Can NRI gift property in India with special power of attorney?

Answered on May 10,2023

We all love gifts, we give and take gifts for many reasons like love, emotion and tradition but when we gift cash and assert, we have to be in line with rules & regulations set by the government.

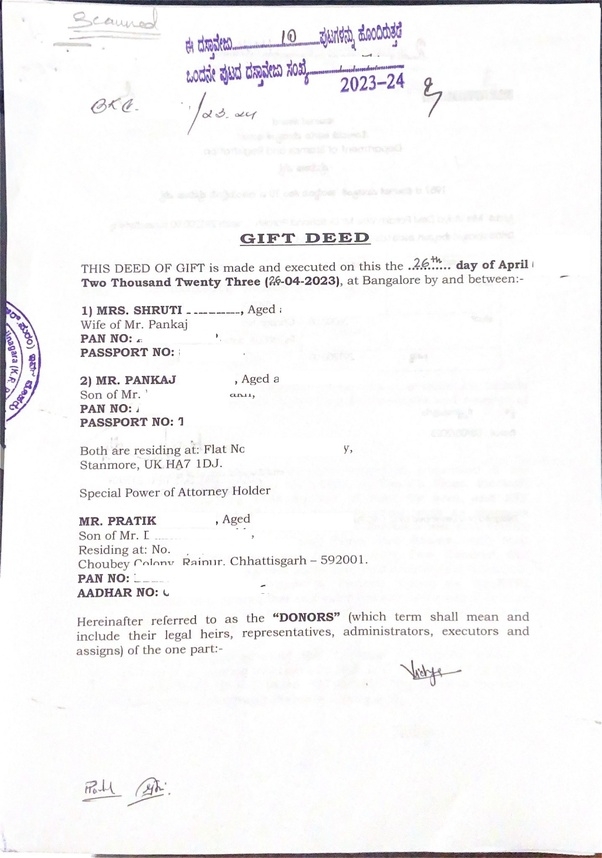

The Stamp Duty & Registration fee for Gift deed is different when gifted to blood relative and non-blood relative

The Blood relatives are Father, Mother, Brother, Sister, Husband, wife, son and daughter, all other persons are considered as non-blood relatives.

The stamp duty & registration fee for blood relatives:

- Stamp Duty: Rs. 5150

- Cess on Stamps: Rs. 500

- Registration Fee: 1000

- Scanning Fee: Rs, 500 (approx)

The Stamp duty & Registration fee for non-blood relatives: (% is based on the guidance value)

- Stamp Duty: 5.1%

- Cess on Stamps: 0.5%

- Registration fee: 1%

- Scanning Fee: Rs. 500 (Approx)

--------------------------------------------------------------------------------------------------------------

The Special Power of Attorney (SPOA) is different from other types of Power of Attorney because the Special power of attorney is issued only to present the deed in sub-registrar office

Under the Special Power of attorney, the executant (who grants the SPOA) signs the Gift deed. The attorney (who received the SPOA) presents the gift deed in sub-registrar office (the attorney doesn’t sign the gift deed)

The Special power of attorney can be given to any of your trusted sources, the stamp duty is just Rs. 200 irrespective of blood or non-blood relative

For your better understanding, let me give an example:

In the year 2016, Mr.Pankj and his wife Mrs.Shruti jointly purchased a 3BHK flat in Bangalore.

In 2018, Mr.Pankj and his wife shifted to Stanmore, united kingdom (UK). They purchased another house in UK and obtained UK citizenship.

Out of love and affection, Mr.Pankaj and his wife gifted the flat to his mother without consideration, whereas his mother rented a flat and earn monthly rental income in India.

