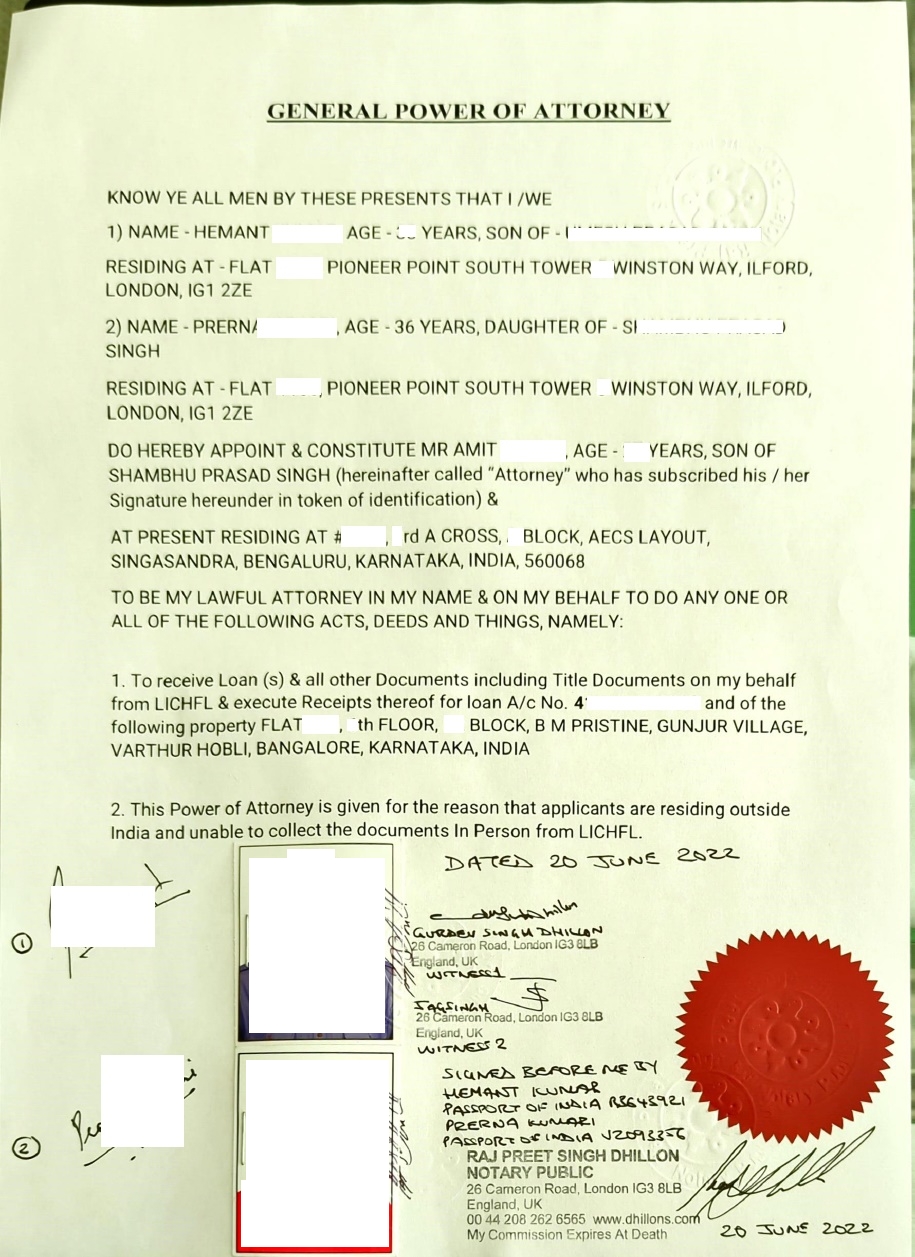

Below is the mock draft from LIC HFL

Step 2: Fill the draft with your required information.