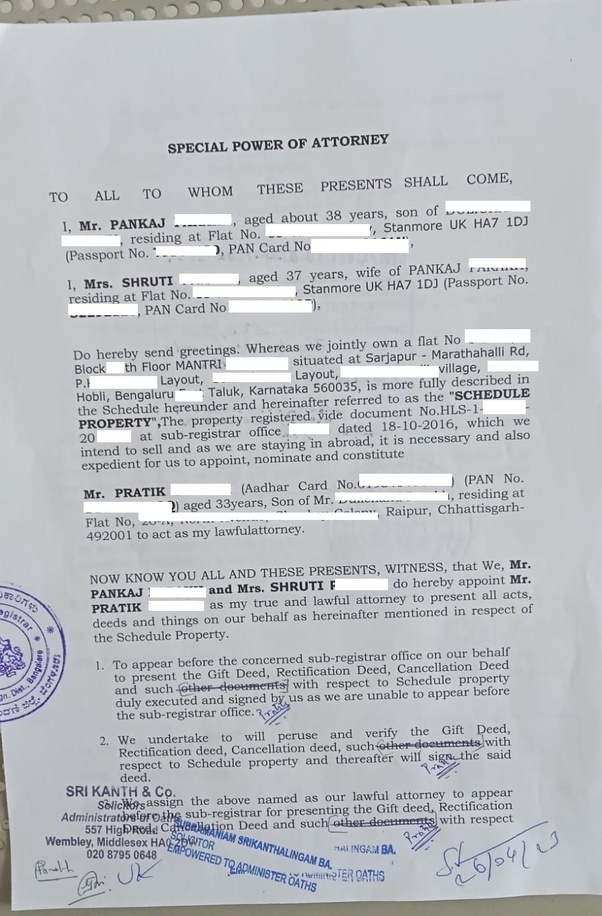

Mr.Pankaj and his wife didn’t come to India for gift deed registration, they gave Special Power of Attorney to his brother in India, the brother's name is Mr.Pratik

We followed the below procedure to execute Special Power of attorney for Gift deed registration In India:

- In India, we drafted Special Power of Attorney and Gift deed in word file.

- We e-mailed special power of attorney and gift deed draft to Mr.Pankaj in UK

- Mr.Pankaj took the printout of special power of attorney and gift deed

- Mr.Pankaj and his wife signed the special power of attorney and gift deed in front of notary in UK. Notary attested the special power of attorney, (notary attestation is not required in gift deed)

- Mr.Pankaj couriered the Notarized special power of attorney and signed gift deed to his brother in India Mr. Pratik

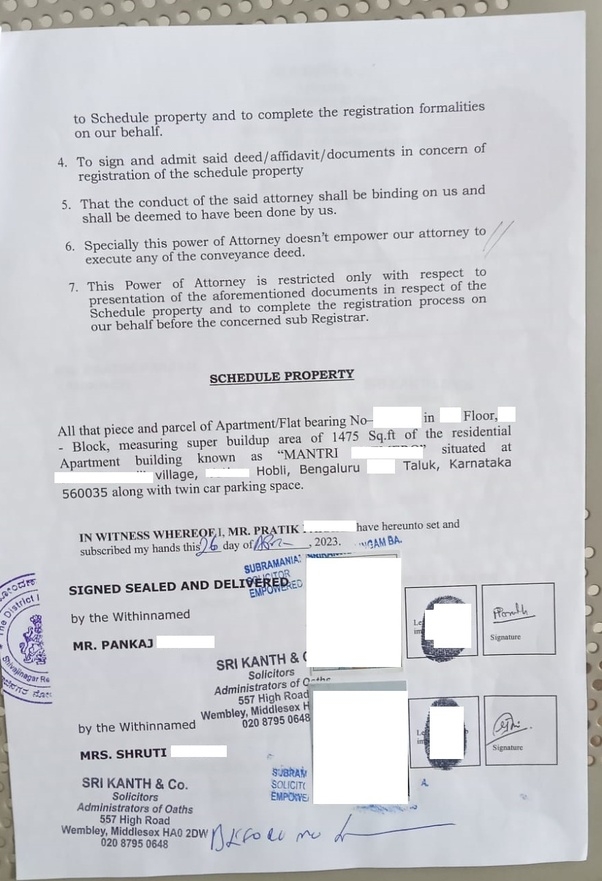

- Special Power of attorney should adjudicate in District Registrar's office. In our case, Mr. Pratik submitted the adjudication require in Shivajinagar District Registrar office, Bangalore, he got special power of attorney adjudication in 2 working days, refer to below image

The Stamp duty for SPOA adjudication is Rs, 200, the above SPOA has two executants (Mr.Pankaj and his wife Mrs. Shruti), we need to pay the stamp Duty of Rs. 200 per executant so the total stamp duty payment is Rs.400 (as per the arrow mark indicated in above image, I paid the stamp duty of Rs. 500 instead Rs. 400 which was my mistake so when you pay the stamp duty, just pay Rs. 200 per executant).