Step 3: Print the draft on normal A4 size paper

Step 4: Affix your passport size photo

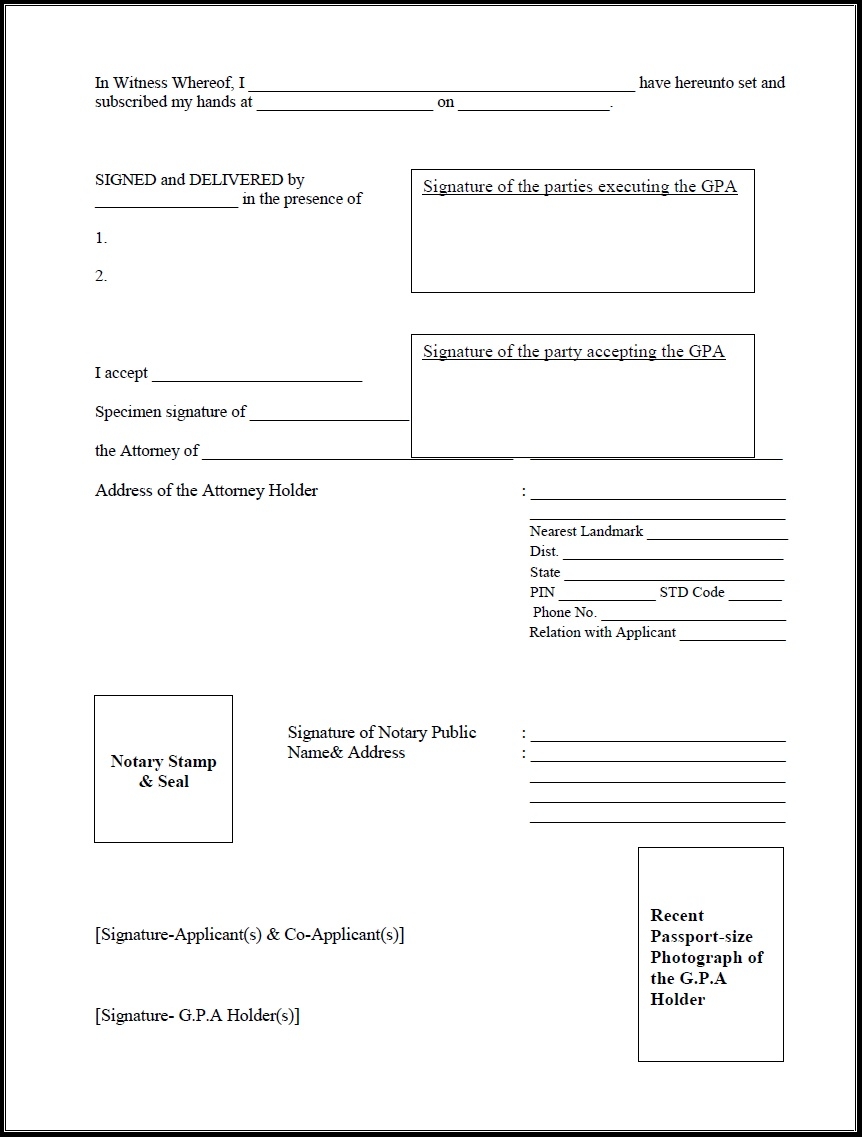

Step 5: Meet notary public near you in your country + Sign the POA in front of notary + Get the POA attested from Notary.

The notarized POA looks like below image (Referring to below POA, the property is jointly owned by husband & wife so issued joint POA to her brother in India)