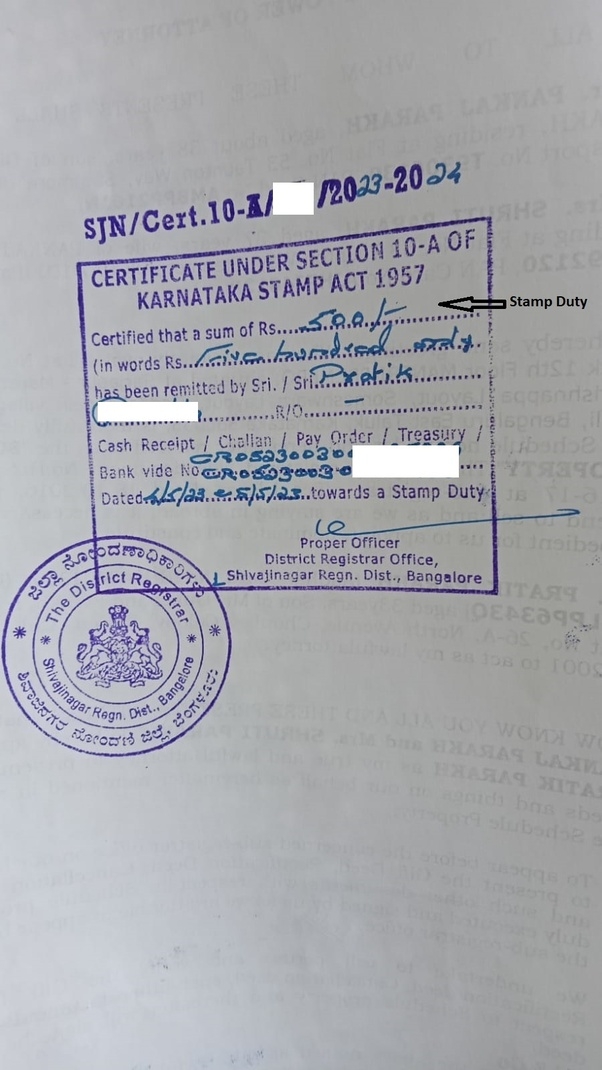

Mr.Pratik carried the following documents to sub-registrar office for gift deed registration

- Photocopy of sale deed executed by Mr.Pankaj & Mrs.Shruti in 2016

- Property tax receipt

- Khata

- SPOA (Shared the image above)

- Gift Deed signed by Mr.Pankaj & Mrs.Shruti

- Aadhaar & PAN

- Stamp Duty Challan (K2 challan in Karnataka)

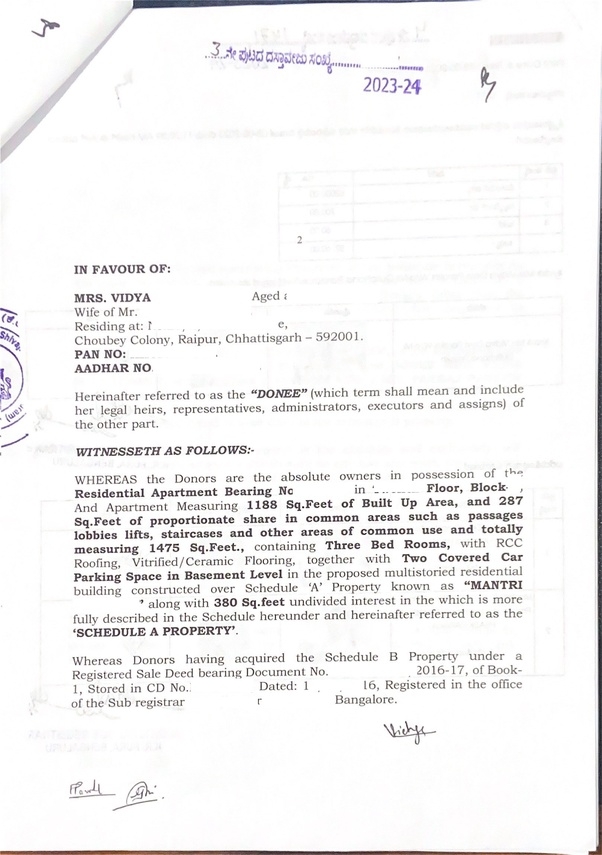

Mother Mrs. Vidya (Donee) carried Aadhaar and PAN with her

In the Sub-registrar office:

- The officer verified the above-listed documents and approved for registration.

- Mr.Pratik and Mrs.Vidya gave thumb impressions and webcam photo

- Mr.Pratik presented the gift deed which was already signed by Mr.Pankaj and Mrs.Shruti. Mrs.Vidya signed the gift deed

Below is the image of registered Gift Deed, you can notice Mr.Pankaj and Mrs. Shruti's signs on left side and Mrs. Vidya's sign on right side of below gift deed, (SPOA holder Mr.Pratik has not signed the gift deed)

Note:

- The classification of blood and non-blood relative are subject to Karnataka. In few other states in India, In-laws, nephews and nieces are considered blood relatives

- In Karnataka, special power of attorney attested by notary or Indian embassy in abroad is accepted, whereas in few other states in India, attestation from Indian embassy is mandatory

-------------------------------------------------------------

We provide assistance for special power of attorney and gift deed registration. To opt for our service, please WhatsApp to + 9 1 - 9 7 4 2 4 7 9 0 2 0.

Thank you for reading…

Share

Share

Clap

Clap

370 views

370 views

1

1 498

498