Step 6: Send the POA to India through reputed shipping partner like DHL or fedex

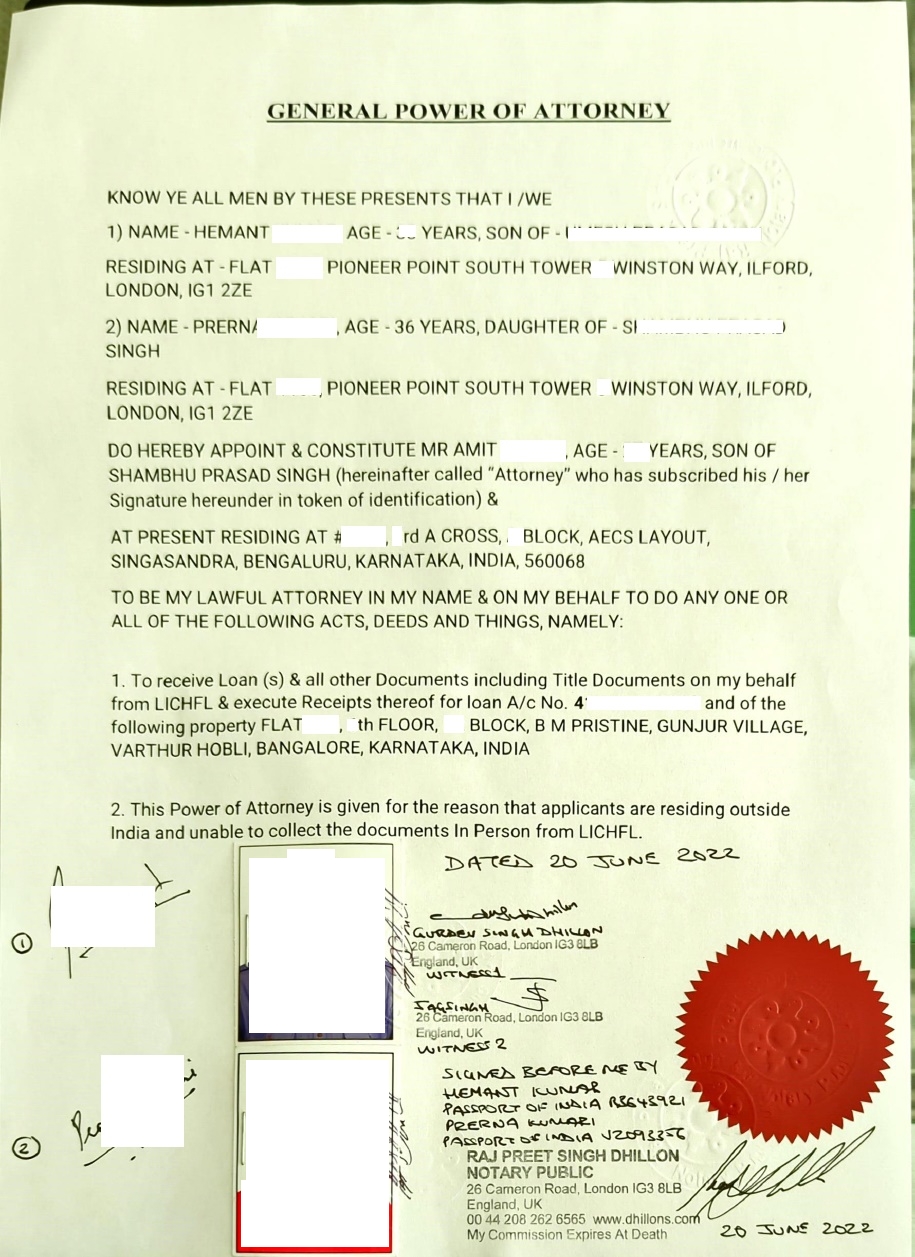

Step 7: Your POA holder in India should carry the following documents to District Registrar office, in the jurisdiction where the property is located. (If the property located in Bangalore, should approach the District registrar office in Bangalore)

- Power of Attorney

- Passport copy of executant & Attorney

- Request letter (share the mock below)

- Stamp duty payment (K2 challan in Karnataka)

Below Is the mock request letter:

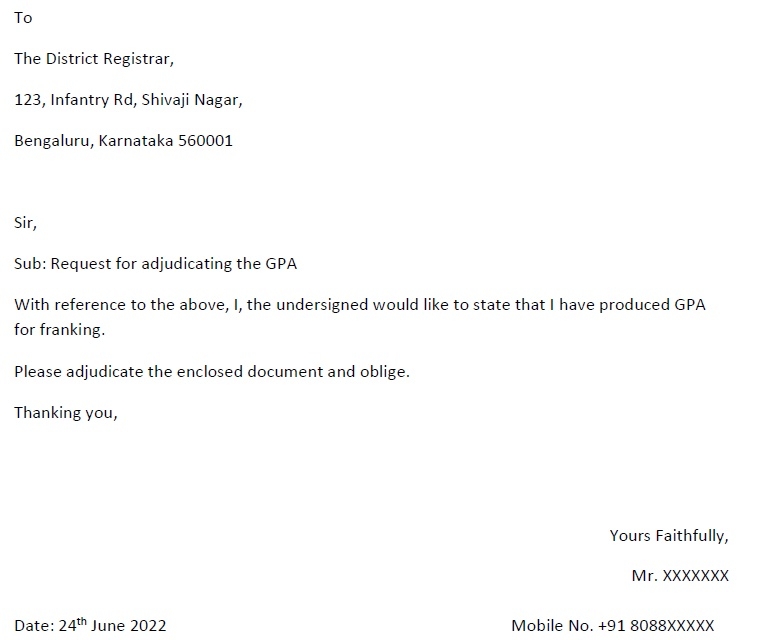

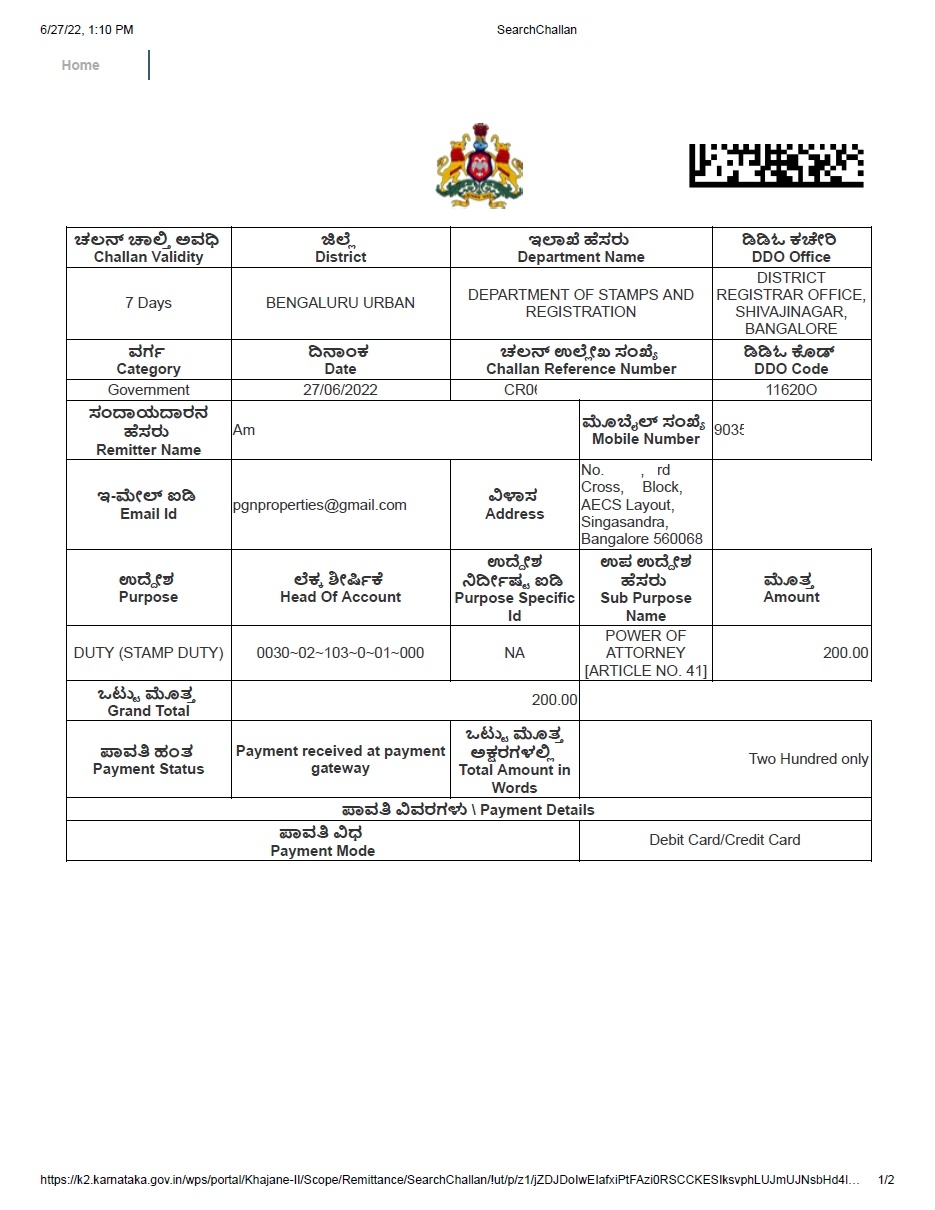

Below is the stamp duty payment (K2 challan for Karnataka)

Step 8: In District Registrar office, the officer verified the documents and approve for adjudication

Step 9: The District registrar calls you next day to collect the adjudicated POA.

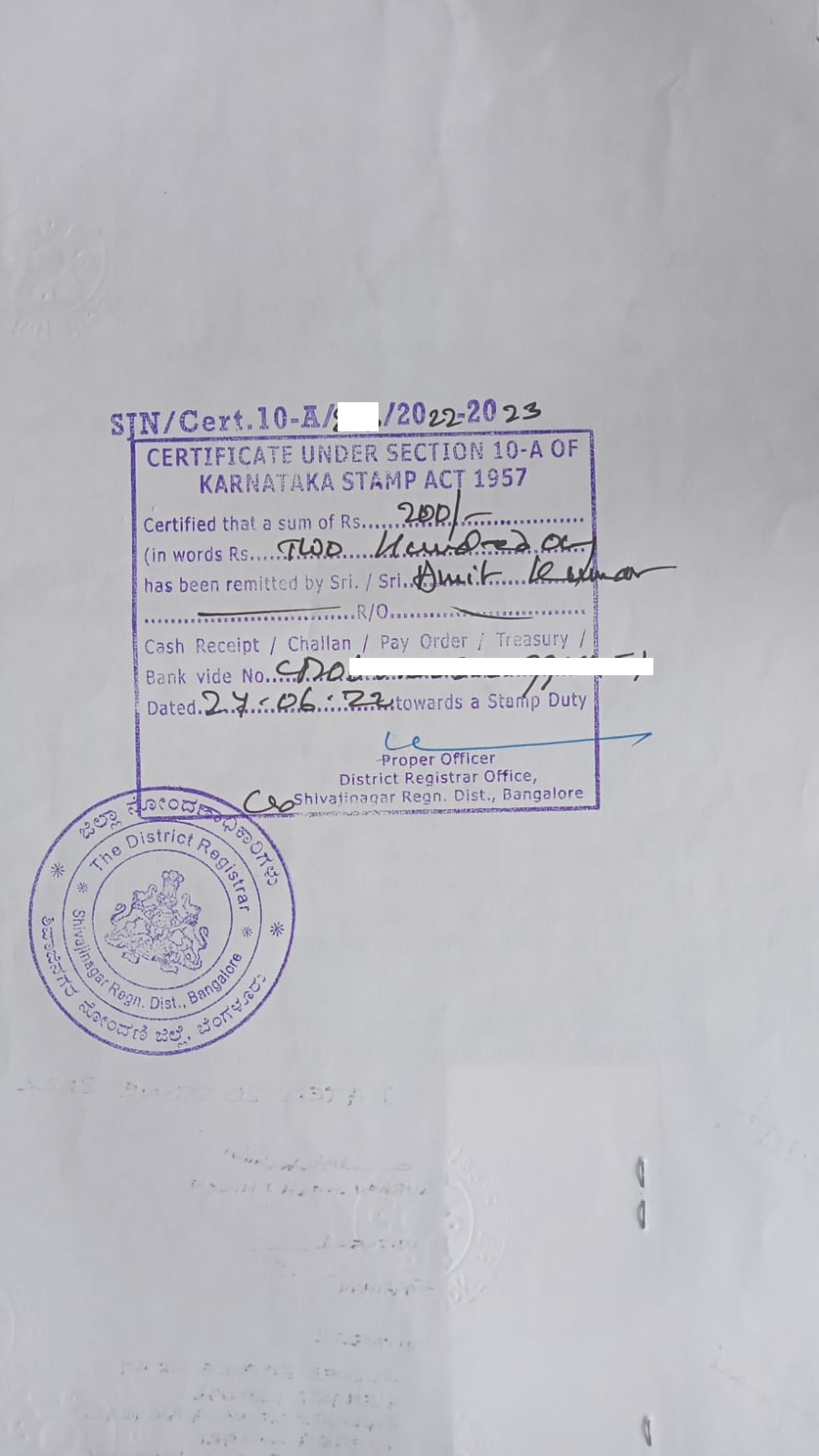

The Adjudicated POA looks like below image

This completes the procedure to give POA to collect documents from Bank.

Your POA holder should carry the adjudicated POA and ID proof (passport copy) to your bank. Bank verifies POA and ID proof and hand over following documents to POA holder

- Sale deed

- No objection certificate in bank’s letter head

- Discharge deed/ Reconveyance deed/ Release Deed (if MODT registered with Bank)

- And any other security documents that you handed over to bank at the time of MODT registration.

--------------------

In a seperate answer, we wrote detailed procedure to remove mortgage lien in sub-registrar office, Below is the link to the answer

-----------------

We provide end-to-end assistance to execute Power of Attorney + collect documents from Bank + remove mortgage lien in sub-registrar office + documents home delivered. To opt for our service, please whatsapp to + 9 1 – 9 7 4 2 4 7 9 0 2 0.

Thank you for reading…

Share

Share

Clap

Clap

528 views

528 views

1

1 1393

1393